-

After 10 years of conservatorship, the new year could finally usher in big steps toward housing finance reform.

December 27 -

The $126 million-asset credit union selected the new core platform in order to increase automation and cut down on "busy work" for employees.

December 27 -

Through a unique partnership, Nutmeg State Financial Credit Union offers DMV services at two of its locations. So far the results have showcased the power of technology.

December 27 -

The pressure is on CEO Christopher Myers, one of our community bankers to watch, to make the most of CVB Financial's biggest acquisition to date.

December 26 -

The industry could see a boost in mortgage lending from regulatory changes, but other factors may slow growth.

December 26 -

While these five bankers made headlines this year, not all of them did so for good reasons.

December 25 -

The settlement of a fight with an insurance company over officer and director coverage yielded a $6 million payout for FNCB in Dunmore.

December 24 -

Top U.S. financial regulators assured Treasury Secretary Steven Mnuchin during a hastily organized call they are seeing nothing out of the ordinary in markets.

December 24 -

The Massachusetts-based institution has paid out over $10 million to its members since 1996.

December 24 -

There is no banking crisis, but the president’s actions are threatening to create one.

December 24IntraFi Network -

Utilizing AI and automation will help stop hackers and reduce repetitive jobs, allowing institutions to save money and reinvest more into products for members.

December 24 EPL, Inc.

