ALEXANDRIA, Va. - (02/21/06) -- NCUA announced Friday it taken overUnion Pacific Streamliner FCU and will run the $39 million creditunion with the goal of returning it to sound financial condition.The 69-year-old credit union, chartered to serve employees andfamily of Union Pacific railroad workers, reported strong capitalof 8% and low delinquency and charge-off ratios of 1% and 0.14%,respectively, at the end of the third quarter, but saw its netincome plunge from $194,000 in 2004 to a loss of $25,000 for thefirst three quarters of 2005.

-

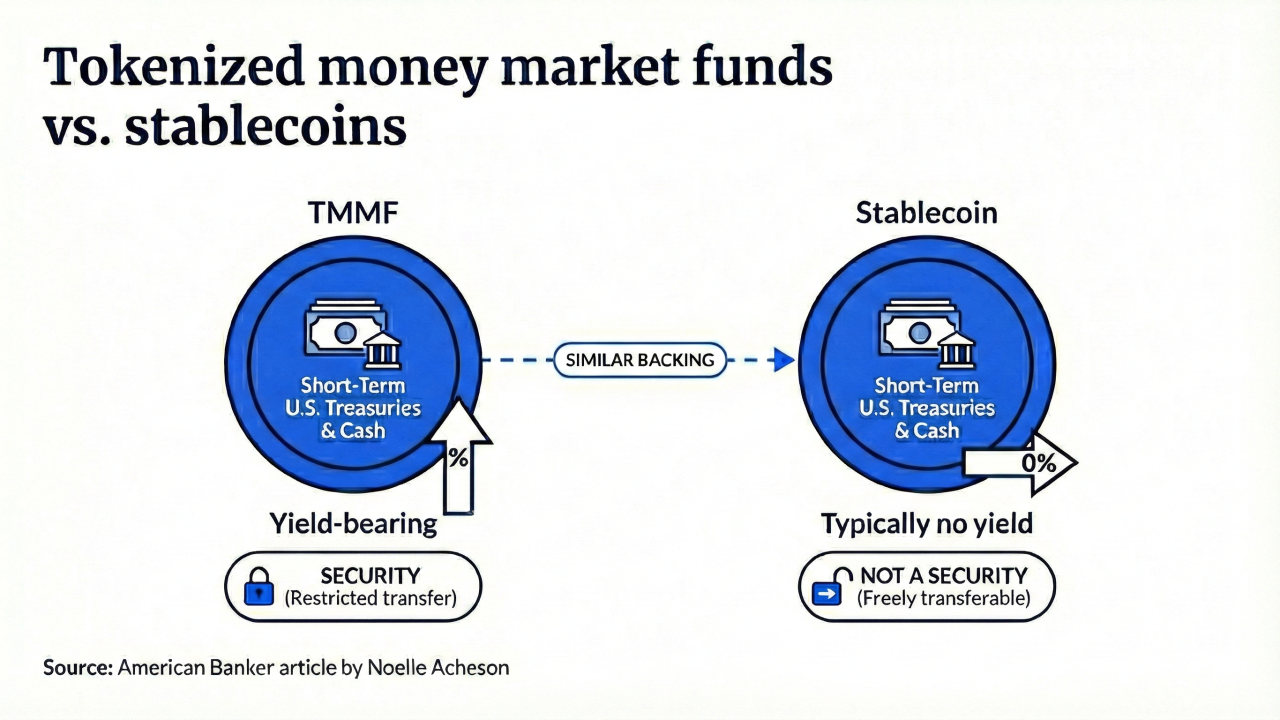

Tokenized money market funds are becoming more money-like — but, unlike the payment stablecoins that share the same backing, they are securities. Noelle Acheson looks at what this means for our understanding of money.

2h ago -

Lenders with between $10 billion and $100 billion of assets grew their core deposits by more than 8% last year, or more than double the industry-wide average. Merger activity was largely responsible for the outsized growth.

4h ago -

The Olympics are boosting spending in Italy, large-in-part thanks to Americans. In the U.K., Barclays is reportedly leading a meeting to seek support for an existing project. The meeting comes against the backdrop of geopolitical concerns and the dominance of American-based payment firms.

February 18 -

Federal Reserve Vice Chair for Supervision Michelle Bowman said in comments Wednesday that the central bank plans to publish its Basel III endgame capital proposal for public comment before the end of March.

February 18 -

The sale of AO Citibank to Moscow-based Renaissance Capital marks the end of an exit plan that started in 2021 and expanded after Russia invaded Ukraine the following year.

February 18 -

Data breach extortion group ShinyHunters used social engineering to steal customer names, addresses and phone numbers from the blockchain lender.

February 18