PEORIA, Ill.-Loan growth plays in Peoria, at least at CEFCU.

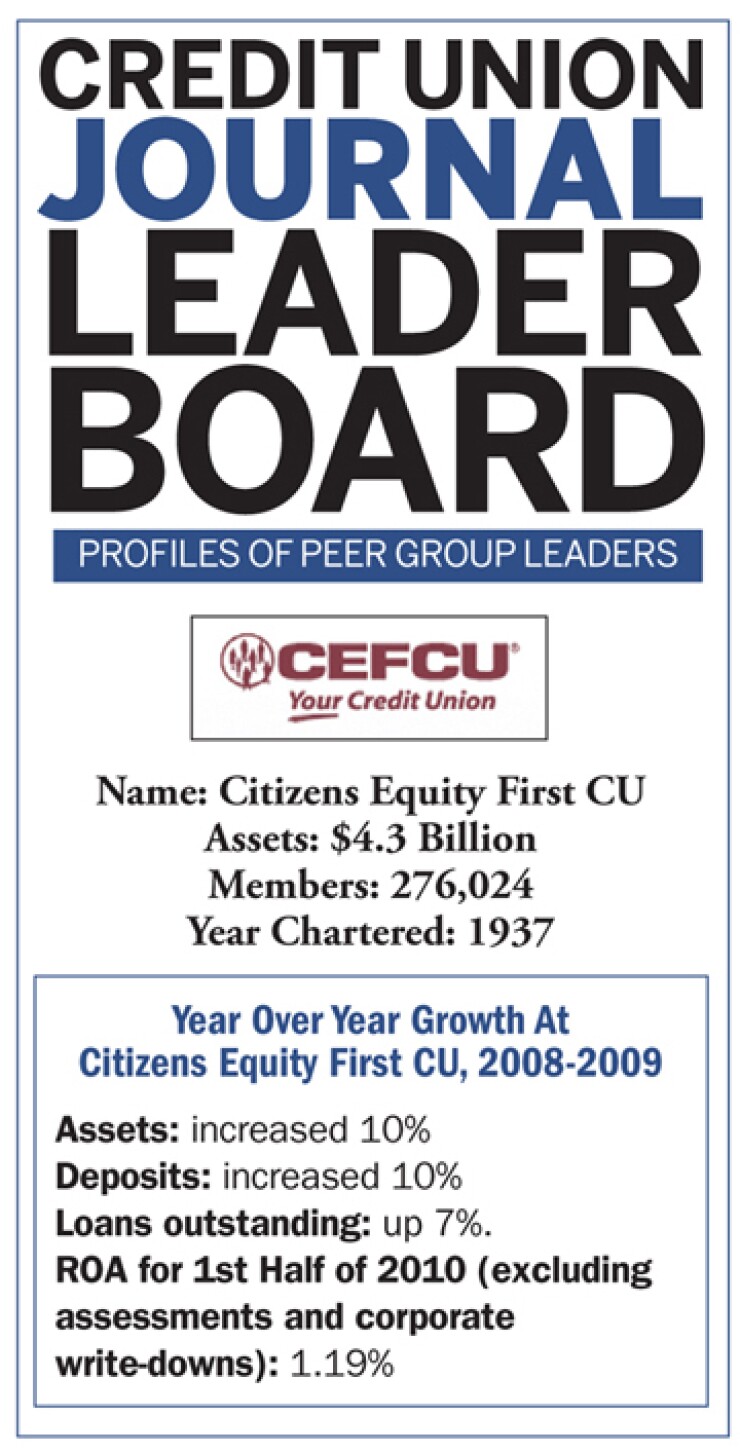

The $4.1-billion credit union, officially named Citizens Equity First CU, had a stellar 2009 and continues to prosper in the first half of 2010, earning it a spot on the Credit Union Journal Leader Board.