EPL, Inc. -

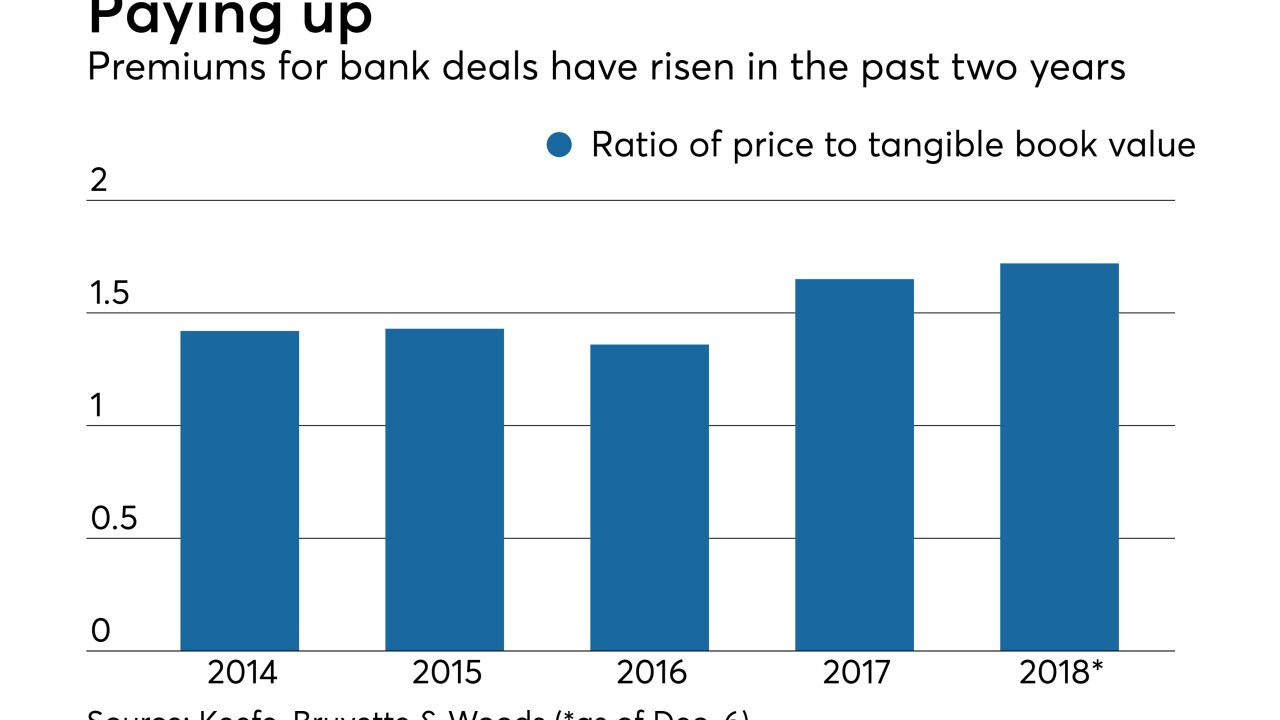

A big splash by Fifth Third, a bid by WSFS to reinvent itself and some bold long-distance expansions highlighted a year where deal activity held steady but premiums rose.

December 23 -

Treasury Secretary Steven Mnuchin called top executives from the six largest U.S. banks over the weekend, he said Sunday on Twitter, a move that followed heavy losses in the stock market last week and a partial federal government shutdown.

December 23 -

Prometheum may succeed whether others have failed because it has attempted to work closely with regulators.

December 21 -

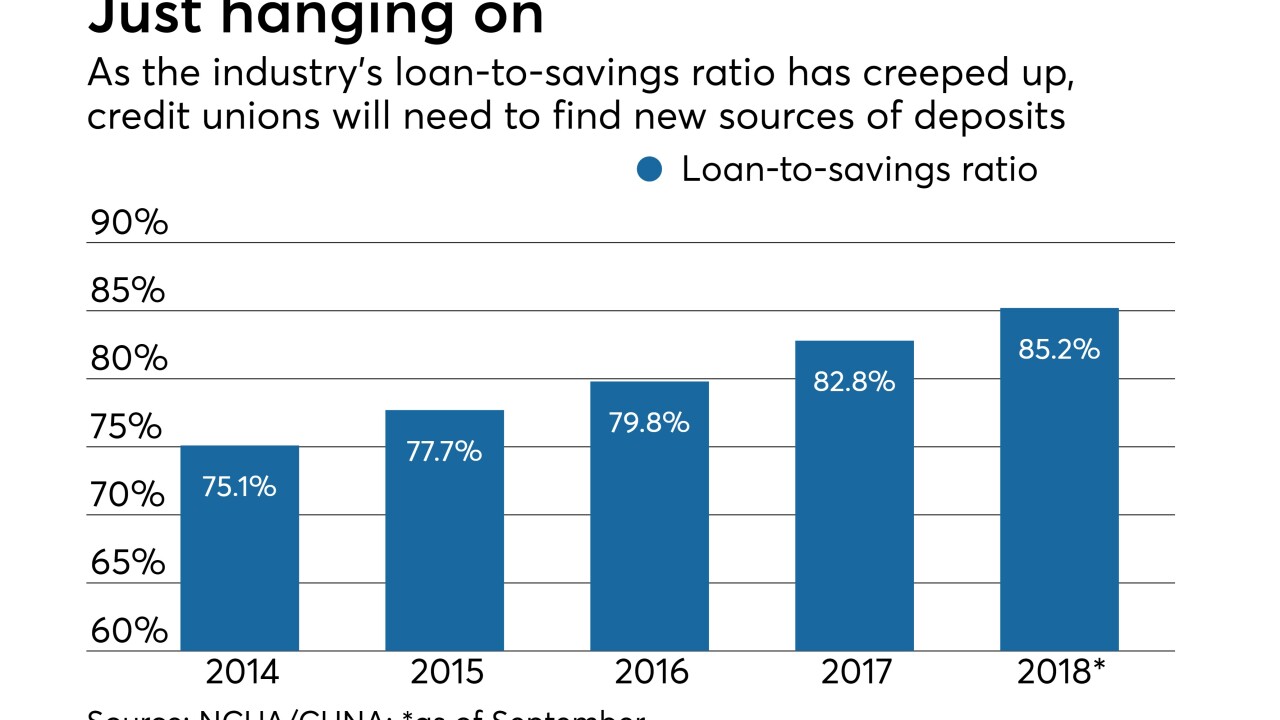

Amid rising rates and a surge in lending, credit unions will need to find additional sources of deposits to fund growth.

