Who Participated in the Survey?

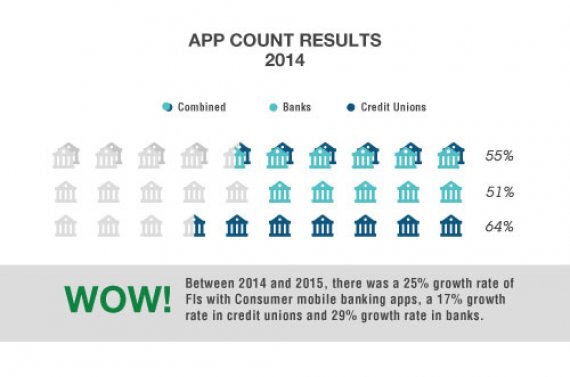

Number of FIs that Had Apps in 2014

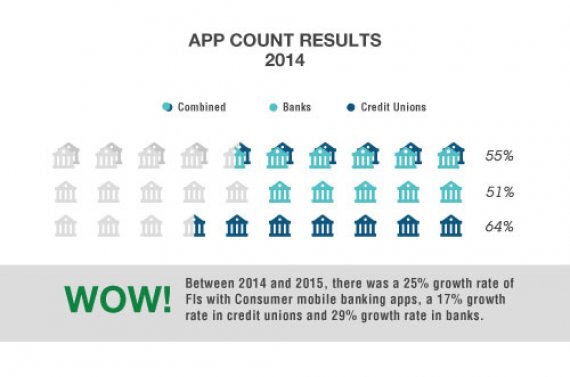

Number of FIs that Had Apps in 2015

Android vs. Apple

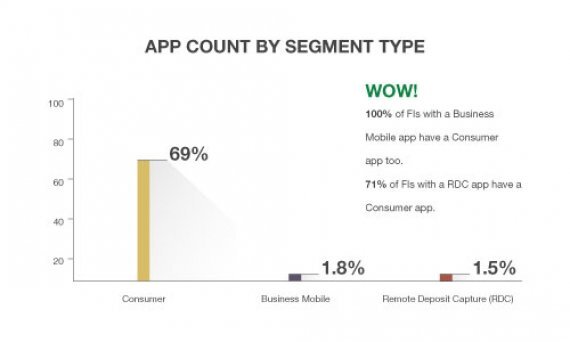

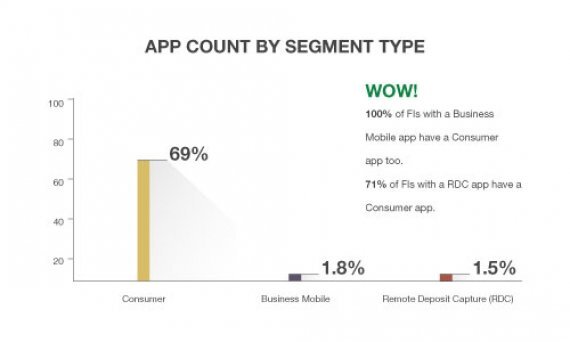

Consumer Apps Far Outnumber Business Banking Apps

Where the Apps Are

A draft spending bill slated for consideration in the House Ways and Means Committee Tuesday maintains the credit union industry's longstanding exemption from most federal taxes, but the issue is far from settled.

Citizens & Northern's deal for Susquehanna Community is the eighth involving a Pennsylvania seller in less than two years. An industry consultant based in the Keystone State expects the pace to slow as the number of buyers dwindles.

Checkout-free retail, which enables transactions without a dedicated point of sale, provides a trove of data that can aid dozens of mobile banking functions, though it's not widely used due to difficult upgrades.

A 90-day pause on reciprocal tariffs between the U.S. and China boosted the near-term economic outlook for banks, but tensions and uncertainty around trade barriers remain high.

The fintech's first-quarter earnings results beat analysts' expectations on nearly every metric. Now, the second-look lender is looking to partner with regional banks as it builds out its pre-screen and lead generation platforms.

President Donald Trump has signed two Congressional Review Act resolutions nullifying the Consumer Financial Protection Bureau's rule capping many overdraft fees and subjecting large data brokers to regulation.