-

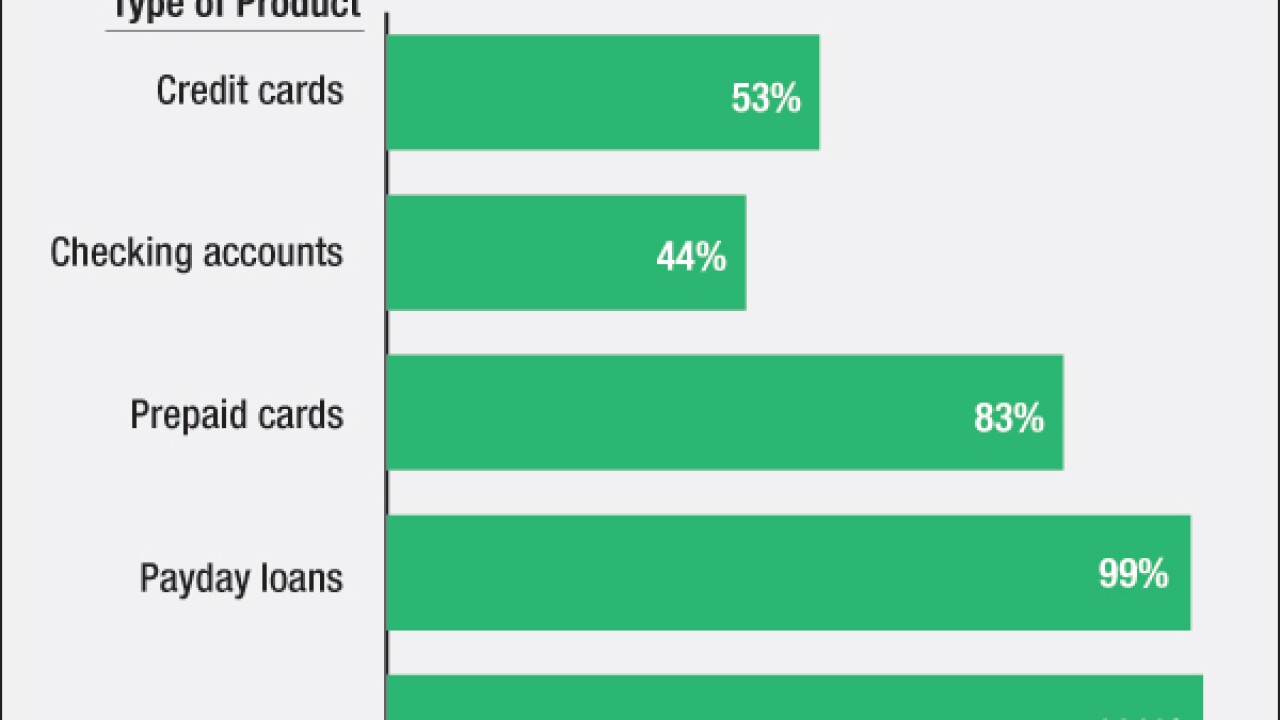

Community organizations and the banking industry are advancing dueling visions for how to reach the unbanked, with community groups asking regulators to strengthen existing rules while community banks want to lighten their regulatory burden so they can extend their services.

October 23 -

A faster than expected recovery following the financial crisis may mean that small banks see a significant reduction in premiums as early as the first quarter of next year, while larger institutions later face a surcharge required by the Dodd-Frank Act.

October 22 -

Two senior Democrats are urging congressional leaders to block financial policy riders from a yearend budget deal, including Sen. Richard Shelby's sweeping regulatory reform package.

October 22 -

Industry representatives are howling about the lack of consumer benefit from the Durbin amendment, but we still know very little about the impact of the debit fee cap.

October 22

-

Federal banking regulators gave ground in a final rule to raise collateral requirements for uncleared swaps, providing special consideration for swaps traded between affiliates of the same firm.

October 22 -

The Federal Deposit Insurance Corp. is set to vote Thursday morning on a proposal that would force big banks to bear the assessment burden of growing the agency's federal reserves to a new minimum.

October 22 -

Democrats clashed over banking reform Tuesday night during the party's first primary debate, underscoring the sharp divide with GOP candidates on Wall Street issues.

October 14 -

This week marks the fourth anniversary of the "Durbin amendment," a defective law directing the Federal Reserve to impose price-controls on debit interchange fees.

October 14

-

The Democratic presidential candidates sparred over Wall Street reform Tuesday evening, debating how to best tame the banking industry roughly seven years after the financial crisis.

October 13 -

Democratic presidential front-runner Hillary Clintons first major speech on Wall Street reform Thursday is unlikely to persuade skeptics on the left that she is committed to going further than President Obama on the issue. Heres why.

