-

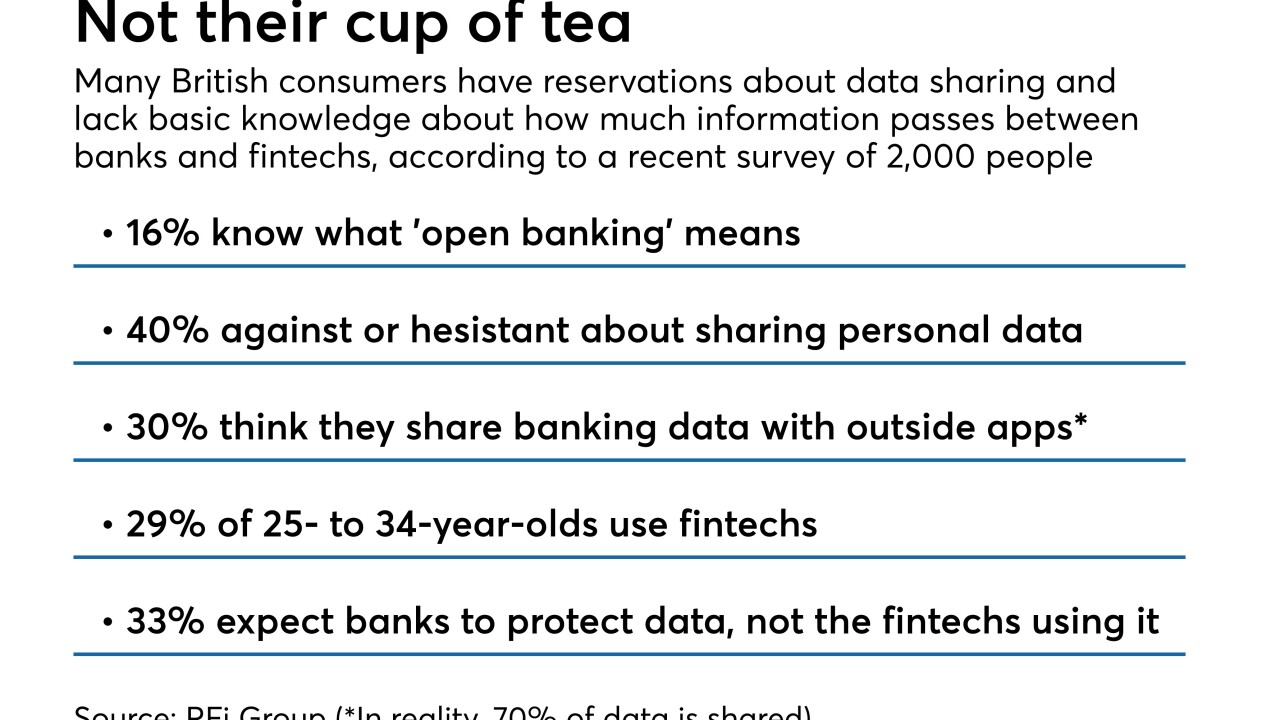

Though it became official in January in the U.K., most people there don't know what it is, according to a new survey that offers many insights for U.S. banks.

December 19 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

In a rare move, Maryland Financial is voluntarily liquidating after its customer base shrank and efforts to sell itself failed.

December 17 -

The fintech's new products may violate several banking and securities regulations and could mislead the public about the differences between coverage on banking and investment accounts, industry officials say.

December 14 -

The fintech Robinhood did not contact the Securities Investor Protection Corp. to discuss protection for deposits, according to SIPC CEO Stephen Harbeck.

December 14 -

The Fed wants more information on Treasury and mortgage-backed securities; will overlook compliance failures resulting from pilot programs.

December 4 -

To convince skeptical bankers about the benefits of distributed ledger technology, some suggest it needs to be separated from the volatile digital currency it underlies.

November 30 -

The initiative would allow financial firms to test new — and potentially less transparent — disclosure forms on customers.

November 29 Americans for Financial Reform

Americans for Financial Reform -

Atlanta Fed chief says consumers don't know the risks of using nonbank payments providers, like Apple Pay; equity derivatives desks will reap rewards of volatility.

November 28 -

A 10-year exemption for banks offering estimated fees and exchange rates under the rule, instead of exact amounts, is set to expire in 2020. Lawmakers should consider a temporary extension.

November 27 Akerman LLP

Akerman LLP