-

The Illinois-based credit union, which recently announced an expanded field of membership, saw loans rise by nearly 7% in 2018.

April 12 -

JPMorgan Chase's banner quarter didn't stop executives from warning that the pause in rate hikes could crimp profits, or from hinting that the bank might downsize its mammoth mortgage operation.

April 12 -

2018 was mixed bag for credit unions in the Wolverine State, with membership and lending still seeing positive numbers but down from previous years.

April 12 -

The company could use its share of proceeds from the IPO to repay debt and pursue bank acquisitions.

April 12 -

Urfer co-founded a business with the banking automation pioneer John Diebold, worked for Chase Manhattan and other major banks, and played an important role in the Nixon administration, phasing out exchange controls.

April 12 -

The San Francisco bank has roughly doubled its assets in the last five years without the benefit of an acquisition.

April 12 -

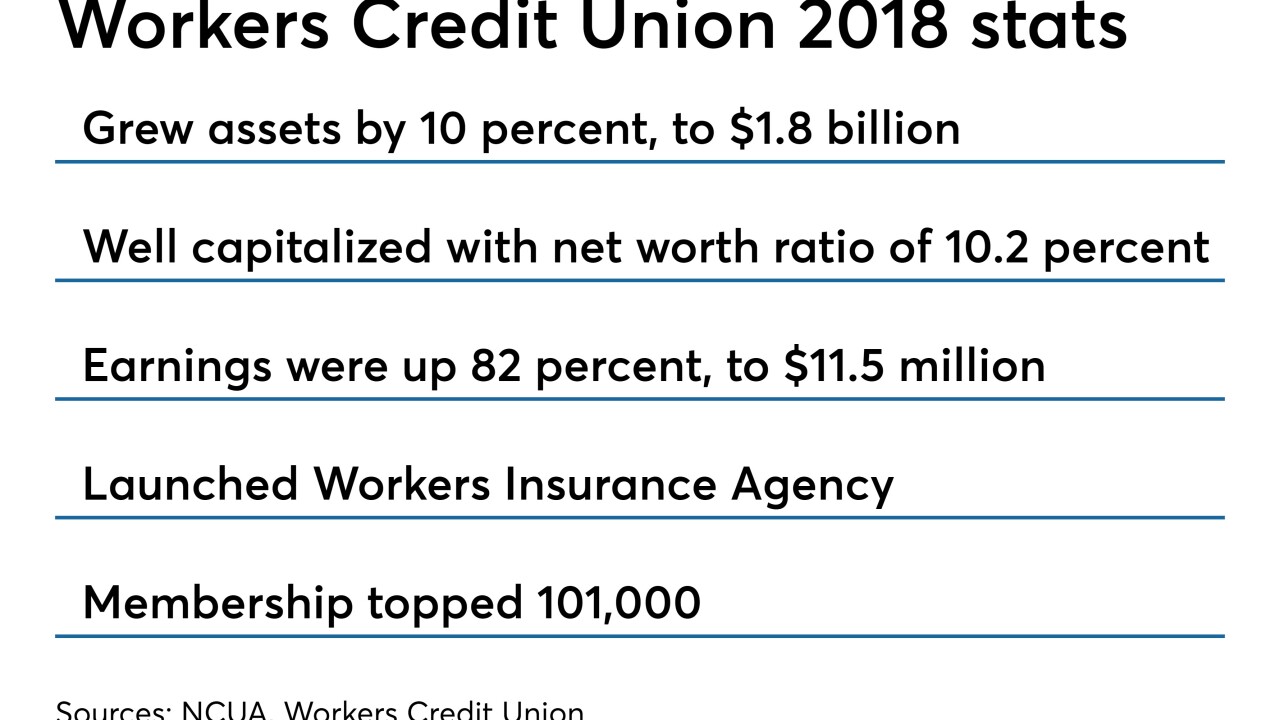

The Fitchburg, Mass.-based institution also started an insurance agency and upgraded its mobile banking last year.

April 12 -

The Pittsburgh company more than doubled its provision for loan losses during the first quarter to keep pace with growth in its loan portfolio.

April 12 -

Wells Fargo & Co. investors who stuck with the bank through a bumpy few months are being rewarded with the best first quarter in five years.

April 12 -

Bank's profits grow 5% on earnings growth; Citi's number 2 exec retirement shows the difficulty retaining a host of top executives.

April 12