Compensation for top credit union executives continues to rise but at a slower pace amid fears of an economic slowdown.

Credit unions face unique challenges in coming up with the proper compensation for top executives and talented lenders given certain regulatory restrictions. On top of that, the potential of a recession is looming, making boards more hesitant to significantly increase pay.

“In the last few years, economists have been predicting a recession. It has been out there so much some people are taking their foot off the gas just a little bit,” said Mike Becher, a vice president with Industry Insights, a research firm based in Columbus, Ohio. “They don’t want to keep pumping up salaries in case the economy flattens out. Just a little bit of conservatism, which we are seeing across all industries.”

All 19 executive positions at credit unions saw increases in base salary, bonuses and total compensation, which includes car allowances, club memberships and other non-salary perks, according to the 2019 Credit Union Executives Society executive compensation survey.

Salaries at credit unions increased by an average of 5%, said Becher, whose firm works with CUES to create the annual compensation survey. That’s compared with an average of 3.1% for all industries, according to data from a WorldatWork survey, Becher said.

Industry Insights also does salary surveys for community banks, but it does not cross-reference CU and community bank studies because the data belongs to the respective associations.

Median total compensation for CEOs at credit unions with more than $1 billion in assets was $672,500, according to the CUES survey. That’s more than five times as much as the median for CEOs at institutions with less than $50 million in assets. The median CEO compensation for all asset categories was roughly $289,500.

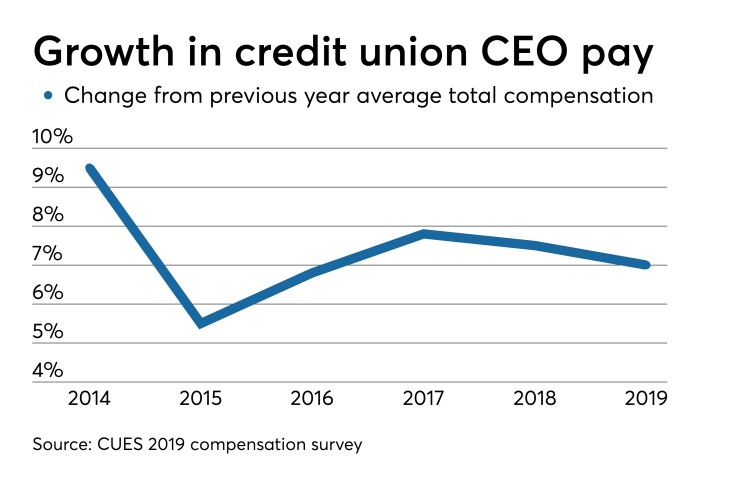

However, more than half of the positions at CUs saw less of a year-over-year increase than the previous year, on a percentage basis. Total CEO compensation increased by 7% this year, which is lower than the 7.5% uptick in 2018.

Dennis Dollar, principal partner at the consulting firm Dollar Associates in Birmingham, Ala., said credit unions have “found themselves behind the competitive curve” for talent because they have not “modernized” their approach to both bonus compensation and executive benefits such as deferred compensation.

Executive benefits is the most significant “area of non-competitiveness” for credit unions, Dollar argued.

This is partly due to National Credit Union Administration regulations that prevent tying incentive compensation to loan production, Dollar said. This has been especially problematic in recruiting lenders. However, this could eventually change.

“Credit unions have tried to catch up with more incentive bonus on growth metrics such as capital growth, return on assets and earnings – measurements that are more overall institutional performance based not subject to potential manipulation such as deposit growth or loan growth can be if not monitored closely,” Dollar said.

While base salaries have increased for credit union executives, he said some types of performance bonuses have been structured on broader institutional categories of performance that work around NCUA’s loan production prohibitions.

“However, many credit unions still have no deferred compensation plans, and if they do have these types of plans, they are poorly structured,” Dollar said. “Credit unions need deferred comp plans for more than the CEO. They need to be able to recruit and retain the best and the brightest in executive talent and, in today’s market, this requires quality deferred comp plans for those most critical senior executives other than CEOs.”

Best practices for salary configuration

Becher said when Industry Insights conducts its CU salary survey, it asks respondents to list the three most important factors they use for determining bonuses for CEOs. Earnings, membership growth and satisfaction and share growth are the most frequent answers.

Asset size, years of experience and education level are top factors that determine compensation, Becher said.

Another trend Becher has noticed in recent years, across all industries, is as the baby boomer generation retires, the length of the average executive contract is getting shorter. For example, while five or 10 years ago credit unions were signing five-year contracts with CEOs, now those deals are for four years.

Hardy Wilkerson, chairman of Cosden Federal Credit Union in Big Spring, Texas, said that his board likes to examine salary surveys for what similarly sized credit unions in comparable markets pay and use those figures as a starting point.

“Then we gauge performance factors such as market share, ROI and year-over-year growth,” he said.

The board realizes competitors might be tempted to recruit the $42 million-asset credit union’s CEO, Laurie Barraza, so it “tries to make sure she is compensated competitively so no one tries to hire her away,” Wilkerson added.

Bill Widlick, chairman of the $15 million-asset Amarillo Postal Employees Credit Union in Amarillo, Texas, leans on his experience of running a home building company to help set pay levels for all of the credit union’s employees, including the CEO.

“We look at what local companies pay their employees, and we try to pay higher than the average to avoid people quitting,” Widlick said, adding the CU uses extra vacation days as an additional incentive. “We treat our employees better, which has always been my philosophy.”