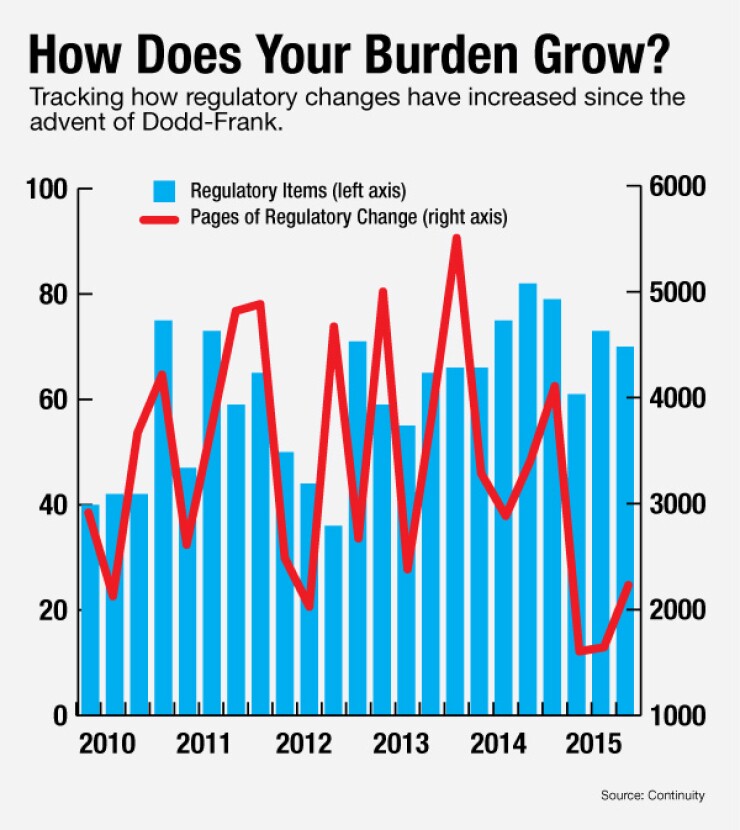

NEW HAVEN, Conn. — The third quarter of 2015 brought 70 new compliance items to credit unions, requiring 2,231 pages to process and expenditure of $29,145, according to advisory firm Continuity.

On a recent Webinar, the company said the third quarter of this year was slightly better than the second in terms of hours needed to comply with new rules. Pam Perdue, EVP of regulatory operations, said the dropoff was "a good thing, because so many credit unions needed to get ready for TRID [the new mortgage disclosure rules]."

Going back to 1975, there has been an average of 50 to 75 new regulatory items each quarter. But Perdue said enforcement actions "skyrocketed" after 2008.

"Do not expect enforcement actions to return to pre-2008 levels," she warned. "There was an avalanche of work in 2015 due to all the pages produced by regulators last year."

Some of the bigger compliance developments during the third quarter that Perdue said should be on CUs' radar include:

- The Military Lending Act was amended in July to provide increased protections for active duty servicemembers. Financial institutions already are reporting being asked during examinations how they will offer protections in a rising-rate environment, Perdue said.

- The FFIEC released new CRA Disclosure Statements in August.

- As of Aug. 11, all credit unions with $10 billion or more in assets are subject to capital planning and stress testing requirements, similar to those facing banks.

- The CFPB issued guidance on PMI in August, clarifying existing rules on borrower-requested cancellation, automatic termination and refunds. "Credit unions should make sure they practices are in line," said Perdue.

- In September the CFPB issued mortgage rules that included a readiness guide and updated exam procedures. "The time frame for compliance has collapsed," said Perdue. "There is not window for messing up — the CFPB expects financial institutions to comply with the new mortgage rules."

- On Sept. 22 the FFIEC released HMDA disclosures statements reflecting 2014 reporting data. These statements must be included in CRA public files. "Treat this as an opportunity to find segments that are not being reached," Perdue advised. "Don't just do it because the government says you have to."

- On Sept. 24 NCUA updated the "small entity" definition of a credit union to $100 million in assets, from $50 million.

- On Sept. 25 the OCC released its 2016 Bank Supervision Operating Plan. "Compliance management is now regarded as an integral part of the overall management of an institution, ahead of credit risk, loan underwriting and cybersecurity."

- NACHA released several updates in September: two rule changes relating to compliance and/or operational topics, and four minor rules changes or definitions. Perdue said the biggest effects will be felt by originators that issue ACH cards to consumers.

- TRID finally was implemented Oct. 3 after some delays. Said Perdue: "It was nice to get a couple extra months, but that did not make up for all the extra hours spent."