-

Democratic lawmakers are calling for Wells Fargo Chief Executive John Stumpf to testify before a Senate panel as part of an investigation into nearly 2 million fraudulent bank and credit card accounts that Wells employees opened in an effort to meet sales incentives.

September 12 -

Its become an all-too-familiar story a big bank is caught doing something bad, it pays a fine, some lower-level employees are let go while higher-level executives appear to get off scot free and no criminal charges are assessed. Many see that happening again at Wells Fargo.

September 9 -

Marketplace lenders that have partnered with banks face more scrutiny after a federal judge in California handed a legal victory last week to the Consumer Financial Protection Bureau.

September 9 -

In an interview Friday morning, Federal Reserve Gov. Daniel Tarullo said that enforcement agencies and even the Department of Justice need to hold individuals accountable amid revelations that thousands of Wells Fargo employees opened illegal accounts for customers.

September 9 -

Nellie Liang, director of the Federal Reserve's Division of Financial Stability, has announced her retirement after 30 years with the central bank.

September 9 -

Wells Fargos reputation as a consumer-friendly bank suffered a significant blow Thursday after it agreed to pay $190 million to settle charges that thousands of employees created unauthorized bank and credit card accounts for customers in order to collect bonuses for themselves.

September 8 -

In response to industry comments, the Federal Reserve said it would follow notice-and-comment procedures when exercising its countercyclical capital buffer authorities a process whereby the biggest banks would hold an additional capital cushion to counteract overheated markets.

September 8 -

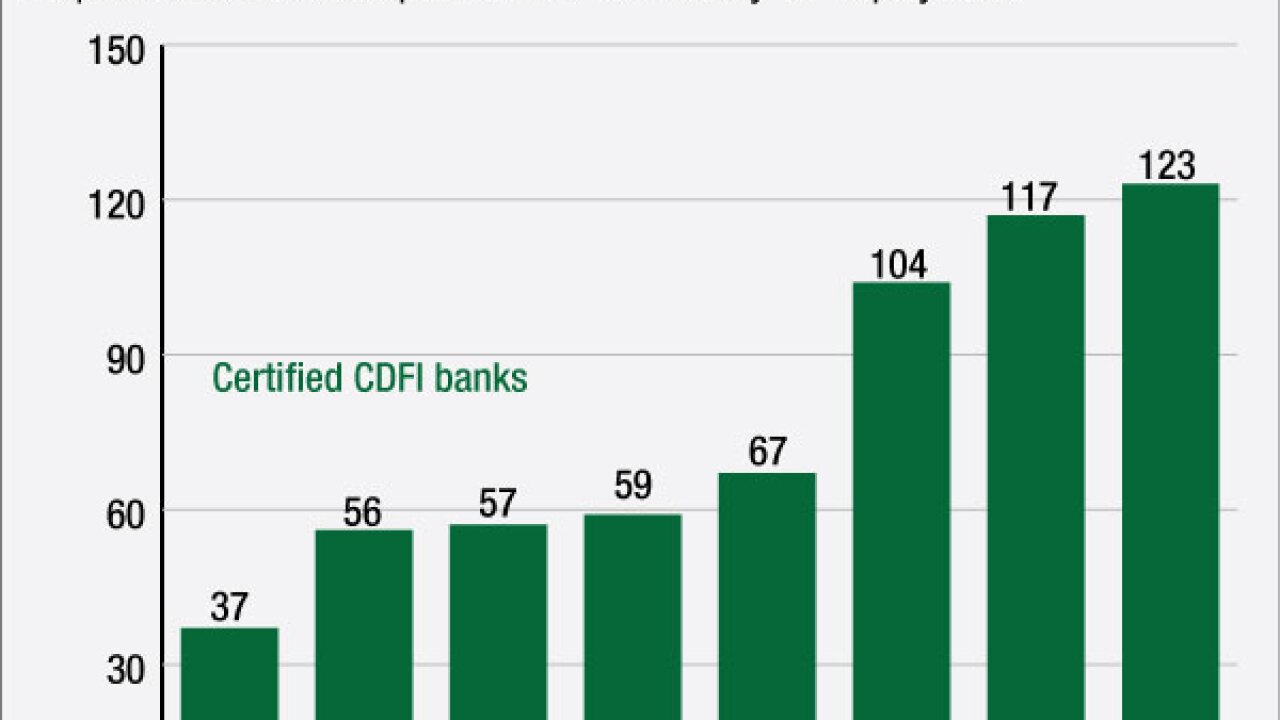

A rising number of banks are looking to become community development financial institutions, emboldened by low-cost capital and an exemption from the ability-to-repay rule.

September 8 -

Wells Fargo has agreed to pay $187.5 million to settle claims by federal regulators that the megabank wrongfully opened unauthorized bank and credit card accounts for more than 2 million customers.