December 21 -

Bank of America is loosening the reins on its investment bankers, sending out dealmakers in search of more middle-sized transactions in the U.S. and seeking to regain market share after cutting back on risk.

December 20 -

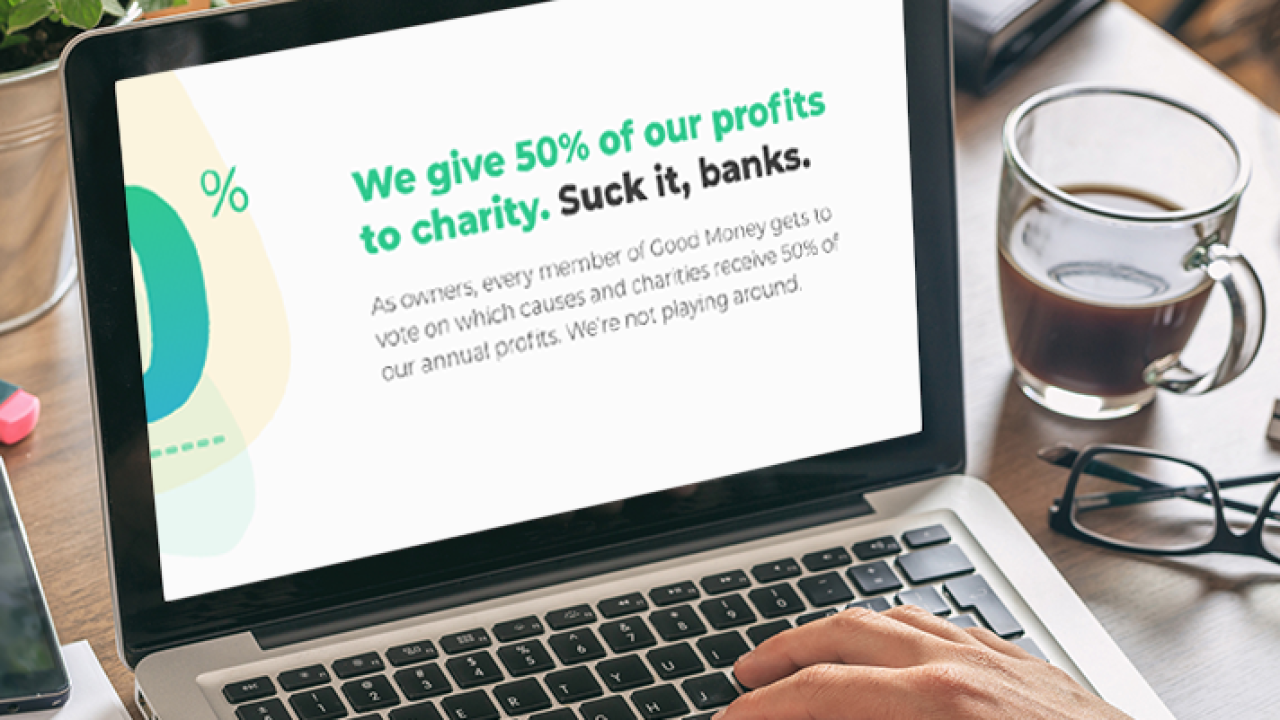

Good Money just raised $30 million and is a year away from launching, but already is raising concerns for its trash-talking of established players.

December 19 -

Stock Yards will remove a competitor in Louisville, Ky., and enter two markets outside of the city.

December 19 -

The Indiana-based institution has increased its starting pay for the last three years.

December 19 -

The agency’s rate cap for banks that are less than well capitalized contains several flaws and poses problems for community banks.

December 19 Independent Community Bankers of America

Independent Community Bankers of America