-

Citigroup restated fourth-quarter results after writing down a portion of a loan to Revlon it now owns after losing a court battle.

March 1 -

Ingenious Financial in Arlington, Va., is raising $200 million in hopes of buying an existing bank. Bank of Ingenious would focus on professionals such as doctors, dentists and veterinarians.

February 26 -

Bank of America will book a $400 million expense in the first quarter to account for a change in bonus policies that sparked anger among high earners.

February 26 -

The bank, formed in 2019 when investors bought and recapitalized Sound Bank, will use the funds to hire lenders and improve its overall infrastructure.

February 26 -

The California company said the issue involves a line of credit it funded earlier this year and that it is working with law enforcement authorities on the matter.

February 26 -

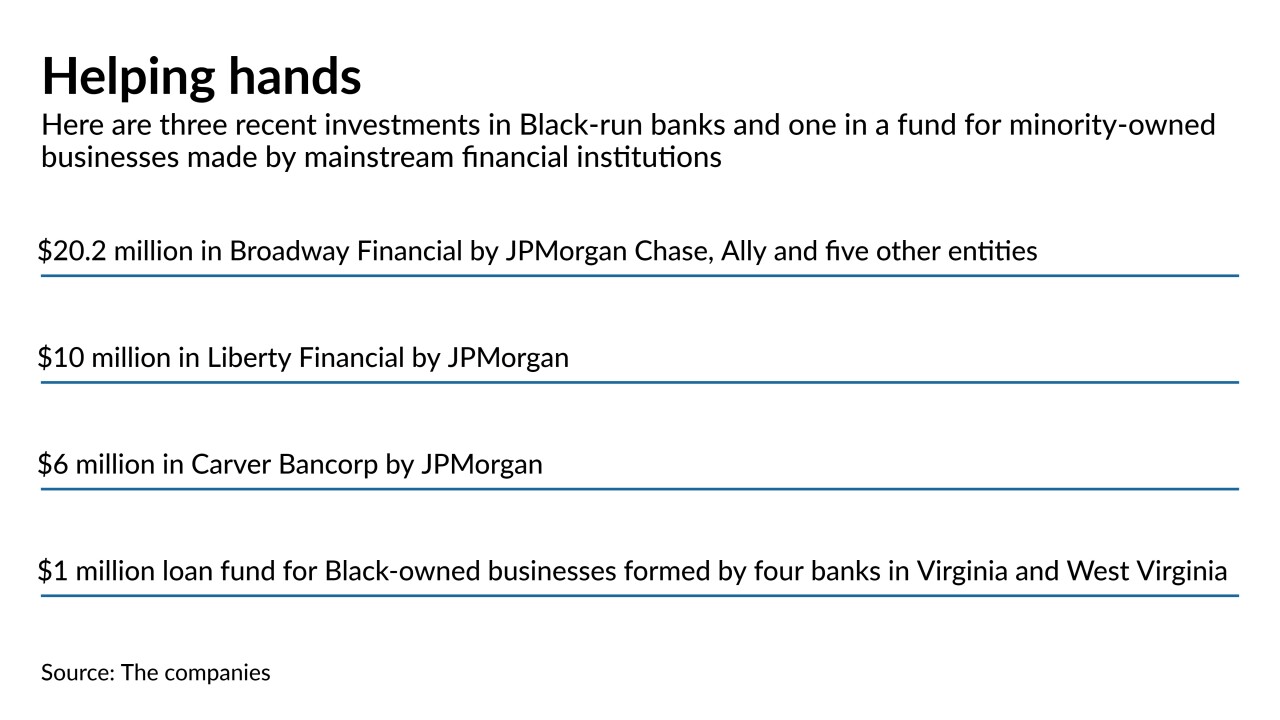

Several large and midsize banks are investing millions of dollars in Black-run banks, while four community banks have started a fund to make interest-free commercial loans in underserved communities.

February 24 -

Hildene Capital, which is pressuring CIB Marine to issue subordinated debt to redeem preferred stock, has nominated two individuals to stand for election to the company's board.

February 24 -

The fintech that gave life to the mobile point of sale market is seeing that business overshadowed by the ever-rising popularity of cryptocurrency.

February 24 -

The fintech that gave life to the mobile point of sale market is seeing that business overshadowed by the ever-rising popularity of cryptocurrency.

February 24 -

The Fortune 500 conglomerate has had discussions about merging Thrivent Credit Union, which operates independently of the company, into the bank if the charter is approved.

February 24 -

Banks lowered their loss provisions at the end of 2020, a sign they feel better about this year than last year, according to data from the FDIC. But loan balances fell for the second straight quarter and the annual loan growth rate was the lowest in seven years.

February 23 -

Prepaid customers’ COVID relief spending boosted the bank’s bottom line in 2020, but executives don't count on a repeat performance.

February 23 -

Prepaid customers’ COVID relief spending boosted the bank’s bottom line in 2020, but executives don't count on a repeat performance.

February 23 -

The decision provides more clarity to noteholders in the state about when the six-year statute of limitations to bring a foreclosure action begins.

February 23 -

M&T had long coveted the Connecticut regional but couldn't make a deal work. Their merger is the latest example of regional banks joining forces to compete in an industry undergoing rapid transformation.

February 22 -

New data from the state regulator shows gains across several key metrics even as allowances for loan losses surged and the loan-to-savings ratio fell by more than 10 points.

February 22 -

With the SEC probing Ripple, MoneyGram sidelines its partner to nurture online operations, which hit a milestone by surpassing in-store Walmart remittances in December.

February 22 -

Rapid changes in payments and regulations have blown open the door to new ideas, creating frontiers for fintech investors. Javier Perez hopes three decades of experience will help him have an early read on startups.

February 18 -

Net income and loan volumes at the Michigan-based credit union were both down in 2020 but noninterest income shot up 41% thanks in part to participation in the Paycheck Protection Program.

February 17 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12