September 8 -

The Federal Reserves structure and makeup and even geographical locations drew criticism from members of Congress and the public as favoring the wealthy and ignoring the conditions of ordinary Americans

September 7 -

Banks, Wall Street critics and regulators are angling to define whether the leverage ratio should be a backstop or a binding constraint for the biggest banks a debate that could be among the most urgent in the post-Obama regulatory landscape.

September 6 -

Though no legislation is likely to pass prior to the election, lawmakers will be busy throughout September with hearings featuring top Federal Reserve Board officials and voting on a much anticipated financial reform bill. Here are five things to keep an eye on.

September 2 -

Regulatory infighting over bond loans offered by down payment assistance programs has the potential to curtail lending to first-time buyers and do real damage to homeownership.

September 2 Offit | Kurman

Offit | Kurman -

Emboldened by supportive comments from presidential hopeful Hillary Clinton, community development banks are asking regulators for more leniency in areas such as disclosure fees and Bank Secrecy Act enforcement.

September 2 -

A federal district court handed the Consumer Financial Protection Bureau a major victory this week by ruling that the online loan servicer CashCall engaged in unfair, deceptive and abusive practices by using a "tribal model" to collect on loans in states with usury caps.

September 1 -

Big banks have less than a month to fix their resolution plans or potentially face severe regulatory consequences.

September 1 -

The largest U.S. banks are starting to question whether the advanced approaches modeling program embedded in the Basel accords is still valuable in a world where their capital levels are increasingly dictated by the annual stress tests and a supplementary leverage ratio.

August 31 -

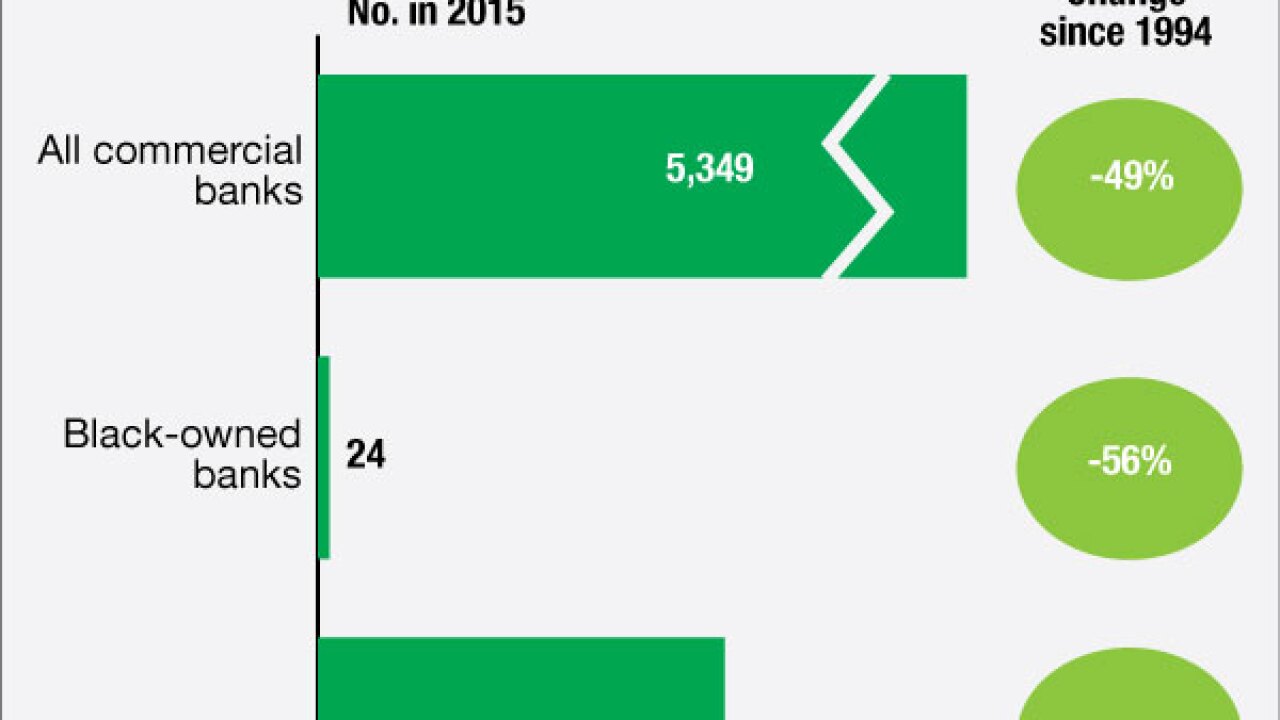

A longtime advocate for African-American-owned financial institutions argues that regulators should be taking more forceful action to keep them alive.

August 30 -

Banks and regulators both deserve credit for how they have navigated the post-crisis period, but how regulators continue to implement rules and how banks continue to deal with this environment will determine if this is a turning point for finance or the prelude to another round of pain.

August 30 Ludwig Advisors

Ludwig Advisors -

WASHINGTON Rep. Carolyn Maloney, D-N.Y., sent a letter to federal regulators Monday requesting an analysis of bank trading data that is being collected as part of the Volcker Rule.

August 29