-

Banks, Wall Street critics and regulators are angling to define whether the leverage ratio should be a backstop or a binding constraint for the biggest banks a debate that could be among the most urgent in the post-Obama regulatory landscape.

September 6 -

Though no legislation is likely to pass prior to the election, lawmakers will be busy throughout September with hearings featuring top Federal Reserve Board officials and voting on a much anticipated financial reform bill. Here are five things to keep an eye on.

September 2 -

Regulatory infighting over bond loans offered by down payment assistance programs has the potential to curtail lending to first-time buyers and do real damage to homeownership.

September 2 Offit | Kurman

Offit | Kurman -

Emboldened by supportive comments from presidential hopeful Hillary Clinton, community development banks are asking regulators for more leniency in areas such as disclosure fees and Bank Secrecy Act enforcement.

September 2 -

A federal district court handed the Consumer Financial Protection Bureau a major victory this week by ruling that the online loan servicer CashCall engaged in unfair, deceptive and abusive practices by using a "tribal model" to collect on loans in states with usury caps.

September 1 -

Big banks have less than a month to fix their resolution plans or potentially face severe regulatory consequences.

September 1 -

The largest U.S. banks are starting to question whether the advanced approaches modeling program embedded in the Basel accords is still valuable in a world where their capital levels are increasingly dictated by the annual stress tests and a supplementary leverage ratio.

August 31 -

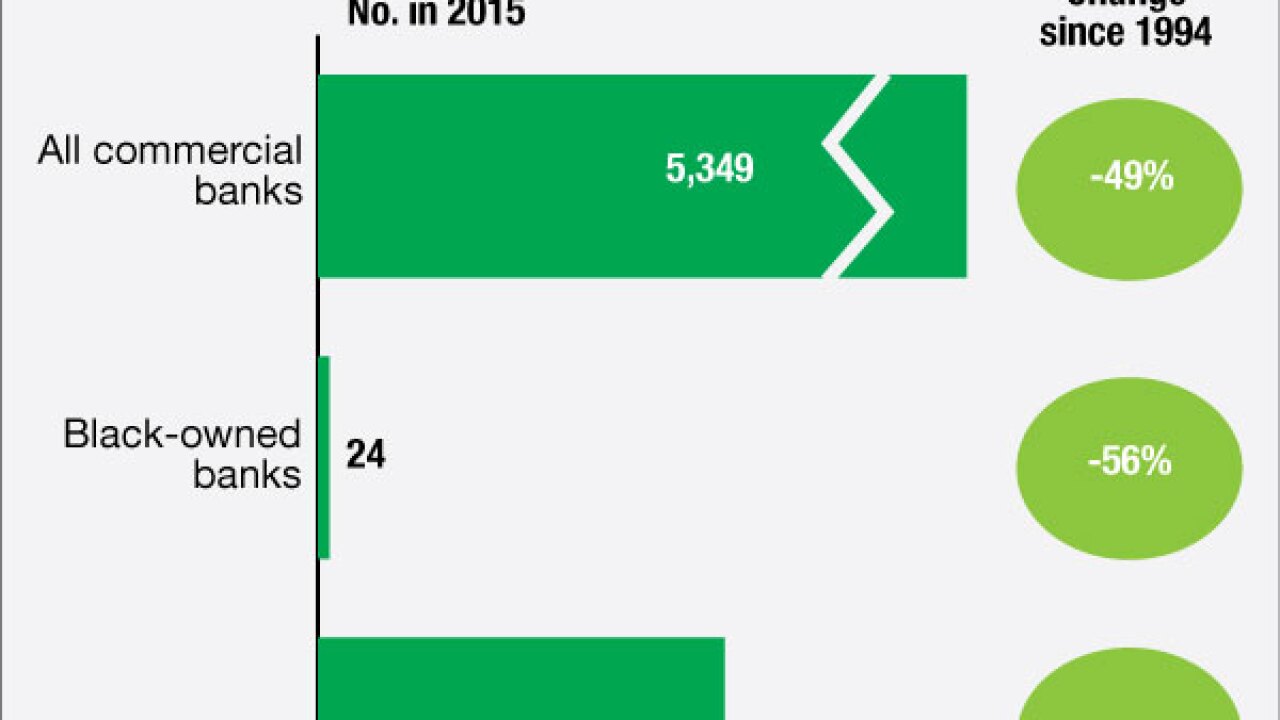

A longtime advocate for African-American-owned financial institutions argues that regulators should be taking more forceful action to keep them alive.

August 30 -

Banks and regulators both deserve credit for how they have navigated the post-crisis period, but how regulators continue to implement rules and how banks continue to deal with this environment will determine if this is a turning point for finance or the prelude to another round of pain.

August 30 Ludwig Advisors

Ludwig Advisors -

WASHINGTON Rep. Carolyn Maloney, D-N.Y., sent a letter to federal regulators Monday requesting an analysis of bank trading data that is being collected as part of the Volcker Rule.

August 29 -

Kansas City Federal Reserve Bank President Esther George is best known nationally as a critic of the Fed's monetary policy, but in a wide-ranging interview she talks about Dodd-Frank, bank capitalization and the challenges facing community banking, in addition to interest rates.

August 29 -

Hillary Clinton's proposal for regulatory relief for smaller institutions largely tracks with ideas already discussed, but her backing could keep alive the momentum for a reg relief plan should she win in November.

August 26 -

The endorsement of Glass-Steagall in the recent party convention platforms reaffirmed the powerful hold that the principle of separating commercial and investment banking has on the public imagination.

August 26 Americans for Financial Reform

Americans for Financial Reform -

Two federal regulators have ordered First National Bank of Omaha to pay a total of $35 million over charges that the bank engaged in deceptive marketing of credit card add-on products that some consumers allegedly never received.

August 25 -

The U.S. Chamber of Commerce and 28 other business groups urged the Consumer Financial Protection Bureau to withdraw its proposal on arbitration and "go back to the drawing board." Their joint letter was one of thousands submitted to the agency.

August 25 -

WASHINGTON The American Bankers Association has fired back at a White House research note that argued the Dodd-Frank Act was not driving community bank consolidation.

August 25 -

Until recently, credit unions rarely used arbitration clauses, and were praised by consumer advocates for pro-customer practices. But credit unions have learned to embrace the use of arbitration clauses and now oppose the Consumer Protection Bureaus plan to rein them in.

August 24 -

WASHINGTON A federal appeals court has scheduled oral arguments in a case that could have profound implications for the government's ability to designate nonbanks as systemically risky.

August 24 -

Discussions around reinstating the Depression-era law are headline-grabbing, but Glass-Steagall has no merit in our current financial environment.

August 24 ConnectOne Bank

ConnectOne Bank -

The Consumer Financial Protection Bureau said Monday that Wells Fargo had engaged in illegal student loan servicing practices by processing payments to maximize late fees.

August 22