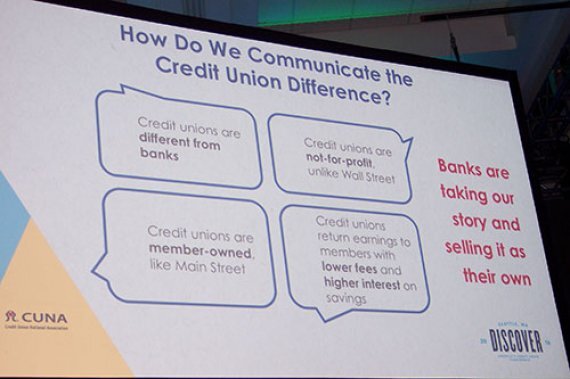

Staatz praised the new chairman of NCUA, saying when CUNA talks about advocacy, its leaders are "really glad" Rick Metsger is there. "He is trying really hard to do his job as regulator and work with credit unions. Jim [Nussle, CUNA's president and CEO] and Ryan [Donovan, chief advocacy officer] are really good, but it is going to take more than Jim and Ryan. It is going to take all of us. We need to make sure banks don't continue to define who we are. We need to make sure banks don't continue to set the agenda. There are many things our members want, but we are limited. We need to remove those barriers. All of you need to develop relationships with your Congressmen and Senators. You have to tell our story it will make a difference. We need to tell everyone about the uniqueness. Make sure everyone knows how good we are to our members. We want credit unions to grow, because that helps more and more households."

The Awareness Initiative is not an advertising campaign, Freeborn stressed. "It will put leagues and credit unions in the driver's seat and provide empirically tested methods. There will be a networked approach because credit unions working together are exponentially stronger."

"After hearing these messages, 82% of bank-only customers say they are interested in moving one or more accounts to credit unions," Kiker said. "We cannot wait. There has never been a better time to move non-members to credit unions, and get non-PFI members to engage more with us. The average age of a credit union member is 48.5 years old, while just 7% of members are 18 to 24."

In Phase I, Step 1, employee ambassadors are "activated."

Step 2: release of the digital engagement and mobilization toolkit. Descalzi said because 90% of millennials are on social media, the toolkit will include social media tips and strategy, weekly shareable graphics for social platforms, and timely content to post on each platform. She said it will result in digital amplification of top content via social media awareness in key areas, profile and background pictures for Facebook and Twitter; and, weekly credit union highlight e-mails.

Step 3: creation of an awareness best practices analysis and hub a way to share ideas. "We know you all are the experts, but you need to be connected so you can work together," said Descalzi. "The hub will include media templates, e-mails, social media language and images. The hub will serve as a learning site."

Phase III will be known as "sustain and measure." According to Dorton, "We will realize the fruits of our sustained labor with transparent measurements of new members and greater wallet share." The Awareness Initiative is a partnership effort. CU stakeholders are invited to send questions and suggestions to:

"We need to tell our story," said Dorton. "Tell about the credit union difference locally, regionally and nationally."

How could CUs disrupt the entire financial services system? Li said they need to create a strategy around member obsession. "Obsess about your members and what they need. Create an organization that obsesses about members. It will look different at every credit union."

According to Li, an engaged leader is someone who uses digital, mobile and social tools strategically to achieve established goals as they relate to leading people and managing organizations. She noted Red Robin restaurants set up a system of listening to customers via employees. They asked the servers on the front line to tell upper management what is really going on. This allowed the restaurant to address deficiencies in 30 days, rather than a year or more. "Listen, share and engage," Li said.

Although millennials get a lot of bad press, Schau said they are on track to be the most educated generation to date, as defined by completing at least a bachelor's degree at ages 18-33. They carry a lot of student debt, their unemployment rate is high, and for those that are employed, they do not have job certainty they do not know if their job will exist from one moment to another. Because of these factors, Schau said millennials have rekindled the former tradition of an extended family which she said was common in America before World War II and remains the dominant form of family worldwide. These millennials living in their parents' homes after they have graduated from college sometimes are referred to as "kidults."

CUs need to prepare for delayed milestones and create "kidult" milestones, Schau suggested, along with reviewing "family" requirements in financial instruments to account for non-traditional families and living arrangements. Possible new products: family fleet cars, "Framily" college funds and loans (friends and family networks), member-funded business ownership and development, and shared services.

"Collaborative consumption is a reality it is not scary, weird or unusual," Schau said. "Ownership models are being challenged. Access economies are emerging. Credit unions, as inherently collective, trusted financial partners, are poised to take on new access models."