-

Mortgage rates edged higher after the Fed held rates steady, with markets weighing political shifts, Treasury moves and mixed signals on where borrowing costs head next.

February 5 -

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

January 29 -

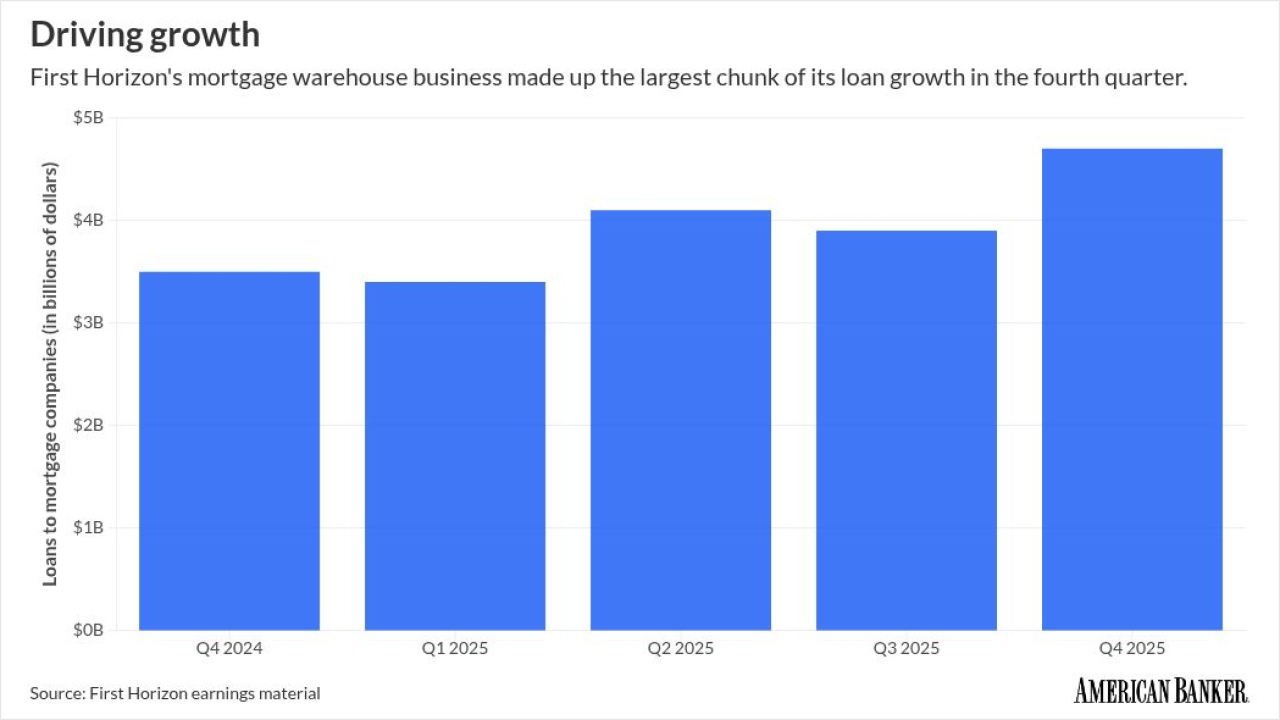

First Horizon's loans to mortgage companies in the fourth quarter rose at the fastest clip in more than two years, as the housing market showed small signs of revival.

January 15 -

The Federal Reserve is slated to undertake a number of important rules and regulations in 2026, but decisions around agency leadership and the Trump administration's avowed effort to exert greater control over the central bank are likely to leave a lasting legacy at the agency.

December 29 -

The 30-year rate dropped just 0.2 percentage points, as Federal Reserve Chair Jerome Powell's recent comments caused Treasury yields to rise.

October 30 -

Allowing lenders to base mortgage decisions on single- or double-pull credit reporting would result in more risk to banks, and higher costs for borrowers.

October 15

-

While new jobs data contributed to falling Treasury yields, mortgage rates showed a mixed picture with some trackers moving in opposite directions.

October 2 -

The 30-year fixed rate mortgage fell 2 basis points this week, Freddie Mac said, but other sources like Zillow and Lender Price reported larger drops.

August 28 -

The bank "temporarily" paused home equity line of credit lending in April 2020, over concerns regarding the economic impact of the Covid-19 pandemic.

August 26 -

Employment came in below estimates, which some economists expect could move the bond market in ways that affect loan costs even before the Fed meets next.

August 1 -

Fannie Mae also foresees more home sales than it did in June, but the Mortgage Bankers Association reduced its origination projections for 2025.

July 24 -

The 30-year fixed mortgage rate rose for the first time in six weeks, driven by Friday's strong jobs report and renewed uncertainty around tariffs.

July 10 -

Growth in conventional originations at U.S. banks came with the unexpectedly rapid rise of 30-year fixed interest rates in 2022, Federal Reserve researchers found.

July 9 -

Bill Pulte's social media posts saying inflation has fallen far enough added to intensified political pressure on the independent Federal Reserve chairman.

June 18 -

Even with the four basis-point drop, the 30-year fixed rate mortgage remained at levels last seen in February as the Spring homebuying season reaches its climax.

June 5 -

Investors face yet another bumpy start to the trading week, although it's mounting concern over US debt rather than tariffs likely generating the volatility this time.

May 18 -

The increase in purchase mortgage rate lock volume provides support for those looking for a strong Spring market this year, Optimal Blue found.

May 13 -

Treasury Secretary Scott Bessent expects the U.S. housing market to quickly pick up steam after recent indicators came in below forecasts.

February 28 -

While Freddie Mac's weekly survey showed 30-year rates falling, other indicators paint a mixed picture for mortgage lenders and borrowers.

February 13 -

The 30-year fixed rate mortgage continues to slip away from the 7% mark, Freddie Mac said, but experts still expect them to stay higher for longer.

February 6