The mortgage industry's digital transformation is revolutionizing the home buying experience and upending the status quo for lenders and servicers. The Digital Mortgage Conference is the premiere event exclusively dedicated to these developments, bringing over 1,500 professionals to Las Vegas on Sept. 17-18 for keynote speakers, panels and the main attraction: live product demos showcasing the latest mortgage innovations.

-

Comptroller of the Currency Jonathan Gould said in a letter to Sen. Elizabeth Warren, D-Mass., that the OCC "intends to act consistent with this duty rather than your demand."

January 23 -

Trump, during his return from Davos, signaled reluctance to allow 401(k) withdrawals for home down payments, but other tax-advantaged options remain on table.

January 23 -

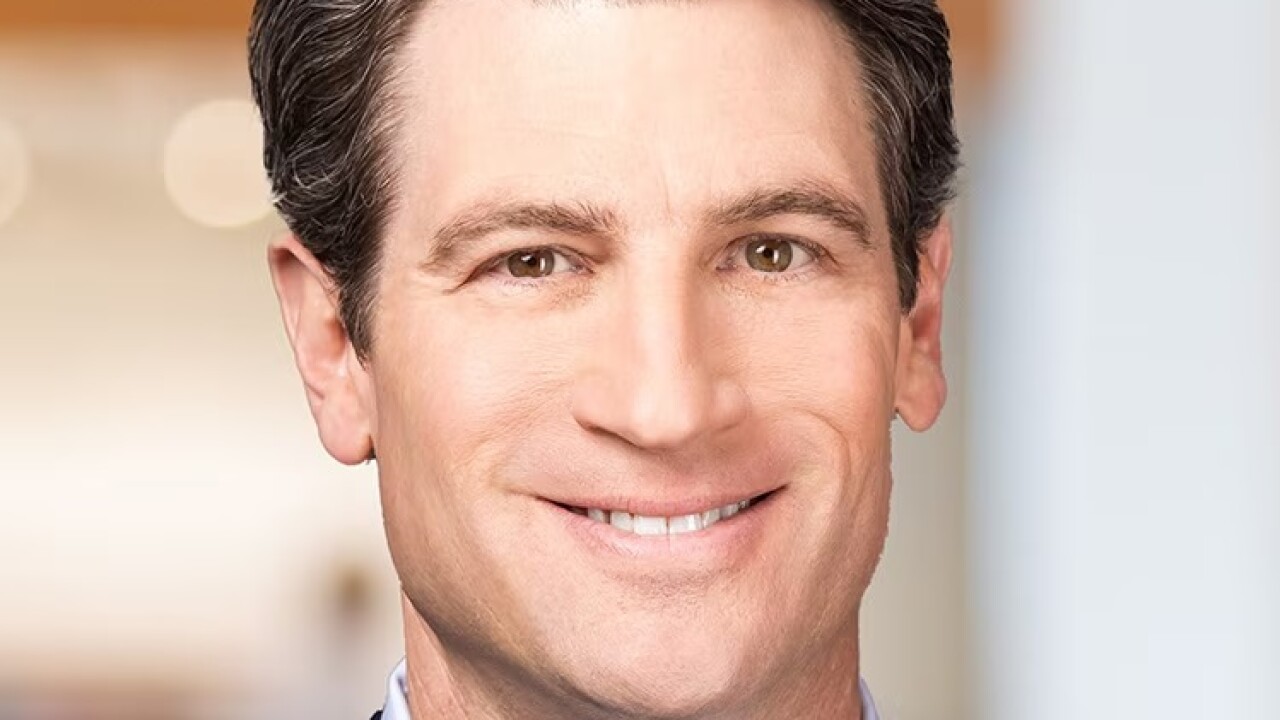

Brent McIntosh is Citi's chief legal officer and corporate secretary. Brent leads Citi's Global Legal Affairs & Compliance organization, which includes the Legal Department, Independent Compliance Risk Management, Citi Security and Investigative Services and Citi's Regulatory Strategy and Policy function. He is a member of Citi's Executive Management Team.

Brent served as under secretary of the Treasury for international affairs from 2019 to 2021. From 2017 to 2019, Brent served as Treasury's general counsel. Prior to that, he was a partner in the law firm of Sullivan & Cromwell.

Brent served in the White House from 2006 until 2009, first as associate counsel to the president and then as deputy assistant to the president and deputy staff secretary. Before that, he was a deputy assistant attorney general at the Justice Department.

January 23 -

Susana Ortega Valle is the VP of Product, where she leads the strategic vision for how small business owners engage with insurance. Throughout her two-decade career, she has built a reputation for developing high-performance teams that thrive on innovation and challenge conventional thinking.

Prior to joining Simply Business, Susana held digital product leadership roles at State Street and Santander Bank. Her approach to data-informed, AI-forward product strategy is backed by a robust academic foundation, including two MS degrees in Telecommunications Engineering and an MBA from MIT.

January 23 -

The Boston bank, which has been targeted by an activist investor over its M&A strategy, isn't pursuing deals, CEO Denis Sheahan said Friday. Instead, the company is focused on organic growth and share buybacks.

January 23 -

Goldman Sachs makes leadership changes across its global credit business; JPMorganChase names Simon Dale global head of the credit portfolio group lending; Citi hires Anand Govind as a managing director on its technology investment banking team; and more in this week's banking news roundup.

January 23 -

The Raleigh, North Carolina-based bank recently made its first payment on a $35 billion note held by the Federal Deposit Insurance Corp. The note was arranged as part of First Citizens' purchase of the failed Silicon Valley Bank.

January 23 -

The House Financial Services Committee passed a community bank tailoring bill 33-21.

January 23 -

The buy now/pay later lender is seeking to create Affirm Bank, a Nevada-chartered industrial loan company.

January 23 -

The Federal Deposit Insurance Corp.'s approval of industrial loan company charter applications for General Motors and Ford Motor Company generated only moderate pushback from banks as crypto, debanking and credit card rate caps dominate the industry's attention.

January 23