You won't get far in Credit Union Journal without finding some mention of a merger between credit unions. It's rare to get through an entire issue without news related to a merger somewhere.

It's not an official merger announcement unless the press release is replete with mention of the fact members "overwhelmingly approved" the combination; it's kind of amazing that members are never "just a bit more than lukewarm" or "apathetic to slightly in favor" of a merger; apparently, it's "overwhelming or bust" when it comes to such votes.

But that's not the case everywhere. In the Queensland region of Australia (in an area known as the "Sunshine Coast") members of Maleny Credit Union have nixed a merger their own board had "unanimously decided" was the "best outcome for members." (There is a bit of a caveat here, admittedly, as the merger vote officially failed because the credit union did not get the special majority of 75% of members voting that is required.)

In all, just 22% of members voted, including 319 at a special meeting at the local Community Centre, with more than 60% of those members (plus those who voted by proxy) rejecting the proposal to become part of Credit Union Australia. For Credit Union Australia, the brush-off had to be as much a surprise as a waitress in a small town greasy spoon telling a passing-through George Clooney she doesn't give out her phone number.

Credit Union Australia has a goal as broad as its name.

At a World Council meeting two years ago Chairman Bob Powell said CUA's objective is to eventually control 25% of all CU assets in the country. What began its life as little St. Anne Credit Union in Sydney at year-end 2010 had $7.6-billion in assets and more than 400,000 members. It has not become the Australian version of Navy Federal thanks to organic growth; at the time Powell spoke to credit unions two years ago, Credit Union Australia had absorbed a whopping 120 other credit unions via merger, some of which he referred to as "rescue mergers."

Mergers can be and often are tricky, political things. For many board members, being on the board is as important to them as how well the credit union is doing in serving members. But Credit Union Australia has found a nifty little strategy for getting board members at other CUs to agree to a merger: it pays them a severance package. (Powell offered an aside, by the way, that doesn't say much about gender diversity on boards: "You can only hope that some of the board members are considering retirement, and you can encourage them to see the value of spending more time with their wife and children.")

I don't know whether members of Maleny Credit Union knew about the "severance package" for members of their board when they decided against being part of the CU Wonder Down Under. But they did turn their backs on what a local media report called a "culmination of months of lobbying by the credit union's board members, who said MCU would not have a sustainable future if the merger did not go ahead."

That same report said the board cited limitations in its current capital base and the increasing complexities and cost of governance, compliance and management in choosing to pursue the merger.

At the special meeting, one board member announced, "Without capital, MCU is not allowed to lend. No lending means no profit."

That message didn't carry the day. A number of people described as "founding members" argued against the merger at the special meeting, and were described as saying the "current board and management do not have the passion to come together with the community to find a solution that keeps the MCU from becoming just another bank."

When it came time for the vote, the "nays" outweighed the "ayes," and when the vote was announced, a media report said, the "at-times rowdy meeting...erupted in cheers," along with a few calls for sacking the board.

The board wasn't sacked, but it is refreshing to see this kind of shareholder democracy in action. On its Web site, Maleny Credit Union states: "The Board will take a little time to consider the strategic direction of the Credit Union and how best to gauge the views of the hitherto silent majority of members."

On that same site Maleny Credit Union proudly displays its logo, which includes its slogan, "Sustainable Banking." Apparently, its members believe that sustainability should be sustained a bit longer.

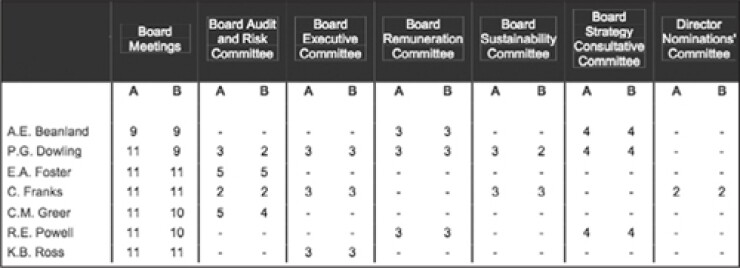

• Separately, and speaking of Credit Union Australia, it includes in its annual report-which is also fully available online-an interesting disclosure that ought to be in every U.S. CU's annual report, as well: a chart showing the number of board meetings a director was eligible to attend, and the number of meetings the director actually did attend (see graphic above).

Frank J. Diekmann can be reached at