As much as credit unions pride themselves on providing high-quality personal service, gaining a clear view of how members perceive their branch experience is a persistent challenge. How do members rate the expertise and professionalism of the employee serving them? Is the branch lobby easy to navigate? How long is too long to wait for service? And how can credit unions best act on member feedback?

Member surveys are an option, but they take time and response rates are often low. Secret shoppers provide another means of assessing frontline service, but savvy staff may be able to discern when their work is being evaluated and respond accordingly.

Just as technology is reshaping financial service delivery, it also offers new tools to evaluate the quality of branch service and to take steps to improve it.

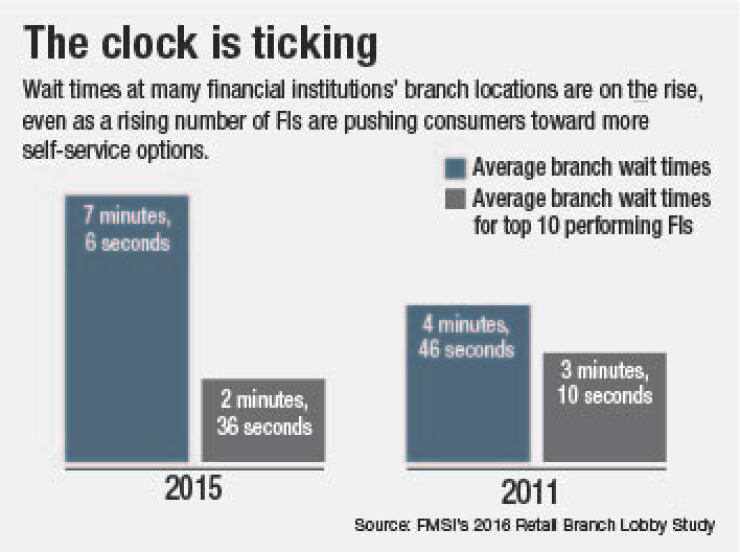

Take, for example, the issue of wait time—the amount of time between members’ arrival in a branch and the beginning of their interaction with a credit union employee. According to FMSI’s 2016 Retail Branch Lobby Study, wait time increased, on average, from 4 minutes 46 seconds in 2011 to 7 minutes 6 seconds in 2015.

However, among the top 10 performing financial institutions in the study, wait time actually dropped from 3 minutes 10 seconds to 2 minutes 36 seconds. That improvement is attributed to proactive steps those credit unions and banks took to improve service delivery, including coaching and smarter staff scheduling.

Monitoring service delivery

Managers at ELGA Credit Union’s eight branches have a clear view of service quality—from stats on how long members are waiting for service and how long each transaction takes to direct member feedback provided immediately as they leave the lobby. The Burton, Mich., credit union, employs software to manage full-time and part-time teller schedules and track the time spent conducting transactions, interacting with members, and “waiting for work.”

“Monthly performance reports tell us what our peak-times are, how we compare to last year in volume, and how centers are doing in terms of transaction times. That’s broken down by branch, and it’s known as TPH, or teller processing hours,” explains Kathleen Smith, vice president of branch experience. “We can track and analyze frontline labor costs and cost per transaction with comparisons to the same time last year.”

That analysis permits more efficient scheduling of part-time employees at peak-times and the assignment of associates to handle outbound sales calls during down time, Smith notes. The scheduling system measures full-time employees’ net difference between optimal versus actual transaction volume, branch labor costs and productivity, and cost per transaction.

Technology tools can also streamline service delivery by connecting members more promptly with a financial service professional who can handle their specific request. Members at Digital Federal Credit Union encounter a kiosk when they enter a branch lobby where they can sign in with their name and service request. The queuing system tracks who’s next in line with for each service and tracks wait and assist times in real time to improve scheduling and assign additional staff to serve members if lines begin to form in the lobby, say Michael Caissey, regional branch manager for the Marlborough, Mass.-based credit union.

Tellers can step in some cases and help members with simple requests like an address change, Caissey says, and member service representatives appreciate the ability to address members by name and know in advance what service they’ve requested. “The efficiencies have really come through for the branch, and the member experience is just that much better,” he notes.

Immediate member feedback

Complementing its behind-the-scenes technology, ELGA Credit Union also tracks members’ perceptions of service by deploying kiosks in its branches and administrative office that invite members to click a range of happy-, neutral- or sad-face icons to rate their experience.

Those kiosks generate at least 4,000 responses each month, averaging in the 94 percent positive range for branch service, Smith says. “That’s not good enough for us, but we’re continually looking at member responses for ways to improve service,” she adds.

Employees in every branch and department get together for a regular brief morning meeting, in which branch managers typically review the service ratings from the previous day. This immediate feedback makes it much easier to identify the source of service lapses than a monthly survey. Conversely, branch teams “look at days where they get 100 percent and try to apply that to days where they didn’t get that high of a rating. They’re able to look at what they’re doing well and what they can improve on,” Smith notes. “When members leave happy, they’re going to hit that on the machine, but they’ll also let you know when they didn’t have a good experience,” she says.

ELGA managers can compare data from teller scheduling software with member ratings to identify when negative ratings might be tied to busy periods at a branch that extended wait times and assess whether scheduling changes are needed.

Especially in combination, these technology tools can help credit unions continually assess and optimize the quality of the personal service they provide. Lobby-tracking software provides an effective queuing mechanism, facilitates more personal and efficient service, and measures wait and assist times so managers can improve scheduling over the long term and even respond in real time when lines begin to form. In addition, tools to gather members’ assessment of the service they’ve received on the spot provide a more immediate means to identify and correct problems—and highlight and build on service successes.

Ultimately, member-facing and behind-the-scenes technology can provide a more complete view of the member experience, “and that’s what it’s all about,” Smith says. “How is the member feeling? What does high-quality service look like? If the wait is too long or associates are talking with each other about where they’re going for dinner that night, that’s not a good experience for members. Those are the things we want to know.”

Meredith Deen is director, Products & Services for FMSI | A Kronos Company, which provides financial institutions with business intelligence and performance management systems for efficient branch staff scheduling and lobby management. She can be reached at