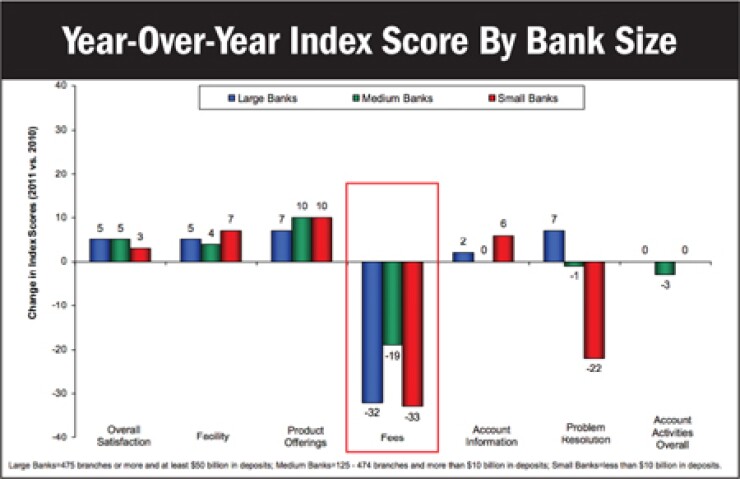

WESTLAKE VILLAGE, Calif.-With credit unions likely adding more fees in 2011 to compensate for growing revenue pressures, there are ways to soften the impact and keep member satisfaction high — just ask the banks.

Some banks are doing a good job of introducing new fees and adjusting others while keeping customers happy, according to the 2011 J.D. Power and Associates Retail Banking Satisfaction Study. Michael Beird, director of banking services practice, shared during a recent Bankerstuff webinar some best practices of banks that are taking a little more from their customers without getting back less on satisfaction scores.

Beird pointed out that fee structure stability improves customer satisfaction and also limits the occurrence of fee-related problems, noting that customers who had their fee structures changed in the last 12 months, compared with those who did not, were more than twice as likely to report a problem. "Things go better when they know what to expect each month," he said.

The study showed that when customers were notified in advance of the new fee or fee change that satisfaction levels were much higher (84% vs. 16%).

But Beird emphasized that the notice must be more than statement stuffers or statement disclosures.

"Customers will find out eventually, we might as well proactively tell them. That means talking to them when they come into a branch, posting signage, and having flyers. It sounds like we are promoting a negative message, but in reality we are just preparing customers so they won't be surprised."

More importantly, added Beird, the financial institution is encouraging customers to ask questions, such as are there things they can do to avoid fees, such as taking additional products or services. "It is better to have this discussion with customers well in advance of the fee rather than waiting until customers get hit with the fee and have them come in upset. You are then dealing with a problem rather than an opportunity."

Proactive Discussion Allows For Cross Selling

Being proactive in the fee discussion allows the financial institution to talk about additional services, but it should be services that meet individual needs. The study showed that customers who felt their bank identified their needs returned extremely high satisfaction scores. "Having that discussion about fees is not something front-line employees relish. But having that talk alongside a discussion about the customer's needs makes that conversation easier and drives down fee-related problems. It ensures the customer walks away with a much better understanding of the fee or service charge."

The key point to banks doing a good job of keeping customers happy while adjusting fees, said Beird, is that there is no benefit to the customer not having a complete understanding of the charge. Anything less than complete understanding puts the financial institution "behind the eight-ball. So it's about ensuring there is consistency, clarity, and understanding."

With that logic in mind, Beird urged bankers considering fee changes to take a long-term view of the need for additional revenue, make the move once, and keep fees stable for as long as possible. "Changing your fee structure multiple times is like death (to the bank) by 1,000 cuts. Customers get bad news on top of bad news and they eventually dread seeing the envelope form the bank."