That was the word from Deedee Myers, CEO of DDJ Myers, who spoke recently at the 39th Directors and CEOs Leadership convention here and offered insights into the secrets of high-performing boards of directors and chief executives.

Myers said a rubber stamp board agrees with everything the CEO presents, adding, "This type of board does not monitor."

According to Myers, a "strategic" board has a good relationship with the CEO. She suggested CUs modernize strategic planning by replacing SWOT with SOAR. Instead of monitoring Strengths, Weaknesses, Opportunities and Threats, she suggested looking to Strengths, Opportunities, Aspirations and Results. "If too much focus is placed on opportunities and threats, then not enough attention is being paid to aspirations and results."

According to Myers, advocacy should be included in every credit union mission. "Every board member and staffer should be 100% equipped to do advocacy," she explained. "Be prepared to tell people why credit unions are credit unions."

"High-performing boards add continuous strategic value," she said, adding this is accomplished through ongoing education, best practice recruitment and retention standards, and a forward-thinking board-CEO relationship. "All boards can be high-performing boards."

Compensation and term limits are ongoing conversations, Myers said. "Succession planning for directors should be done strategically so there is not a crisis five of seven board members leaving at the same time. Think about what the board should look like in three years and work backward."

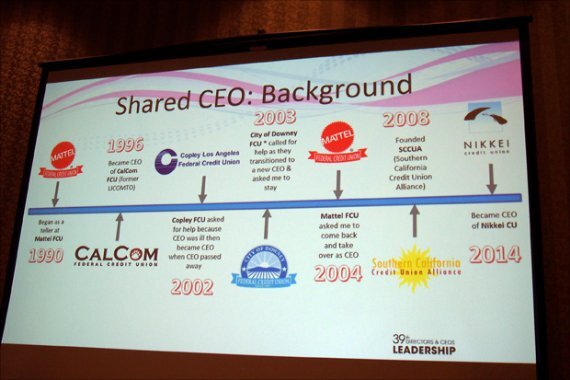

Jon Hernandez began his credit union career as a teller at Mattel FCU in El Segundo, Calif., in 1990. He became CEO of CalCom FCU in 1996. In 2002, Copley FCU asked him for help because the CEO was very sick. When the CEO of Copley passed away, the board asked Hernandez to become CEO. Copley eventually merged with CalCom. In 2003, City of Downey FCU asked for help as it transitioned to a new CEO and asked Hernandez to stay on as CEO. In 2004, Mattel FCU asked him to come back and take over as CEO. In 2012, City of Downey merged with CalCom. In 2014 he became CEO of Nikkei CU.

Currently, Hernandez is CEO of three credit unions $62 million CalCom, $25 million Mattel and $65 million Nikkei, in Torrance, El Segundo and Gardena, Calif., respectively. CalCom has two branches, the other two CUs have one branch each.

Carlos Ghosn is CEO of Renault and Nissan, two very large automakers, one in France and one in Japan, so Hernandez said even large CUs should not dismiss the idea of a shared CEO out of hand. "Putting two organizations is reliant on good leadership. In a merger, one credit union will see its identity disappear. Merger is an option, but it is not the only option."

To share a CEO, that person must have strong time management skills, Hernandez advised. He said meetings should be wrapped up in 30 minutes, and the CEO must delegate day-to-day operations to the management team, while following the mantra of "Trust, but validate." Technology helps Hernandez be responsive offering a sense of "always being there" by responding to e-mails or phone calls within 24 to 48 hours.

One risk management person is shared by all three CUs, CalCom and Mattel share a marketing person, Mattel and Nikkei share a collections person. Hernandez hopes to have a business development officer shared by all three CUs in the near future.

A shared CEO is not a temporary solution, or a step that should be taken just for the sake of reducing expenses, Hernandez asserted. He said both CUs and their boards must be completely accepting of a shared CEO, and must not see the other CU as a potential competitor. Otherwise, as soon as an issue comes up someone will say, "That's because we don't have a full-time CEO."