Video banking is becoming increasingly popular, but BluCurrent Credit Union in Springfield, Mo. was way ahead of the bandwagon, launching into it four years ago.

The process wasn’t as successful as hoped, and after a year the credit union was back to the drawing board, ultimately landing on the solution it uses today.

According to BluCurrent COO Derek Williams, that the CU’s internal IT staff of six employees worked with a “well-known” video platform provider and developed an in-house video solution, but there were snafus.

“We ran into issues trying to integrate into our process,” said Williams. “We ran a pilot program for a year and realized we needed to take it to the next level. We looked to the marketplace to see who the best in class provider was.”

After vendor vetting, BluCurrent CU selected Hackensack, N.J.-based visual communication solutions firm Vidyo. Three to four months later, and after a process of tweaking and fine tuning, the new enhanced video platform was launched.

“We started in one location and asked members if they would be willing to try the video banking and provide feedback,” said BluCurrent CU’s Executive VP Gary Kirk. “We learned a lot from this process.”

There were two major takeaways from the video trial, explained Kirk. The employee who greets members, the liaison, has to be informative and welcoming as they “hand off” the member to the virtual loan officer or account manager.

“The other thing we learned was about the environment. We started with a more modern, minimalist design, but the feedback was that it felt sterile and cold,” said Kirk. “We remodeled all the video rooms so the members felt like they were in their living room—warm and cozy.”

After two years with Vidyo, all three branches now have video chat capabilities. And the goal of increasing efficiencies has been realized with the help of three well-trained full-time video tellers who serve members during normal business hours, explained Williams. Video calls from the branches are directed to the CU’s member experience center. The average wait time for a member to speak to a representative via video is three minutes.

“Right now we run at about a three-to-one capacity. This means that one employee can serve three stations, which has helped us tremendously from a staffing perspective,” said Kirk. “We have also seen a 20 percent increase in cross-sells.”

Williams explained the credit union’s reasoning behind entering the video banking space was to “learn how to better utilize our staff and improve wait time for members. We didn’t want a just traditional phone line; we wanted to make it more personal with video.”

Gaining traction

Video banking isn’t yet widespread, but the functionality is gaining traction.

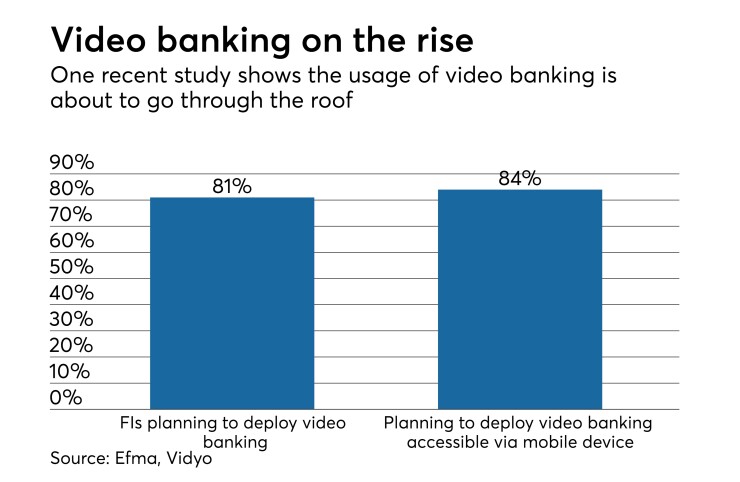

In 2016, Vidyo and Efma, a not-for-profit association of 3,300 retail financial services companies in more than 130 countries, released findings from their report, “Video Banking: The next chapter in a bank’s digital transformation.” Respondents included 136 bankers from 52 countries.

The report found that 81 percent of respondents claimed that their institution had intentions to deploy or have already deployed video banking services within their branches. Additionally, 84 percent claimed they had intentions to deploy or are in the process of deploying video banking services that would be accessible from personal devices.

“The survey results indicate that today’s customers want to interact with their bank in a way that is both convenient to them but personal as well,” said Vincent Bastid, CEO of Efma. “The fact the majority of bankers are looking to incorporate video banking in the future indicates that not only is it set to grow, but video banking is set to become a medium customers will become increasingly comfortable with and reliant upon.”

Respondents also said the following services make the most sense for video banking: private banking (66 percent), mortgage and loans (63 percent), investments (60 percent), new customers (57 percent), current accounts (41 percent) and insurance (38 percent).

“Respondents indicated that complex services such as private banking, wealth management, mortgages and loans, savings and investment plans were the most important types of offerings to include as part of video banking services offered,” according to the report.

Demographic blur

BluCurrent CU’s average member age is 46, and the credit union has 3,063 active mobile users and 9,722 active online users. While conventional wisdom would indicate that video banking user rates would skew to a younger demographic, the opposite is proving true.

“When we started out, we had a concern that some demographics would not be open to it,” said Williams. The response from Baby Boomers was somewhat unexpected, he said. “They would tell us they like it because they Skype with their grandkids all the time.”

Jacqueline Post, BluCurrent’s VP of Marketing, said retired members are actually serving as the best brand advocates for video banking.

“Because of the novelty of the experience, they are more apt to go back home and tell family members or talk to their friends about it,” said Post. “We hear more from them how ‘cool” it is and that’s because it’s non-traditional.”

Williams explained BluCurrent continually polls membership on video banking. The poll asks members to rate the service and ask if they would recommend it.

“Out of a five-point scale, our average rating is 4.5 for a positive experience and 93 percent of members would recommend it, which blew away our expectations,” he said.