Want unlimited access to top ideas and insights?

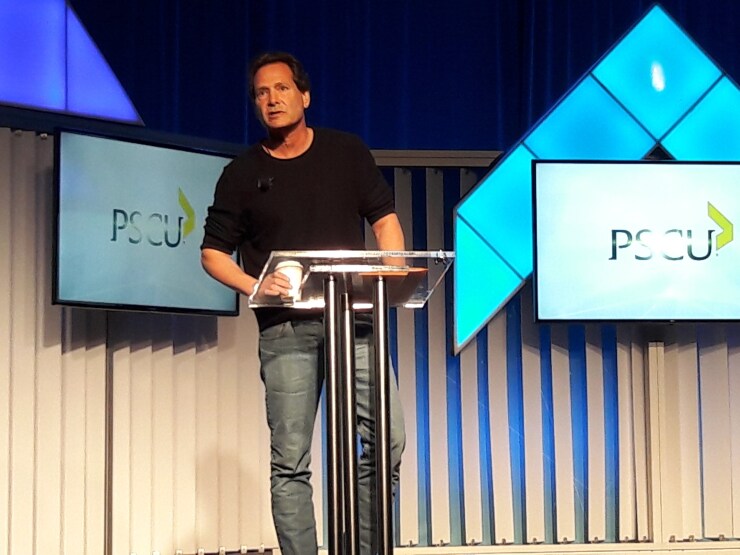

ST. LOUIS—According to PayPal CEO Dan Schulman, the financial services industry is likely to change more in the next 10 years than it has in the last 70 years.

Schulman offered that prediction during a keynote speech on the second day of PSCU’s 2018 Member Forum here —

“Our industry has a chance to make a real difference by bringing folks that are outside [the financial mainstream],” he said, adding “We should be able to bring them in. We should be able to do the things that the typical financial services industry did when it started out — but do it at less cost — by using software.”

That technology, he said, will remake the financial services industry, but it could also pose a few potential threats to credit unions.

“Basic consumer transaction, whether it be cashing a check, getting a loan, paying bills, are going to be done via the mobile phone, and they’ll be done through sophisticated data and algorithms,” he said. “Already at PayPal, with our data and information, our modeling allows us to be almost better than FICO scores today. We’ve given out over $5 billion of working capital loans to small businesses around the U.S. — almost 150,000 of them — without ever looking at their FICO score. We just do it based on data and information we have, and we can use machine learning around that.”

And while Schulman didn’t refer specifically to credit unions, he offered a warning that could strike fear into such a service-oriented industry, by encouraging the audience to reconsider its value proposition.

“I know a lot of people think the value proposition is personal touch. We know the people who come in,” he said. “I’m just going to say to you with full respect that that value will be going away as machines and interfaces learn more about that person than any one person could do, and as the next generation comes into being. I call it Gen Tech — they’re just born on screens; that is what they’re used to, it’s their preferred methodology of interface. There may be certain segments we can serve differently, but we need to really reexamine the value proposition we have.”

With that in mind, Schulman suggested credit unions consider “How would you bring down your value proposition given what you know about the world today?”

Everyone in the financial services industry, he added, should be thinking along those lines and using that as part of their innovation strategy.

“I hope we as a financial services community can work with regulators and work with each other to create a future better than the one we had and bring more people into our system,” he said.