-

Kansas City Federal Reserve Bank President Esther George is best known nationally as a critic of the Fed's monetary policy, but in a wide-ranging interview she talks about Dodd-Frank, bank capitalization and the challenges facing community banking, in addition to interest rates.

August 29 -

Hillary Clinton's proposal for regulatory relief for smaller institutions largely tracks with ideas already discussed, but her backing could keep alive the momentum for a reg relief plan should she win in November.

August 26 -

The endorsement of Glass-Steagall in the recent party convention platforms reaffirmed the powerful hold that the principle of separating commercial and investment banking has on the public imagination.

August 26 Americans for Financial Reform

Americans for Financial Reform -

Two federal regulators have ordered First National Bank of Omaha to pay a total of $35 million over charges that the bank engaged in deceptive marketing of credit card add-on products that some consumers allegedly never received.

August 25 -

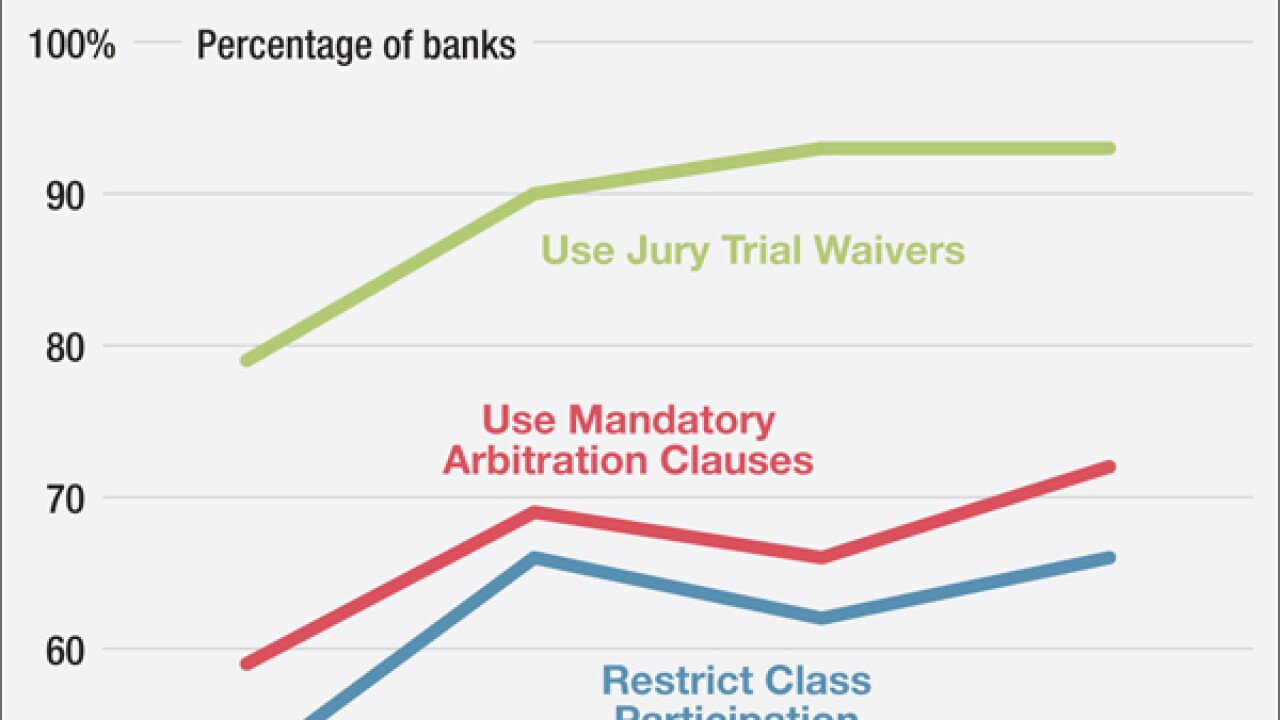

The U.S. Chamber of Commerce and 28 other business groups urged the Consumer Financial Protection Bureau to withdraw its proposal on arbitration and "go back to the drawing board." Their joint letter was one of thousands submitted to the agency.

August 25 -

WASHINGTON The American Bankers Association has fired back at a White House research note that argued the Dodd-Frank Act was not driving community bank consolidation.

August 25 -

Until recently, credit unions rarely used arbitration clauses, and were praised by consumer advocates for pro-customer practices. But credit unions have learned to embrace the use of arbitration clauses and now oppose the Consumer Protection Bureaus plan to rein them in.

August 24 -

WASHINGTON A federal appeals court has scheduled oral arguments in a case that could have profound implications for the government's ability to designate nonbanks as systemically risky.

August 24 -

Discussions around reinstating the Depression-era law are headline-grabbing, but Glass-Steagall has no merit in our current financial environment.

August 24 ConnectOne Bank

ConnectOne Bank -

The Consumer Financial Protection Bureau said Monday that Wells Fargo had engaged in illegal student loan servicing practices by processing payments to maximize late fees.