While many institutions were languishing, CEFCU was reporting record achievements (see Leader Board stats at right). "Loan growth is down due to weak demand overall, other than a successful July," CEFCU CEO Mark Spenny said. "Net income is $25.2 million, although $10.3 million, or 30 basis points of insured deposits, was accrued for the corporate stabilization and NCUSIF assessments."

Unusually Strong Loan Growth

Many credit unions have seen assets and savings deposits rise as consumers soured on banks, but CEFCU's strong loan growth of 7% is unusual. Spenny said one key contributor has been that central Illinois did not see home values "disconnect from income," meaning there was no real estate bubble.

"We did not have to deal with problems many areas of the country dealt with," Spenny noted. "There has been a little depreciation, but only about 5%, which makes life easier."

Spenny proudly said CEFCU has "done things right for years." He said it is "very aggressive but very disciplined" in lending, never delved into subprime mortgages, but maintains a broad-based focus on consumer lending, especially auto loans.

"We make loans to people with less than perfect credit, but we have a sustainable pricing and underwriting model," he said. "Many captives have moved out of the market, with helped us capture market share. In mortgages we also saw competitors exit the market and not be players for that business. In credit cards, again, some national players pulled back, allowing us to pick up market share. We did not have to curtail our members' credit cards."

On the business lending front, CEFCU has had a dedicated business loan function for more than 15 years. As in the case with other areas of lending, Spenny said it has a sustainable and disciplined model and has picked up business over the past 18 months.

"Our model is sustainable through a variety of business cycles. It features common sense and discipline," said Spenny. "Part of discipline is avoiding layering risk with borrowers. We can handle risk in one area, such as the borrower only able to put down a small downpayment on a mortgage. That is OK, because we can get private mortgage insurance and the borrower pays the premium. But layering is a small downpayment and a high debt-to-income ratio or undocumented income. We won't layer risk because no one has ever proved they can handle that risk."

CEFCU achieved 7% loan growth without any special loan promotions in 2009-it simply picked up market share across the board in consumer loans, mortgages, business loans and credit cards, he said.

At $4.1 billion in assets CEFCU is one of the largest credit unions, but Spenny said other than a few areas, it offers nothing that other credit unions can't also offer.

"Certainly size helps in several ways. We are able to spread compliance costs over a large base of assets," he noted. "We can bring many functions in-house. We don't outsource data processing or check processing, and we have found we can do those more efficiently ourselves."

Paying attention to operating expenses is something CEFCU's management and board have done for years. He said the CU has "comfortable" offices but nothing extravagant.

The credit union's employees are "the key," he insisted, adding the staff is "extraordinarily productive."

"The number of transactions they perform per hour and per day is very high compared to benchmark averages. We benefit from our location in that our people tend to have the Midwestern work ethic, but we take a long-term approach with our employees. We promote from within and we keep people for a long time. We don't think of training as an expense, we invest in training. Many of our employees have been around for years and have a great deal of institutional knowledge, which helps with efficiency."

In years past CEFCU aggressively identified profitability down to the member level. However, the practice wasn't giving management a lot of actionable information. Today, the credit union measures product penetration by products per member or, more importantly, usage index-the products members have and are using.

"Our members tend to be very loyal. Our online banking members are the most loyal and consider us their primary financial institution, so we are focusing our efforts on members that use online banking."

Online Members Are Efficient & Loyal

In 2009, the number of online transactions exceeded all branch transactions. Spenny said this fact does not mean branches are fading in importance and remain effective for cross-selling, opening accounts and pushing to get mortgages.

"But the utilization of our online channel lets us manage the number of tellers we have and keep costs of branches down."

New regulations have forced many changes in the retail marketplace, but Spenny said CEFCU has not yet had to do a lot of repricing of its products to make up for declining income in other areas, such as overdraft or interchange.

"CEFCU never has been dependent on fee income: 0.6% of average assets compared to 1% or more at most credit unions," Spenny observed. "We are much more driven by lending."