-

Since the pandemic began, many members of small credit unions have defected to banks that offer better digital products and services. The credit unions are focusing on in-person banking or catering to small businesses and other niches to rebuild their customer base.

November 1 -

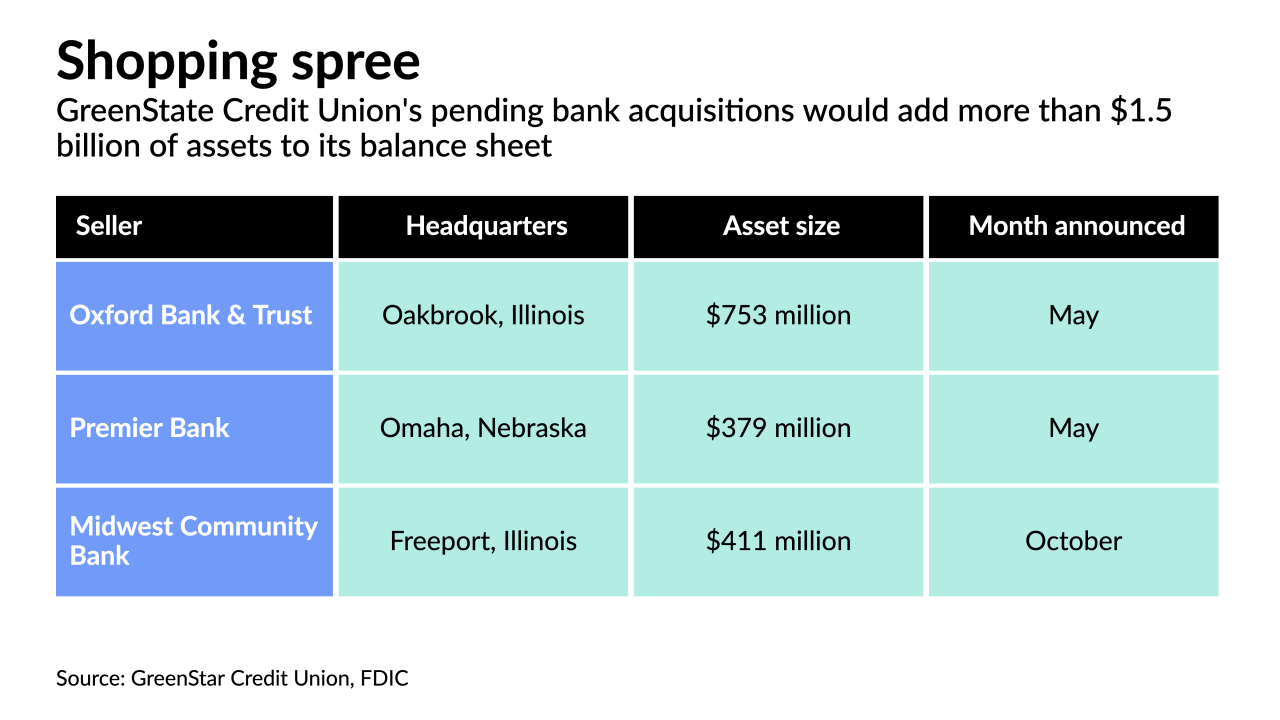

GreenState Credit Union has announced three bank deals this year. Its CEO says purchasing banks can be easier than merging with rival credit unions, though the state's banking regulator has made it difficult to do so within Iowa.

October 28 -

Temenos and Mbanq created a platform to offer technology and compliance services to credit unions via application programming interfaces.

October 25 -

The National Credit Union Administration adopted a rule that allows credit union service organizations to offer a wider range of loans over the objections of agency Chairman Todd Harper, who said it risks deposit insurance losses.

October 21 -

The industry generally likes a National Credit Union Administration plan that would count Treasury funds as secondary capital. But it opposes the exclusion of 30-year investments under the the Emergency Capital Investment Program, which credit unions say are essential to revitalizing Black and Hispanic communities.

October 20 -

Finastra, a technology vendor to credit unions and small banks, is adding the Bakkt digital asset app to its platform. This will allow clients' customers to buy, sell and hold digital assets like Bitcoin.

October 19 -

Consumers are saving more and borrowing less, making it harder for credit unions to meet a key ratio that the National Credit Union Administration uses to gauge their financial health.

October 15 -

After extending its deadline for request for comment on cryptocurrency by a month, the National Credit Union Administration heard from credit unions and other organizations that want clarity on the boundaries the agency plans to set.

October 14 -

Through these partnerships, lenders can diversify their portfolios and even help members recoup their investment by selling or gaining credits for excess energy.

October 6 -

Failures and forced consolidation among smaller institutions could accelerate in 2022 and 2023 once the federal stimulus programs that have propped up the economy run their course, experts predict.

September 28