August 22 -

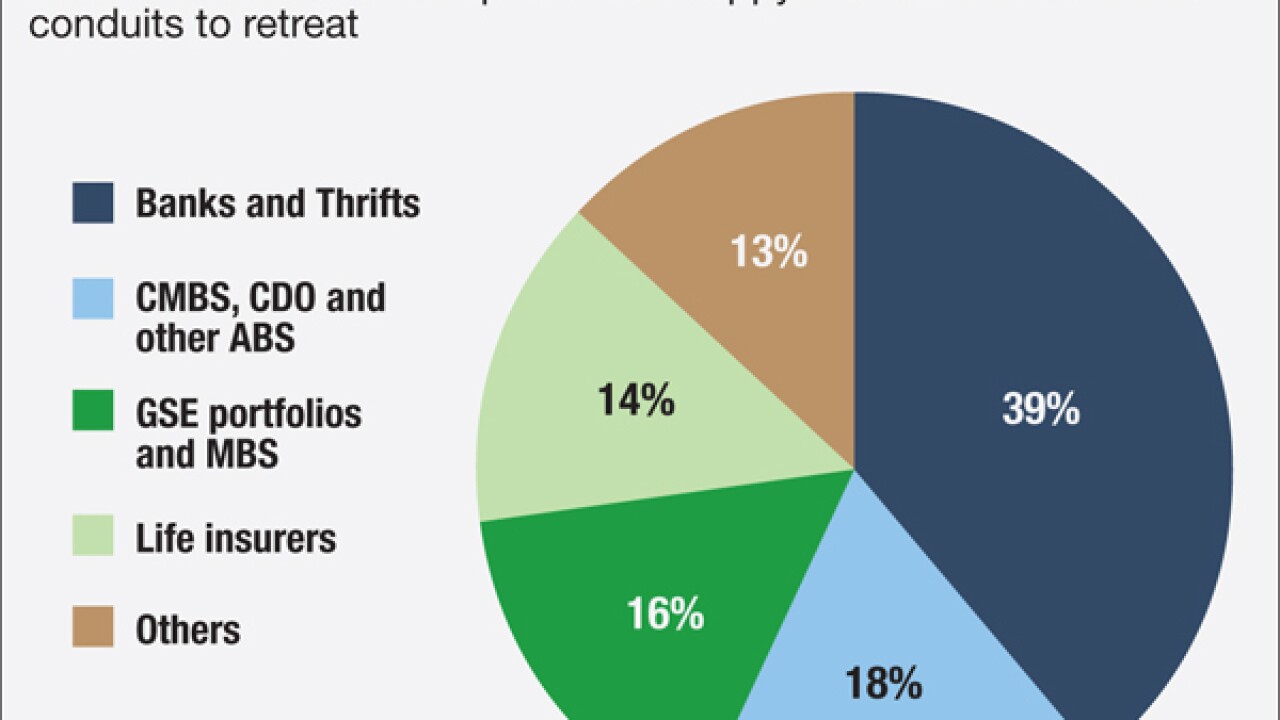

The first commercial mortgage-backed security to comply with "skin in the game" requirements was extremely well received. Market participants credit the way the large banks sponsoring the deal retained the risk a strategy unavailable to nonbank lenders.

August 19 -

The Consumer Financial Protection Bureau on Thursday urged student loan servicers to provide more help to consumers who apply for income-driven repayment plans.

August 18 -

Industry representatives pushed back against a report that continues to paint a negative picture of arbitration clauses just as the Consumer Financial Protection Bureau plans to restrict such agreements.

August 18 -

Roughly 73% of donations from commercial banks' political action committees are going to Republicans in this election cycle, the most tilted toward one party by the banking industry in recent memory. Here's why.

August 15 -

Banks and industry representatives are asking whether the proposed long-term liquidity rule properly takes into account the risk profiles of certain assets, the interaction with other liquidity rules, and even whether the regulation is needed at all.

August 12 -

Those wanting to break up banks act as though policymakers had no regulatory response to the crisis, but heres an illustration of how actual reforms would have prevented a large failure.

August 11 Global Risk Institute

Global Risk Institute -

The Consumer Financial Protection Bureau has met the requirements for convening small-business review panels, though most panelists said they disagreed with the agency's final rules, the Government Accountability Office said Wednesday.

August 10 -

WASHINGTON The Dodd-Frank Act of 2010 has not had a negative impact on community banks, contrary to assertions by Republicans and many bankers, according to a group of White House economists.

August 10 -

A single paragraph in a lawsuit filed by the Consumer Financial Protection Bureau is sparking fears by third-party payment processors that the agency is quietly and significantly expanding its authority over the industry.

August 10 -

Financial reform advocacy groups are criticizing regulators' executive compensation proposal as too lax, saying the firms themselves are essentially given the freedom to ignore many of the harshest penalties

August 9