October 8 -

Banks say the Consumer Financial Protection Bureau plan to ban arbitration clauses for individual claims will aid trial lawyers, while consumer advocates say the move is overdue and may not go far enough.

October 7 -

From "too big to fail" to Glass-Steagall, the two leaders of the postcrisis recovery hashed out the economic issues, while pitching Bernanke's new book.

October 7 -

Democratic presidential candidate Hillary Clinton staunchly defended the Consumer Financial Protection Bureau on Wednesday in a letter urging House Democrats to stand by the agencys single-director structure.

October 7 -

The Consumer Financial Protection Bureau's impending proposal, to be reviewed by a small business advisory panel, would block companies from using arbitration clauses to avoid class actions but allow them for individuals.

October 7 -

Republicans and the banking industry face long odds in making structural changes to the Consumer Financial Protection Bureau this year, but the ultimate outcome of the battle is still far from certain.

October 5 -

The Mortgage Bankers Association is disappointed that the Consumer Financial Protection Bureau has not provided an explicit temporary safe harbor for lenders who have made a good-faith effort to implement new disclosures.

October 2 -

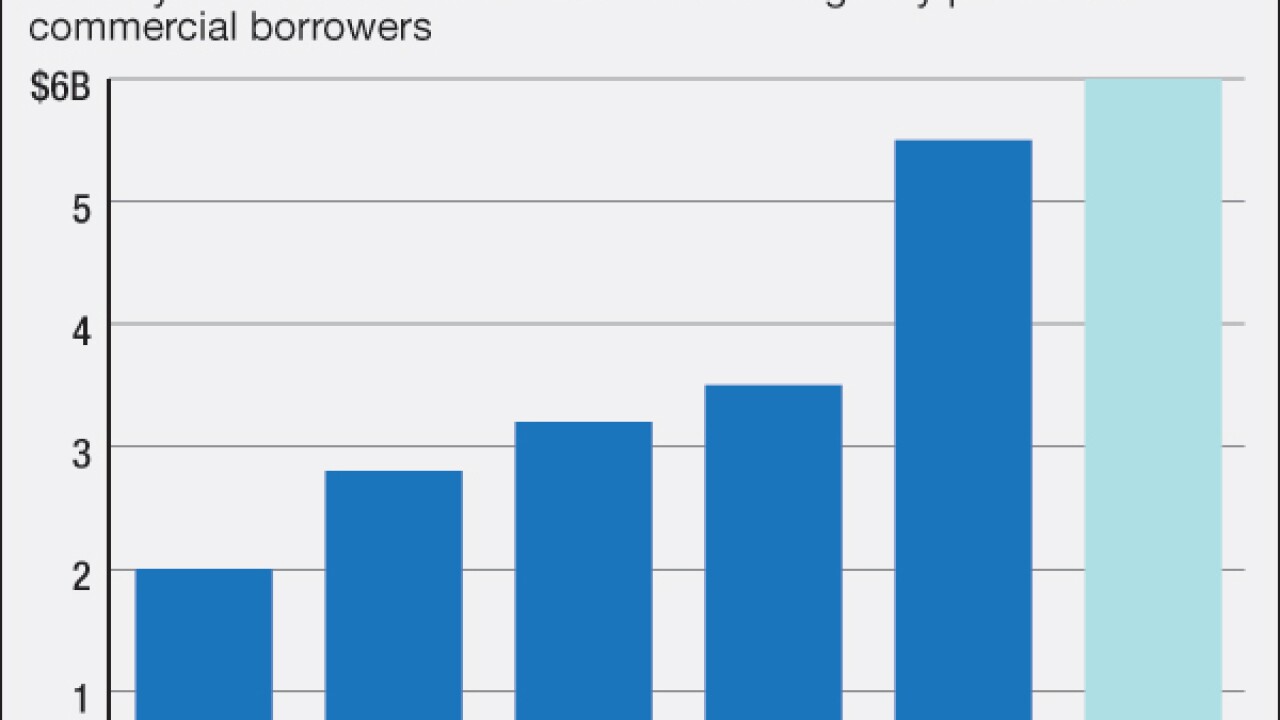

The Small Business Investment Company program may be less famous among banks than some of the SBA's other programs, but it enjoyed a record in fiscal 2015 that wrapped up this week. Stories like that of Opus Bank in California shed light on why.

October 1 -

The question of whether new liquidity rules are having a dramatic negative impact on capital markets continues to rile regulators and the financial industry, with policymakers providing ammunition to both sides of the debate just this week.

October 1 -

The Federal Housing Finance Agency is planning to issue a final rule in the next 12 months to require Fannie Mae and Freddie Mac to better serve underserved markets, including manufactured housing, the agency said Thursday.

October 1 -

A handful of moderate Democrats are supporting a controversial bill to restructure the Consumer Financial Protection Bureau, and are expected to help the House Financial Services Committee approve the legislation.

September 30