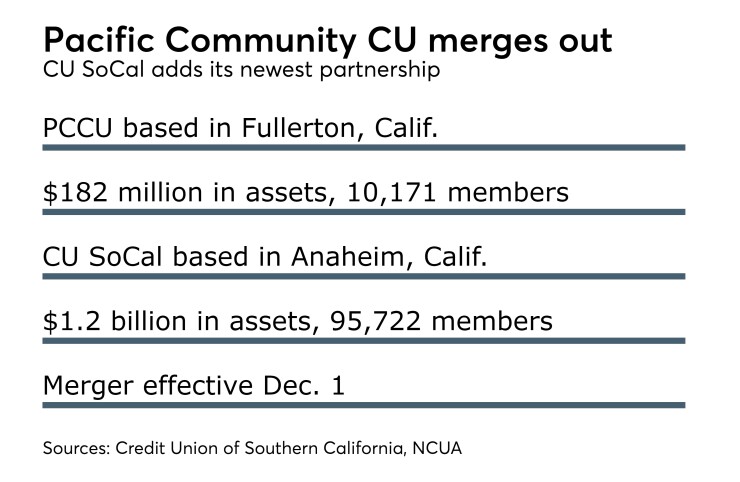

Pacific Community Credit Union, based in Fullerton, Calif., has merged into Anaheim, Calif.-based Credit Union of Southern California.

The merger, made effective Dec. 1, was announced late Monday.

Pacific Community CU had been a $182 million institution serving 10,171 members. Credit Union of Southern California – better known to residents of California’s Orange County as CU SoCal – had $1.2 billion in assets and 95,722 members prior to the merger.

The two CUs cited “greater value and convenience for the combined membership, and increasing opportunities for employee development and career advancement” as the primary reasons for the transaction.

CU SoCal noted this is the largest “partnership” it has entered into to date. It said the newly combined organization will have more than $1.4 billion in assets, 20 branch locations and serve more than 100,000 members throughout Southern California.

Dave Gunderson, president and CEO of CU SoCal, remains as president/CEO of the combined organization. Kevin Pendergraft, who had been PCCU’s president and CEO, will serve on the senior team of the combined organization, the two credit unions said in a statement.

PCCU’s branches in La Habra and Irvine will remain open with the same associates and service hours, the credit union said, adding the merger will provide “new opportunities” to serve the communities in Riverside County.

“I am excited for the expanded opportunities that await you in your new positions,” PCCU’s Pendergraft said while addressing his employees just before the merger. “I am also excited that our members will be part of a credit union that shares our values of providing world-class service and recognizes our members as member-owners.”

“We are equally excited about this partnership,” Gunderson said. “CU SoCal and PCCU both share a commitment to building better lives for members and employees. Together, we bring our members and employees greater value in both the long and short term.”

The credit unions said they relied on employee engagement and CU SoCal’s experience with past mergers to mitigate “complexities” associated with integrating member data and to successfully finalize the partnership just in time for the holidays.