Credit unions should gird themselves for new premiums sometime this year to shore up the National Credit Union Share Insurance Fund.

That was the message Thursday from NCUA Chairman Todd Harper during his first board meeting in charge of the agency.

“It is increasingly clear the question is no longer if we have to assess a share insurance premium, but when and how much,” Harper said.

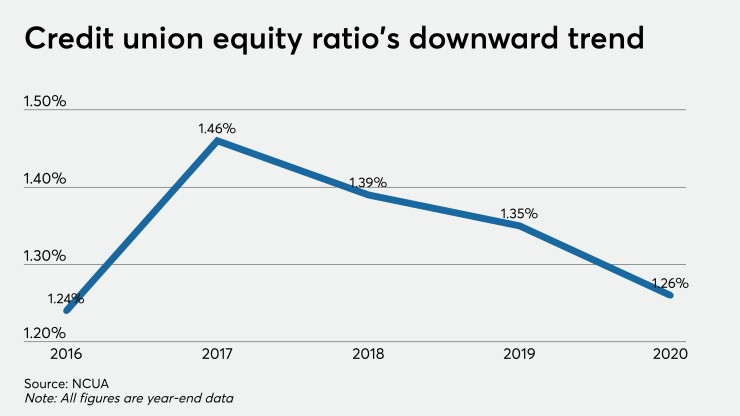

His comments followed a briefing by Chief Financial Officer Eugene Schied, who reported the share insurance fund’s equity ratio stood at 1.26% at the end of 2020, well below the target level of 1.38%.

The equity ratio measures the share insurance fund’s assets — which totaled $19.1 billion at Dec. 31 — against insured shares held by credit unions. If the equity ratio dips below 1.20%, the agency is required by law to assess a premium or develop a fund-restoration plan.

The equity ratio has been trending downward in recent years after peaking at 1.46% in 2017 following the closure of the Temporary Corporate Credit Union Stabilization Fund and its merger into the share insurance fund.

NCUA last assessed a premium in November 2009, partly in response to a wave of credit union failures triggered by the financial crisis. Twenty-eight credit unions failed in 2009 and another 28 in 2010. In 2020, by contrast,

The share insurance fund’s current woes are the product an influx of deposits paired with plummeting investment yields. Flush with cash from government stimulus programs, consumers and businesses are

At the same time, persistent low interest rates mean NCUA’s investment income can’t keep pace. Share insurance fund investments carried a weighted average yield of 1.88% in December 2019. A year later, the yield had fallen to 1.30%, according to Schied.

By law, Treasury bills are the only investment vehicle open to NCUA. “There's a pretty tight range of what our options are,” Schied said.

One bright spot in what Harper termed a “sobering” update: The equity ratio should receive a boost of about five basis points in April after credit unions make a regularly scheduled true-up of the 1% capital deposit they are required to maintain with NCUA. That payment is expected to increase the share insurance fund by about $866 million.

While capital deposit payments offer some breathing space, they will likely be offset by continued declines in investment yields, as well as stimulus-driven deposit increases, Schied said.

“The driver has been the increase in insured shares,” Schied said.

NCUA isn’t scheduled to recalculate the equity ratio until after June 30. Kyle Hauptman, the board’s vice chairman, indicated he wanted to wait until then before considering a premium.

“We don’t have enough information,” Hauptman said, noting credit unions are already grappling with the effects of the coronavirus pandemic.

“When someone is experiencing financial difficulties, I’d prefer not to respond by saying, `'OK, write us a big check,’ ” Hauptman said.

Not surprisingly, many in the industry have pushed back against the possibility of new premiums.

In a letter to the board sent in advance of Thursday’s meeting, Curt Long, vice president of research and chief economist at the National Association of Federally-Insured Credit Unions, predicted the capital deposit payments would push the share equity ratio back above the 1.33% target, or normal operating level, rendering a premium unnecessary.

“NAFCU opposes any premium that is the direct result of excess share growth rather than material weakness in the [share insurance fund],” Long wrote. “The 2020 [share insurance fund] audited financial statements show that the fund remains in a solid position, and that no premium is necessary at this time.”

For his part, Harper called a premium a short-term solution, suggesting Congress should consider broadening the agency’s investment authority, a theme that struck a chord with Lucy Ito, president and CEO of the National Association of State Credit Union Supervisors.

“NASCUS is intrigued by the suggestion of possible congressional action to expand the investment authority of the insurance fund that would maximize yield while assuring the protection of the fund,” Ito said Thursday in a press release. She added that the state credit union system will be studying the Federal Deposit Insurance Corp.’s investment options in order to inform potential legislation.

Overall, the share insurance fund reported $272 million in investment revenue in 2020, down from $304 million a year earlier. That trend is expected to continue as long as the agency is required to reinvest the proceeds of expiring notes into new ones paying lower rates, Schied said.

In other actions, the board unanimously approved a rule streamlining requirements for insuring jointly held accounts. It amends a requirement that each account holder maintain a personally signed account signature card allowing a credit union to provide alternative evidence from its account records to satisfy the signature card requirement.

The rule is intended to ensure prompt payment of share insurance in the event of a failure.