-

Wise bank managers make sure that they are training employees for their next roles, and creating a deep bench of versatile talent.

June 28

-

Bank of Montreal is raising the minimum wage for its U.S. branch and contact-center employees to $20 an hour, its second such pay bump in less than a year, as companies fight for workers in a tight labor market.

July 11 -

Bankers say they're putting up with behavior from entry-level workers that never would have been tolerated in the past because it's so hard to fill positions. Those compromises can undermine corporate culture.

November 22

-

It’s easy — but pointless — to lament the havoc that the economy has wreaked on performance metrics lately. Instead, draw up an opportunistic new plan, urge your employees to focus on execution and worry less about what rivals are doing.

April 16

-

A severe cold snap in the state has tested financial institutions unaccustomed to such weather-related disruption.

February 19 -

Despite limiting on-site visits and adding more self-service channels, the industry is forging ahead with plans for hundreds of new or expanded brick-and-mortar locations.

January 8 -

The New Canaan, Conn., company said it will record a pretax expense of $3.9 million in the fourth quarter related to branch and office closings, severance payments and the end of a vendor contract.

December 31 -

Bank and credit union groups are pushing to include the industry’s front-line workers in the next priority group, but even as a recommendation is coming soon from a CDC advisory panel, the decision ultimately will be made state by state.

December 18 -

Some banks and credit unions boarded up branches and closed early in anticipation of unrest tied to the tense presidential race.

November 3 -

Some banks and credit unions boarded up branches and closed early in anticipation of unrest tied to the tense presidential race.

November 3 -

With coronavirus cases on the rise, Hoosier Hills CU in Bedford, Ind., has chosen to temporarily restrict access to its facilities. Observers say other institutions are likely to follow suit eventually, whether they want to or not.

October 27 -

Whether it was their nimble shift to digital, or willingness to interact in new ways with customers in branches, bank employees have met head-on the business challenges posed by the outbreak.

September 30

-

A nationwide branch network remains a calling card for the entire industry, while also exemplifying the movement's cooperative spirit.

September 24 CO-OP Financial Services

CO-OP Financial Services -

“What COVID has done for us is it has showed us where to prioritize investments,” William Demchak said at an industry conference in discussing the Pittsburgh company's plans to speed up the shift to digital banking.

September 15 -

The Liberty Lake, Wash.-based credit union has agreed to buy four branches from the Roseburg, Ore.-based bank.

September 11 -

Members are completing more of their banking online than ever before, forcing many institutions to rethink their strategies for physical locations.

September 11 -

Dennis Devine will have to navigate a number of issues, including economic strife and a pandemic, as he takes the helm at the $13 billion-asset institution.

August 19 -

A handful of credit unions have embarked on co-location strategies, sharing branch space with coffee shops and other businesses, but the social distancing era may force some institutions to rethink those plans.

August 7 -

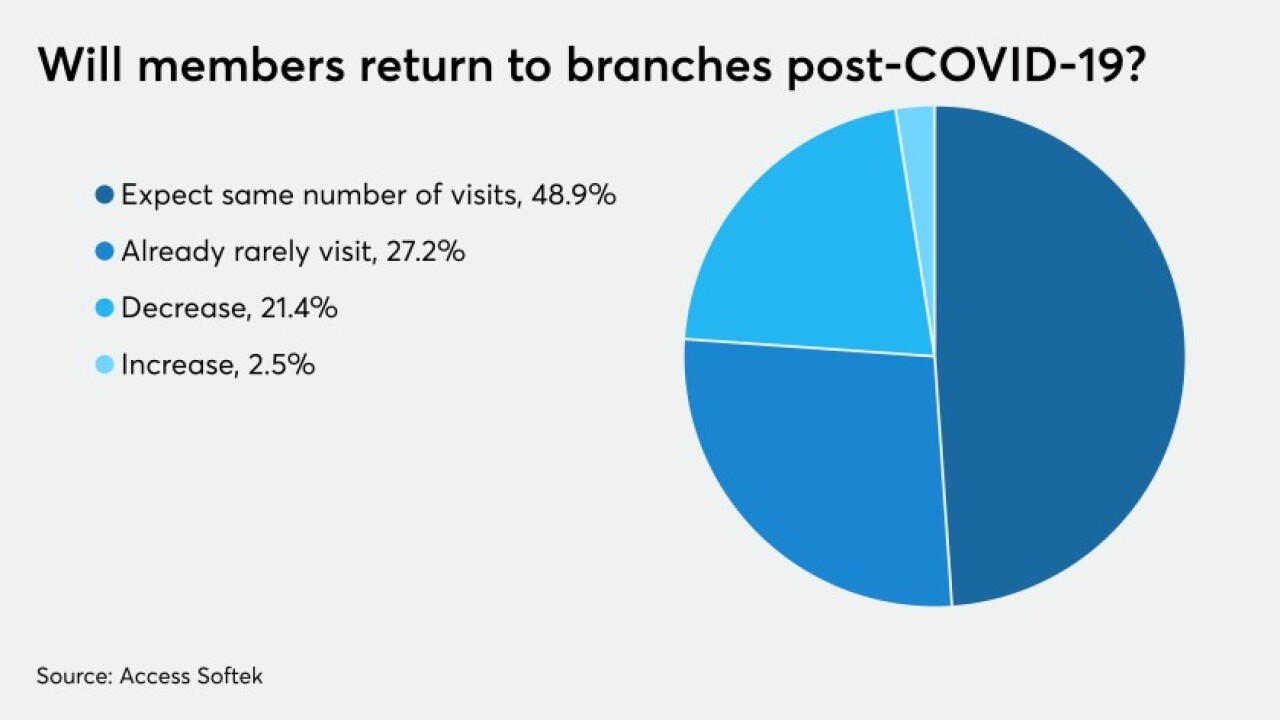

A new report from Access Softek showed at least one in five members are likely to reduce their branch visits once the pandemic ends, though the risk of consumers leaving their credit union entirely may have declined.

August 5 -

Like many other institutions, the South Florida-based credit union had reopened its locations after restricting member access from March to May while much of the nation was in lockdown.

July 27