-

Federal Reserve Gov. Lisa Cook said in a speech Monday the central bank is monitoring record highs in the stock market to see if it proves to be a bubble.

March 25 -

A key bank stock index ticked up after the Federal Reserve hinted that it could lower rates later this year. But there are still a number of economic uncertainties that are holding shareholders back.

March 20 -

A trio of Republican Congressmen stated they will investigate how the program got fast-tracked by the Biden Administration.

March 19 -

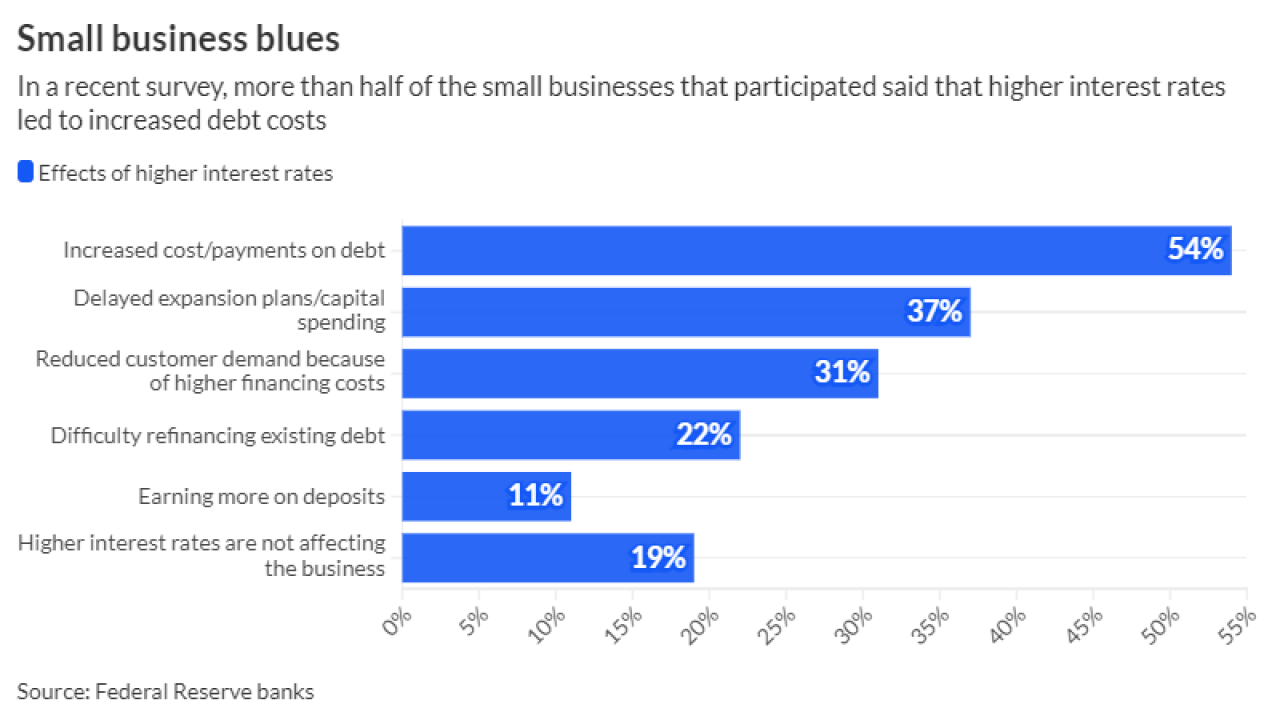

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

March 18 -

Investing in Main Street Act has passed the House three times with overwhelming majorities but has failed to gain traction in the Senate. Backers, including banks that invest in the funds, hope to flip the script with a third version.

March 18 -

Peapack-Gladstone's wealth unit is pursuing an ambitious de novo expansion in New York and perhaps elsewhere because M&A has become expensive as private equity money has inflated seller expectations.

March 13 -

Midsize lenders have largely defied the most dire predictions following Silicon Valley Bank's demise. But the nation's largest banks still have structural advantages, and the regionals remain hampered by their real-estate heavy portfolios and the continuing impact of high interest rates.

March 11 -

Bank of America, Citi and Navy Federal are among banks and credit unions to recently manage through unforeseen challenges.

March 11 -

Here's how the former regulator thinks Fannie Mae and Freddie Mac could exit conservatorship and where he sees the residential market headed this year and next.

March 8 -

MoneyLion saw continued financial growth in 2023, achieving four straight quarters of positive earnings. In 2024, it plans to develop a partnership with EY to bolster its enterprise services.

March 7