Earnings

Earnings

-

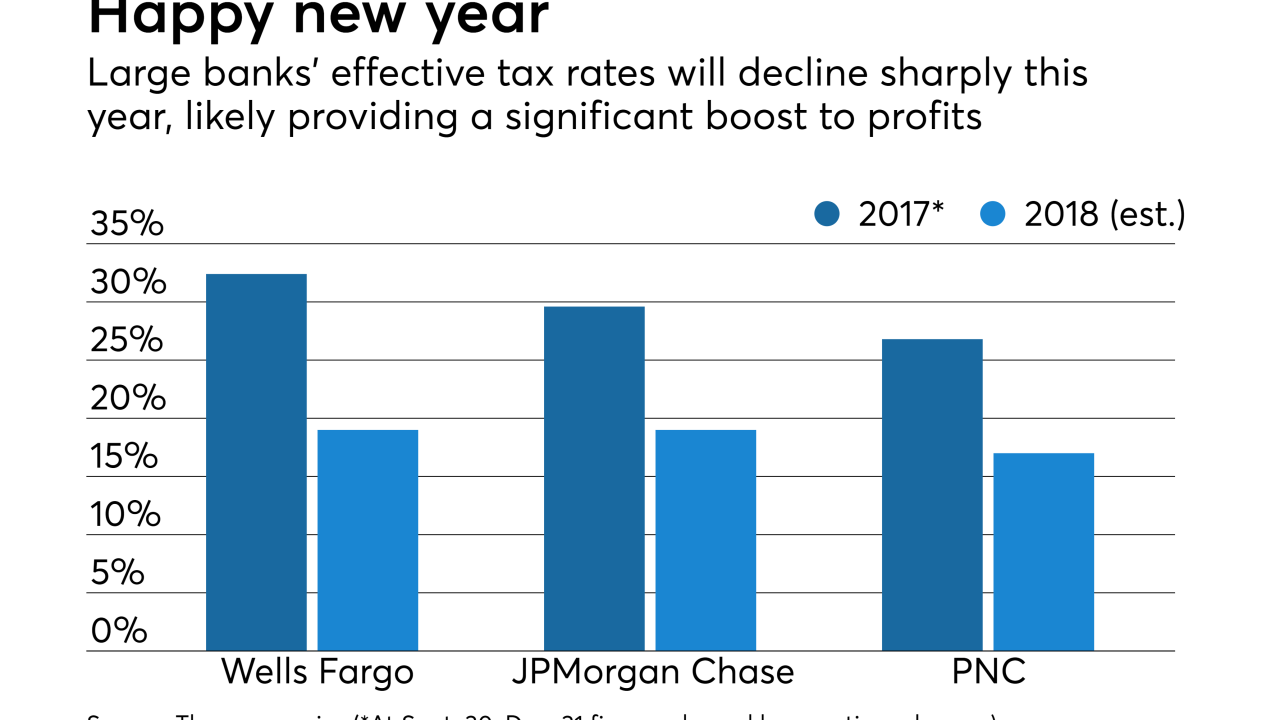

Tax reform and other regulatory factors could allow Citigroup — and other banks — to maintain high capital levels and strong rewards for shareholders.

January 16 -

Kevin Fitzsimmons, who had recently covered banks for Hovde Group, will become FIG Partners' deputy director of research.

January 16 -

Wealth management assets, deposits and fee income swelled at the San Francisco bank, but interest and noninterest costs rose along with them.

January 16 -

The Arkansas company's net income topped $100 million for the first time, though it largely reflected the revaluation of its deferred tax liability.

January 16 -

The bank plans to stick to its multiyear plan to pay out at least $60 billion in capital to shareholders even after booking a larger-than-forecast charge of $22 billion to adjust to the new tax regime

January 16 -

The two banks' tax reform expectations differ as they move in opposite directions; bank bows to pressure to report pay discrepancies.

January 16 -

Apart from a one-time adjustment for deferred taxes, the Dallas company reported strong gains in net interest income and meaningful improvement in all of its key performance ratios.

January 16 -

The JPMorgan Chase CEO is rejecting arguments that banks are poised to loosen underwriting standards to win more mortgage business. He said what's needed to encourage banks to make more loans to borrowers with spotty credit files are changes to FHA rules and other policy fixes.

January 12 -

Executives of large banks told investors and analysts what they wanted to hear Friday when they said they plan to increase returns to shareholders.

January 12 -

Wells Fargo had another surprise for investors in the form of its biggest legal charge yet, showing the lender is not yet past its consumer banking scandals.

January 12