The $1.5 billion-asset Rogue Credit Union reported “strong loan demand” during the first quarter of 2018 across all regions it serves.

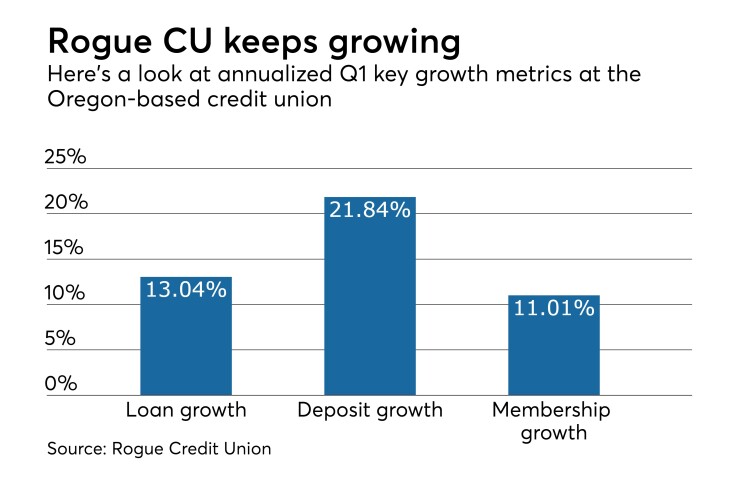

Specifically, in the quarter, Rogue CU increased its loan portfolio by more than $35.5 million (13.04 percent) on an annualized growth basis, for a total loan portfolio of more than $1.12 billion. This compared to loan growth of $17.5 million (7.19 percent) in the first quarter 2017.

Rogue CU’s total deposits reached $1.32 billion (21.84 percent annualized growth) at the end of the quarter, which the credit union said continues to be “well above” credit union industry average and an increase from the 19.73 percent deposit growth it saw in Q1 2017.

Furthermore, Rogue CU’s membership grew to 125,251 during the first quarter, an 11.01 percent increase – slightly better than the 10.23 percent uptick seen at the same time last year.

“Growth is not a strategy,” Rogue CU president and CEO Gene Pelham said in a statement. “It is the result of local consumers trusting us with their savings and loans as they seek a personal touch through a robust branch network and the convenience of capable technology solutions.”

Also, Rogue CU’s equity position remains “stable and strong” as the credit union closed the first quarter of 2018 with a 9.68 percent net worth ratio, well above the “well capitalized” regulatory requirement of 7 percent.

Rogue CU posted net income of about $17.2 million in 2017, down from about $19 million in the prior year.

The credit union’s total leases and loans amounted to about $1.08 billion at the end of 2017, up from about $960.7 million in the previous year.