The Small Business Administration failed to secure an appropriation in the fiscal 2022 budget that would have empowered the agency to lend directly to small businesses. In the wake of strong opposition from banks and credit unions, it omitted funding for direct lending altogether in its fiscal 2023 spending plan.

That doesn’t mean the SBA is giving up on the idea.

In testimony last week before the Senate Committee on Small Business and Entrepreneurship, Administrator Isabella Casillas Guzman said the SBA was “asserting our interest in continued research in this area within the budget,” though Guzman acknowledged the agency did not ask for any “specific” direct-lending funding.

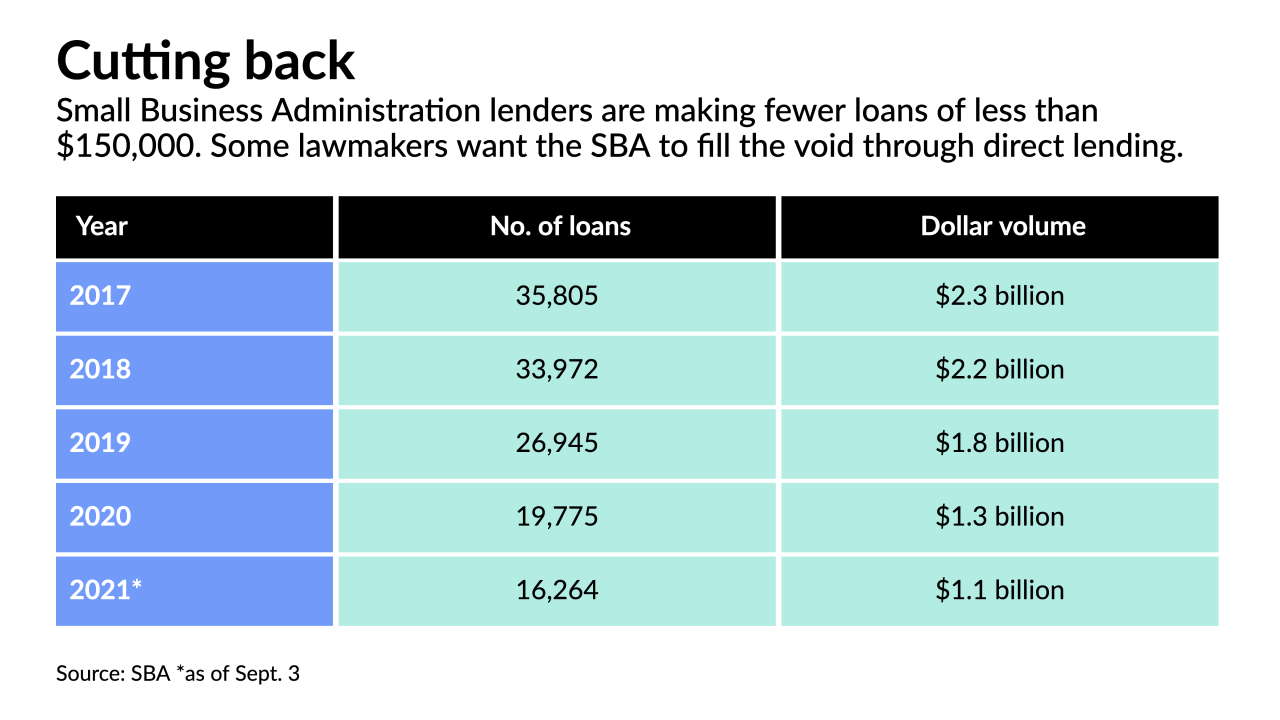

Banks, which dominate the agency’s 7(a) and 504 loan guarantee programs, are making fewer small-dollar loans — especially those under $50,000, according to Guzman. That makes it tougher for minority and underserved small businesses to access capital, she said.

Hence the SBA’s ongoing interest in direct lending.

“We’ve seen a decline in small-dollar loans … with less lenders in that space,” Guzman said. “They’re complicated loans to do and just as expensive as a larger loan.”

Guzman told lawmakers she envisions a model where lenders, including banks, could refer deals they were reluctant to make on their own to the SBA. “It could be a community bank that is not underwriting restaurants but wants to retain that depository relationship and that customer and continue to support that business, so they could access the SBA’s direct-lending vehicle.”

“That’s the intent of the program,” Guzman added. “It’s really to simplify lending at SBA and to continue to work through our banking partners, as well as others.”

Sen. Ben Cardin, D-Maryland, chairman of the small-business committee, expressed support for a “reimagined direct-lending program” that would create “another avenue for access to capital, filling the current gap in our financial ecosystem.”

The Biden administration

The White House and key lawmakers want to allocate $4.5 billion for smaller 7(a) loans that would be made by the Small Business Administration. The financial services industry says the government should collaborate with the private sector rather than compete with it.

For their part, banks and credit unions appear determined to preserve the status quo, where, aside from disaster relief, the SBA’s direct-lending role is limited. In 7(a), the agency’s flagship program, in lieu of lending money on its own, the SBA provides guarantees of 50% to 85% on loans made by private-sector lenders.

The American Bankers Association and other financial services trade groups say there’s no reason to tinker with a system that has produced more than $70 billion of loans for small businesses since October 2019.

“Thanks to the efforts of banks across the country and the SBA, the current 7(a) program continues to exceed its lending goals every year,” ABA spokesman Jeff Sigmund said Friday. “We still believe that small businesses would be better served by building on the success of that existing public-private partnership rather than have the SBA create a direct-lending program that would compete with banks.”

Credit union representatives delivered a similar message.

“This public-private partnership works as borrowers can obtain loans from financial institutions that they know well and that have vested interests in their borrowers’ success,” Credit Union National Association President and CEO Jim Nussle wrote Tuesday in a letter to Cardin and Sen. Rand Paul of Kentucky, the ranking Republican on the small-business committee.

In testimony before the House Small Business Committee last month, Robert Barnes, president and CEO of the $895 million-asset PriorityOne Bank in Magee, Mississippi, said the SBA lacks an adequate distribution network, so any loans it offers would reach fewer borrowers.

“Today, there is a strong network of community banks, community development financial institutions, and other lenders already in place to meet demand for small-business borrowers,” Barnes told lawmakers. “Direct lending is a poor and costly alternative.”

In addition to the ABA, CUNA and the Independent Community Bankers of America, on whose behalf Barnes testified, the National Association of Federally-Insured Credit Unions, Consumer Bankers Association and Bank Policy Institute have all declared opposition to direct lending by the SBA.

Guzman has taken several steps on her own aimed at boosting small-dollar lending. In March, for instance, Guzman

The 11-year-old Community Advantage program was created to give low-income borrowers and those in underserved communities wider access to capital. In contrast to 7(a), Community Advantage loans are made by nondepository CDFIs, though the SBA guarantees them.

Earlier this month, the SBA

According to agency statistics, 7(a) lenders seem to be making more small-dollar loans lately. Between Oct. 1, the start of the 2022 fiscal year, and April 22, 7(a) lenders made $693 million of loans for $150,000 or less, up 22% from the same period in fiscal 2021. But the fiscal 2022 number represents a 41% drop-off from the same period in the 2018 fiscal year.

Community Advantage loans totaled $30.2 million as of April 22, up 31% from the same period in fiscal 2021.