COVID-19 changed the relationship between employers and the workforce, and 18 months later human resources departments everywhere are still navigating the best way forward.

For many credit unions, the plan is a continued commitment to the people who got them through the crisis: their employees.

This means helping ease the stress on a continuing basis with boosted employee benefits that will outlast the pandemic.

“There’s no going back,” said Joe Mecca, vice president of communications at Coastal Credit Union in Raleigh, North Carolina. “The things that you put in place to take better care of your employees during COVID, to now try to dial those back, you're going to lose employees to the places that are making that a permanent part of their culture.”

In a survey of all types of companies, 98% said they intended to enhance their employee benefits this year, according to Jellyvision, a benefits software company. And while those changes mean a greater financial investment going forward, the overall cost of benefits is expected to increase by just 6.5% in 2022, slightly less than the 7% jump in 2021, based on PwC data.

That extra money is going toward adding programs — and improving existing ones — that make employees feel supported in and out of the office, as our survey of the

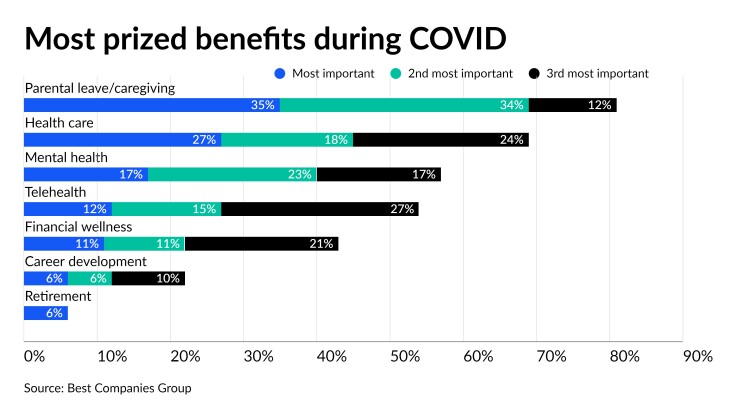

Among these credit unions, 80% plan to increase employee benefits this year. The areas they’ll target include career development (48%), financial wellness (42%) parental leave and caregiving (22%) and retirement (13%).

Nearly every one of the 55 credit unions in the 2021 ranking also reported that they currently have an employee assistance program, or EAP, that provides emotional support benefits. The $143 million-asset Railway Credit Union in Mandan, North Dakota, for example, gives employees access to a free and confidential counseling service for just about any issue, including marital trouble, substance abuse, work problems and financial concerns.

Heightened focus on well-being

COVID placed the importance of a strong health care plan in stark relief last year, and many credit unions responded to the increased fear around health by paying for their employees’ plan premiums in full.

This was the practice even prepandemic at Coastal Credit Union, which ranked No. 7 this year on

Even once COVID is a distant memory, Coastal has committed to continue fully paying for health care premiums.

“Our benefits expenses do go up every year and we're constantly trying to tweak how we do it,” Mecca said. But forgoing any employee contribution to the cost is an investment in building the kind of supportive workplace culture that the $4 billion-asset Coastal sees as a key to its success, he said.

America First Credit Union in Riverdale, Utah, removed all COVID-related costs from their employees’ health care deductibles in 2020, which it will continue to do throughout 2021.

“It did not change our budget, and we did not see any financial implications from this,” said Kent Streuling, senior vice president of human resources at the $15.8 billion-asset America First. “Our priority will always be our employees and their families and making sure our benefits are the most helpful and responsive to their needs.”

Financial wellness, retirement benefits boosted

COVID put retirement security at risk for many: A quarter of all U.S. employees had to reduce or stop their retirement plan contributions during the pandemic, according to the Employee Benefit Research Institute.

But in an industry that helps individuals build financial security, employees’ retirement savings is often a priority.

A case in point: Notre Dame Federal Credit Union in Indiana is among those that decided to step up its 401(k) contributions in 2020.

The $897 million-asset credit union in Notre Dame, Indiana, increased its safe harbor match to 100% of the first 5% that employees put in. It matches 50% of the next 1% from employees, and they are fully vested immediately upon being eligible to contribute.

See all the Best Credit Unions to Work For (as ranked by assets):

Fairwinds Credit Union in Orlando, Florida, continued its 401(k) match of 6% for all employees, and contributed a total of $2.16 million to its employees’ retirement savings in 2020. In addition to free in-person retirement planning meetings with its financial advisors, Fairwinds also offered its first online retirement planning webinar last year.

The $3.7 billion-asset credit union aims to support its employees’ financial health in other ways as well. It encourages them to use their free access to a financial wellness program called SmartDollar as a family activity. And it provides cash incentives to those who achieve financial freedom milestones.

Expanded PTO

Paid time off is the most in-demand employee benefit outside of health care, with 35% of employees prioritizing this perk, according to the insurance company Unum.

In response to COVID-19, many employers enhanced their PTO policies, and credit unions were no exception.

Coastal Credit Union has a PTO sell-back program, and now allows employees to roll over or get reimbursed for more unused hours than it did previously, a plan it will review for 2022.

“Last year we had a lot of employees that just weren't using PTO,” Mecca said. “This year, people are definitely using it more as things open up, but we’re still wanting to make it that there’s not this pressure to use it or lose it. It puts extra money in people’s pockets and allows them to have that flexibility.”

The $221 million-asset Landings Credit Union in Tempe, Arizona, gave employees an additional 40 hours of leave time to use as they needed.

Meanwhile, others allowed employees to carry a negative balance on their PTO — up to 48 hours negative in the case of the $1.5 billion-asset Arkansas Federal Credit Union in Jacksonville.

Child care, other supplementary benefits added

Child care has been a professional, psychological and financial burden for many families during the pandemic — mothers especially. Women worldwide lost $800 billion in income due to job loss over caregiving demands, according to data from Oxfam International.

America First ramped up its benefits for working parents in response to the pandemic, providing more flexible schedules and allowing sick time to be used for child care needs. Those policies will remain in effect going forward.

America First’s workforce is mostly female, and “a majority of our employees have children attending K-12,” Streuling said. “The impact COVID-19 continues to have on families requires us to ensure that all employees are able to attend to their needs.” (America First ranked No. 16 among the Best Credit Unions to Work For

As credit unions like these try to figure out their next steps, they have found providing support during the darkest times — and committing to continue these enhancements in the future — has engendered greater loyalty from employees. That benefit, as they see it, is priceless.

“We’re definitely spending more money to make sure that employees are well taken care of,” said Mecca, who added that Coastal Credit Union is more concerned with how the changes enhance its culture than with “quantifying” the deeper loyalty from its 3,000-plus employees, something that seems so evident to him.

“Making workplace improvements, adding benefits, that kind of stuff is something that we're committed to putting more into within the next five years,” he added. “We’ve never been afraid to make those investments.”