-

American International Group announced $3.6 billion in new costs to fill a reserve shortfall and said it will hold an initial public offering for its mortgage insurer and sell an adviser network as Chief Executive Peter Hancock seeks to boost returns and protect his job after criticism from activist investor Carl Icahn.

January 26 -

Progressives' push for a more drastic overhaul of the industry ignores post-crisis changes that have had an undeniably positive effect.

January 22 IBM Global Business Services

IBM Global Business Services -

Sen. Bernie Sanders and former Gov. Martin OMalley pledged to reinstate the Glass-Steagall Act to separate commercial and investment banking, while former Secretary of State Hillary Clinton said her reform plan was the only one to go after the nonbanks like AIG that caused the crisis.

January 18 -

Financial services issues that helped define a presidency were largely absent from Tuesday's State of the Union address, including the crucial policy items that have not yet been resolved.

January 14

-

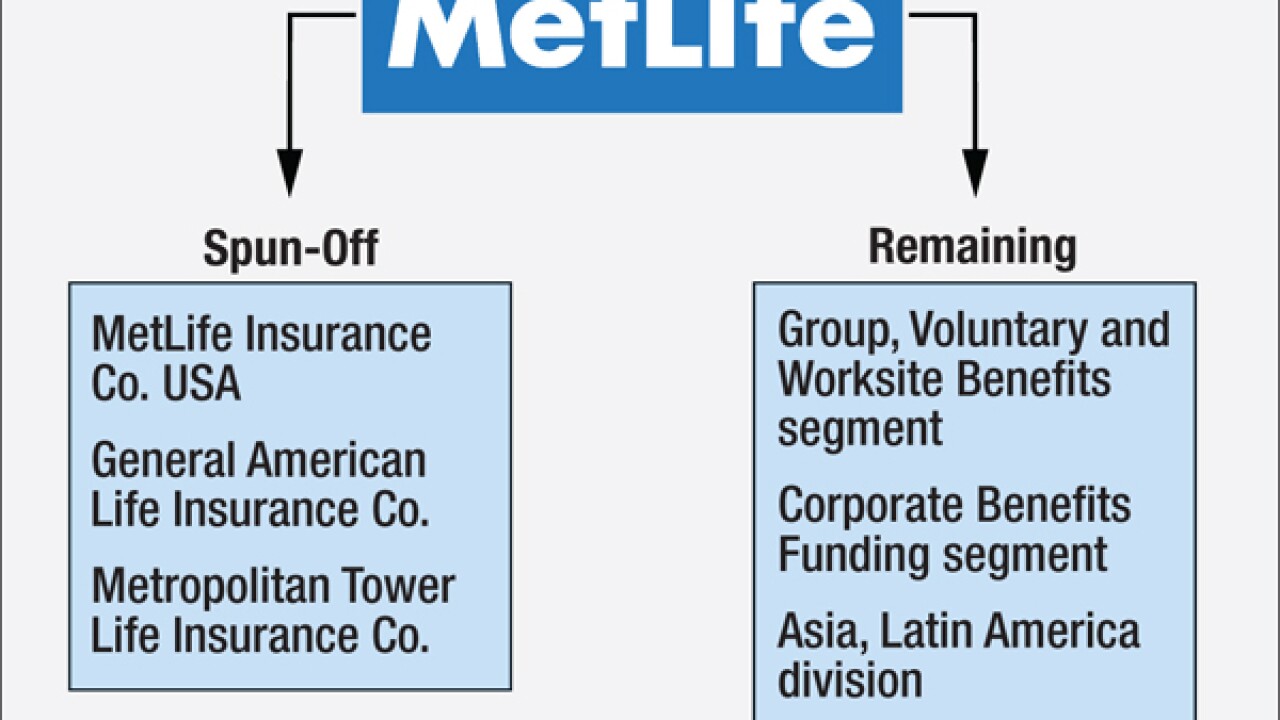

The conventional wisdom is that MetLife is breaking itself up partly as a response to its designation as a systemically important company. But there is significant evidence that's wrong here's why.

January 13 -

As fintech pitches itself as the future of consumer financial services to bankers, regulators, legislative staffers and journalists, it's not enough to claim that innovations are better. We nontechies want an explanation why, in layman's terms.

January 13

-

Raising capital has been tough for community banks ever since the financial crisis, especially the smallest ones. But a few firms have developed structured products that offer banks a chance to band together to raise needed Tier 1 capital at relatively low cost, while avoiding the regulatory ire that befell trust-preferred securities.

January 11 -

The financial industry is fractured over a Federal Deposit Insurance Corp. plan to require big banks to temporarily pay more in deposit insurance premiums, with small banks lobbying to force bigger payments over a shorter time frame and many large ones wanting to stretch it out.

January 8 -

In theory, Sen. Bernie Sanders' plan to use Section 121 of the Dodd-Frank Act to break up the big banks sounds plausible. In practice, it won't ever happen. Here's why.

January 7IntraFi Network -

Sen. Richard Shelby's bill changing how regulators gauge if a bank is "systemic" would refocus post-crisis policy on institutions that pose the greatest threat.

January 7

-

In a speech in New York City, Sanders vowed to remove the ability of the Federal Reserve to pay interest to banks for their excess reserves, turn the credit rating agencies into nonprofits, allow the U.S. Postal Service to offer bank products, and cap ATM fees and interest rates for loans.

January 5 -

The Financial Stability Oversight Council will face critical tests in 2016, including a lawsuit over its designation of MetLife as a systemically important nonbank and whether it will de-designate GE as a SIFI.

January 5 -

Lawmakers are expected to debate a number of key banking provisions this year, even with the November elections on the horizon.

December 31 -

Some lost their jobs while others made major missteps or faced serious challenges to their business plans. Here are the folks who had a rough 2015 and are looking forward to better times in 2016.

December 29 -

Sen. Richard Shelby, R-Ala., has a limited window to move his regulatory reform legislation next year, after failing to secure passage for the bill as part of the budget fight.

December 24 -

For steering the Winston-Salem, N.C., company through an extended period of industry adversity, while providing a blueprint for large-scale M&A, King has been named American Banker's Banker of the Year for 2015.

December 20 -

WASHINGTON The House and Senate have approved major spending and tax packages, which are now en route to the White House to be signed into law.

December 18 -

Despite months of intense lobbying, the banking industry failed to secure a number of key reforms in Congress's must-pass spending package, unveiled Tuesday night.

December 16 -

The central bank's "total loss absorbing capacity" proposal must be reworked to ensure that costs of huge failures don't fall on society at large.

December 16

- Minnesota

Over the past three decades William Cooper has led TCF Financial through two crises and reinvented the bank to keep it profitable. He also sued the Federal Reserve in the aftermath of the financial crisis, for imposing a cap on debit card fees. For his strong leadership in the industry as well as his candid, off-the-cuff style American Banker has named him its lifetime achievement honoree.

December 14