-

-

Verifying the identity of a business is a much more complex task than verifying the identity of an individual, yet the underlying technology used in both is the same.

August 26 -

A vast majority of IT leaders at banks want to ditch passwords for something better and safer, and many tech vendors are moving in that direction already. But it's easier said than done.

August 5 -

Mastercard has begun to trial a biometric payment system for brick-and-mortar stores, using facial recognition rather than contactless cards, smartphones or memorable PINs.

May 17 -

-

-

-

-

-

-

-

-

-

-

-

Truepic, which helps companies like banks and insurers fight fraud by verifying images, raised $26 million in a funding round led by Microsoft’s M12 venture capital arm.

September 14 -

-

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 -

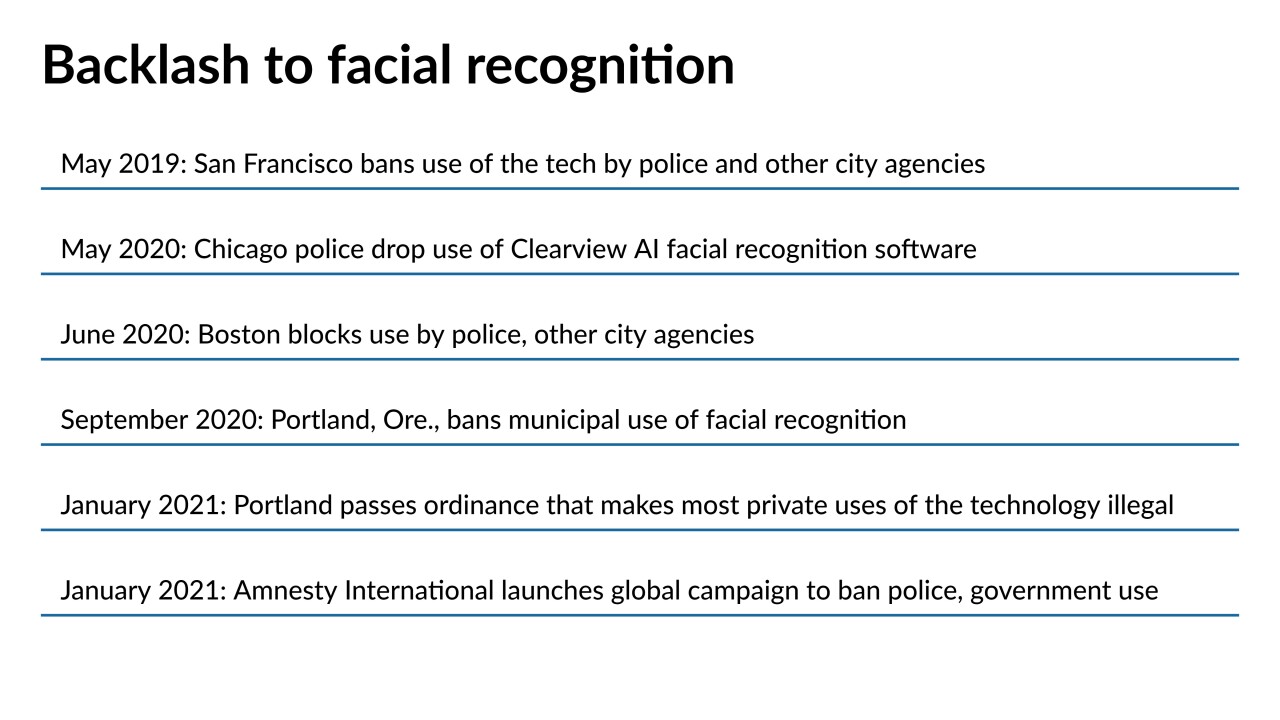

Citing the risk of bias and misidentification, cities and civil liberties groups are calling more loudly for a ban on the use of face scans.

May 3 -