Who Said Anything About a Peak?

David Enertson II, consumer loan administrator, Whatcom Educational CU, Bellingham, Wash.

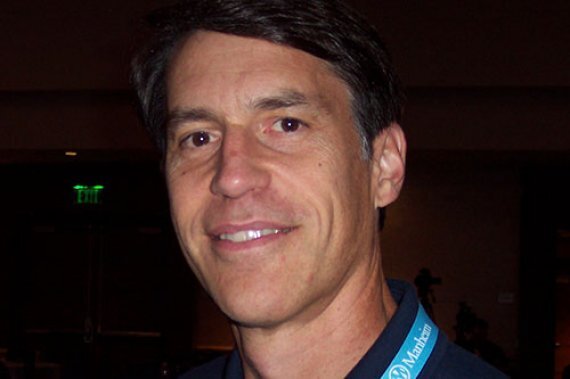

Rich Black, indirect lending manager, Oregon Community CU, Eugene, Ore.

Norm Phillips, centralized lending manager, SELCO Community CU, Eugene, Ore.

Rick Loyd, SVP and chief marketing officer, Truity CU, Bartlesville, Okla.

Tamara Wass, VP of indirect lending, Goldenwest CU, Ogden, Utah

Victoria Gomez, director of indirect lending, Landings CU, Tempe, Ariz.