-

Banks, Wall Street critics and regulators are angling to define whether the leverage ratio should be a backstop or a binding constraint for the biggest banks a debate that could be among the most urgent in the post-Obama regulatory landscape.

September 6 -

Though no legislation is likely to pass prior to the election, lawmakers will be busy throughout September with hearings featuring top Federal Reserve Board officials and voting on a much anticipated financial reform bill. Here are five things to keep an eye on.

September 2 -

Regulatory infighting over bond loans offered by down payment assistance programs has the potential to curtail lending to first-time buyers and do real damage to homeownership.

September 2 Offit | Kurman

Offit | Kurman -

Emboldened by supportive comments from presidential hopeful Hillary Clinton, community development banks are asking regulators for more leniency in areas such as disclosure fees and Bank Secrecy Act enforcement.

September 2 -

A federal district court handed the Consumer Financial Protection Bureau a major victory this week by ruling that the online loan servicer CashCall engaged in unfair, deceptive and abusive practices by using a "tribal model" to collect on loans in states with usury caps.

September 1 -

Big banks have less than a month to fix their resolution plans or potentially face severe regulatory consequences.

September 1 -

The largest U.S. banks are starting to question whether the advanced approaches modeling program embedded in the Basel accords is still valuable in a world where their capital levels are increasingly dictated by the annual stress tests and a supplementary leverage ratio.

August 31 -

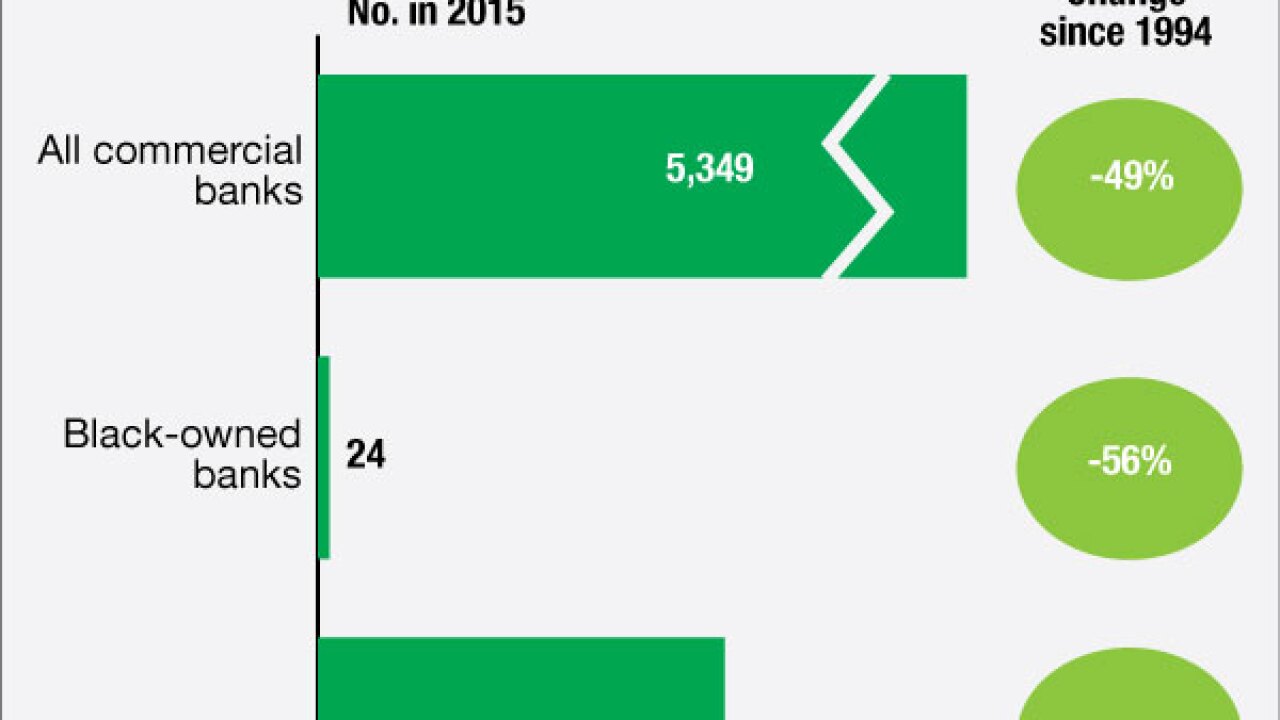

A longtime advocate for African-American-owned financial institutions argues that regulators should be taking more forceful action to keep them alive.

August 30 -

Banks and regulators both deserve credit for how they have navigated the post-crisis period, but how regulators continue to implement rules and how banks continue to deal with this environment will determine if this is a turning point for finance or the prelude to another round of pain.

August 30 Ludwig Advisors

Ludwig Advisors -

WASHINGTON Rep. Carolyn Maloney, D-N.Y., sent a letter to federal regulators Monday requesting an analysis of bank trading data that is being collected as part of the Volcker Rule.

August 29