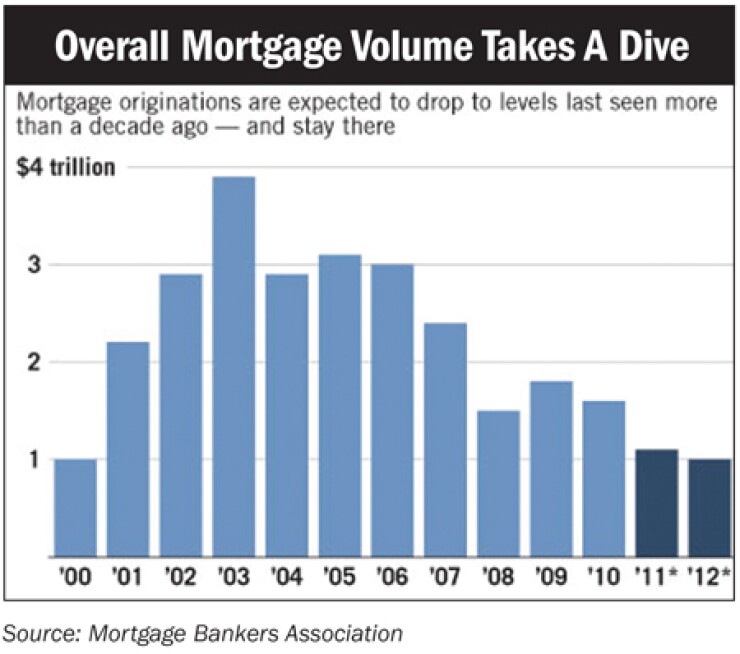

WASHINGTON-A drop in mortgage lending volumes to the lowest level in over a decade is forcing lenders to consider new cost cuts and staff reductions.

The lack of activity comes despite a boost from low interest rates that has sparked a wave of refinancings, and is prompting lenders to face the prospect that refis and home purchases may remain moribund for an extended period.

"This is the bleakest I've seen the forecast in 26 years," Mick Rizzo, vice president and operations manager in Marshall & Ilsley Bank's mortgage unit, told American Banker, an affiliate of Credit Union Journal.

Mortgage origination volume fell 35% in the first quarter, to $325 billion, according to the Mortgage Bankers Association. For the entire year, the figure is expected top out at around $1 trillion and to remain at that level in 2012, the MBA predicts. That would be the lowest level of originations since 2000.

What Worked Before Isn't Working Now

During past downturns, low interest rates helped pull mortgage lending out of the doldrums. This time around, however, lenders appear resigned to the notion that refinancings have run their course. With housing starts and permit issuances flat, there simply are not enough purchases of new and existing homes to offset declines in refinancings.

"If anyone is depending on the market to rescue them, I'm not sure that's a sound strategy," said Willie Newman, head of residential mortgage originations at the $4.6-billion Cole Taylor Bank, a unit of Taylor Capital Group Inc. of Chicago.

Bankers are responding to the slump by reducing head counts, expanding into new markets and reducing costs, American Banker reported.

Wells Fargo & Co. in April said it planned to cut 4,500 employees from its mortgage division. Bank of America Corp. eliminated 3,500 employees and closed 100 small fulfillment centers.

JPMorgan Chase & Co. has avoided staff cuts and instead is focusing on opening 1,500 to 2,000 retail branches in the next five years, mostly in California and Florida.

More cuts and further consolidation appear likely in the coming quarters, as well as a reduction in the ranks of small and midsize lenders and brokers.

Lenders have long been bracing for a drop in mortgage volume, despite previous reprieves from falling interest rates, said Cameron Findlay, chief economist at LendingTree, a unit of Tree.com Inc. Tree.com announced in May that it had agreed to sell its mortgage origination subsidiary, Home Loan Center, to Discover Financial Services.

"This has been coming for almost two years, and most originators are opting to throw technology at this, to improve the efficiencies of operations and cut overhead," Findlay said. "Many shops are looking at where they can cut overhead, which does not bode well for employment. There's definitely going to be consolidation."

Some lenders also say the largest banks are propping up their own margins and refusing to lower prices for borrowers because of capital restrictions that have been proposed as part of Basel III liquidity requirements.

The expected drop in originations this year would result in a 10% to 20% drop in profits from mortgage originations, largely as a result of lower loan spreads and fees, Moody's said in a report released in May. A 30% drop in origination volume would mean a 45% decline in net income from mortgage sales, according to the rating agency.

Industry Stuck In Catch-22

American Banker reported that this appears to have the mortgage industry in a Catch-22. Lenders need new borrowers to sop up the shadow inventory of foreclosed homes. They are scarce, however, because the traditional crop of "move-up" homebuyers is unable to sell existing homes.

Nearly a quarter of current homeowners have negative equity, owing more than their homes are worth. Others do not qualify under stiffer guidelines or "they are waiting, hoping prices will go up," said Yuliya Demyanyk, a senior economist at the Federal Reserve Bank of Cleveland.

Many lenders say the largest bank aggregators are being extremely cautious, funding only those borrowers with high FICO scores and low loan-to-value ratios, which further reduces the pool of potential buyers.

Lenders are responding by focusing on products that will satisfy the market's limited demand and financing.

M&I Bank, for example, is focused on financing short sales and real estate-owned properties. It also is developing a product for borrowers who are regarded as good risks but may not qualify for government loans.

"The competition will get very, very brutal, and you have to be versatile in this environment to compete," Rizzo said.

One of the biggest concerns for lenders is low pull-through rates, which show the percentage of applications that are ultimately converted into closed loans.

Tightened underwriting guidelines have increased the risk that a loan will not make it all the way through the pipeline, further increasing costs.

"Loan officers are digging loans out of the bottom of the trenches, and some we're seeing are among the worst loans," Rizzo said. "Healthy organizations won't fall for that, but younger organizations or small entrepreneurial shops might take a short-term win for a long-term risk."

At Cole Taylor, the drop in volume prompted the lending unit to adopt "service-level guarantees," extending the time period that a borrower can lock in an interest rate.

By extending the rate-lock, borrowers are not harmed if the bank has too much capacity or backlog, Newman said. The change gives the lender's network of mortgage brokers an edge in promoting its customer service.

New Compliance, New Technology

Concerns about buybacks from the government-sponsored enterprises and indemnifications of Federal Housing Administration loans also have forced many lenders to adopt new technologies to catch compliance problems.

"Reviews from investors are very detailed and post-closing scrutiny is high," Newman said. "Lenders have to be adept at learning quickly what the issues are with investors on the closing side, because there has been significantly more focus placed on closing documents relative to two years ago."

A few lenders are still plying the refinance market, hoping to attract longtime homeowners who can still take advantage of low rates.

Quicken Loans Inc., one of the nation's largest mortgage banking companies, created a new lending product called the Yourgage. Its underwriting guidelines are identical to those used by Fannie Mae and Freddie Mac, but instead of a 30-year or 15-year term borrowers can choose a fixed rate for eight or nine years.

Bob Walters, Quicken's chief economist, said refi activity has picked up in the second quarter, but the drop in originations is already leading to consolidation.

"The middle tier is growing and picking up the market share that mortgage brokers left behind," he said.

Demyanyk at the Cleveland Fed said the boom-and-bust cycles of the past 20 years make it extremely difficult to determine an historic average for mortgage originations.

"It's hard to determine what the real market is," Demyanyk said. "There's still a lot of uncertainty about where housing prices could go, whether there's a second dip [yet to come] or the market will recover."