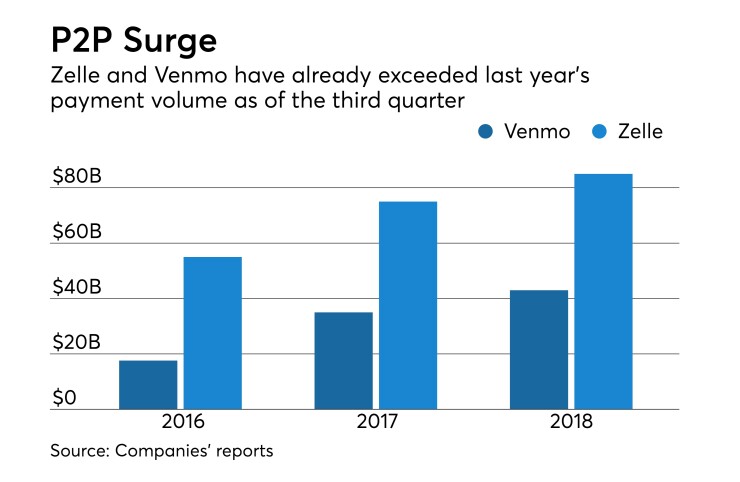

Consumers are continuing to warm to Zelle, the bank-owned person-to-person network, which revealed Monday that it had processed 116 million transactions during the third quarter, up 15% from a quarter earlier.

The transactions were worth $32 billion, up 13% from the second quarter. Forty financial institutions signed up for Zelle in the third quarter, with Early Morning executives predicting more will follow.

“As we strive for ubiquity, we are working closely with banks and credit unions of all sizes in offering a fast and consistent payments experience,” said Paul Finch, Early Warning CEO, in the press release.

Many credit unions were early adopters of Zelle and

The news of Zelle's growth comes as its biggest competitor, Venmo, has increased its fees for instant account transfers, prompting some consumer backlash. Venmo raised the fee from 25 cents to 1% of the transfer amount, though the minimum will be 25 cents. Users can still transfer funds for free, but must wait one to two business days to receive their money.

Some Venmo users flocked to Twitter to chastise the company about the fee increase and vowed to abandon the service. Such angst will likely do little, however, to stop Venmo’s momentum as it also continues to break transaction records.

Venmo’s total payment volume in the third quarter increased 78% to almost $17 billion. The company hauled in $1 billion in fees associated with the instant transfer feature.

Venmo’s fee controversy could turn into an advantage for the banks associated with Zelle as the two platforms, along with others like Square Cash, continue to go head-to-head for market share. Zelle has positioned itself as an easier and quicker way to transfer funds between family and friends. Transfers are nearly instant, and free.

That, in turn, has been viewed as a boon for banks and credit unions that continue to battle fintechs that are changing the conversation about financial services in 2018.

“These aren’t cute little experiments anymore,” said Dave DeFazio, partner at StrategyCorps, Monday during a presentation in New York City at the annual ABA Convention. “These kinds of services are table stakes. Luckily for banks, you can hop on board with Zelle as all the core processors are equipped to make the connection for your bank.”