-

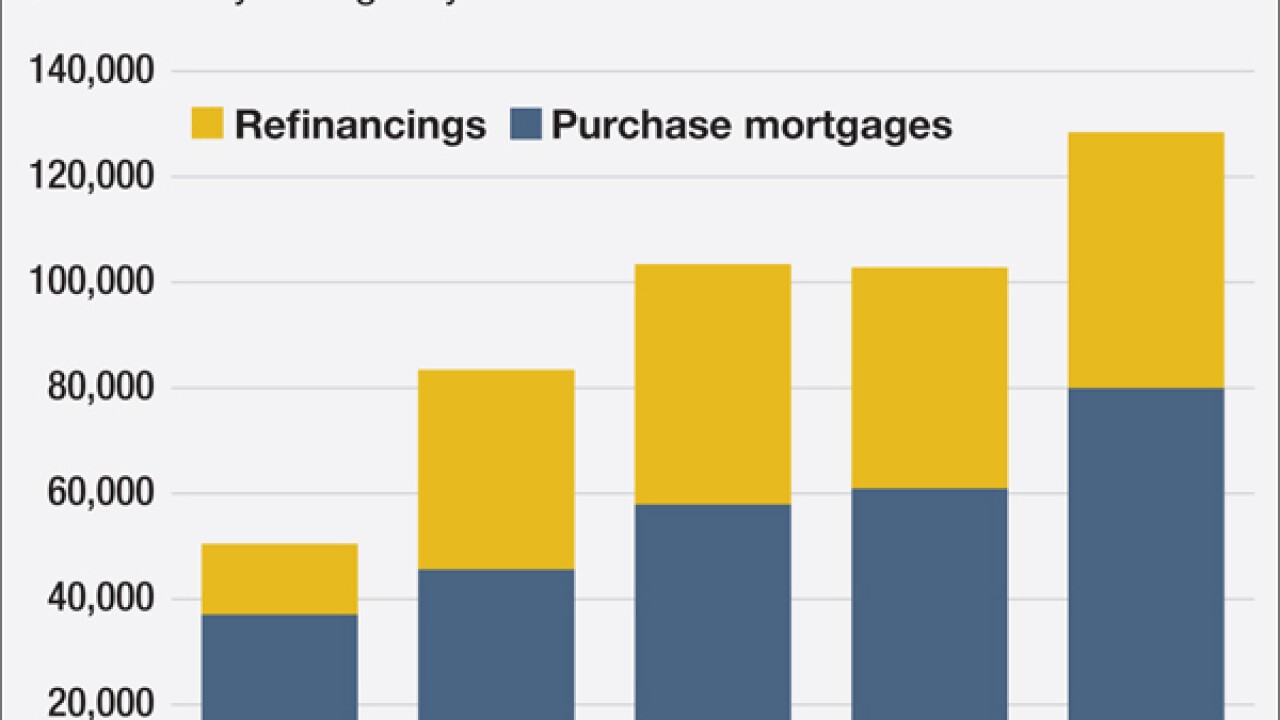

Loans to first-time homeowners and others with low credit scores are a big part of the Federal Housing Administration's growth in purchase mortgages since the agency cut premiums.

August 25 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and from our social media platforms.

August 21 -

WASHINGTON The Federal Housing Finance Agency on Wednesday officially increased the target for loans purchased by Fannie Mae and Freddie Mac that benefit affordable housing, but the uptick is not satisfying housing advocates.

August 19 -

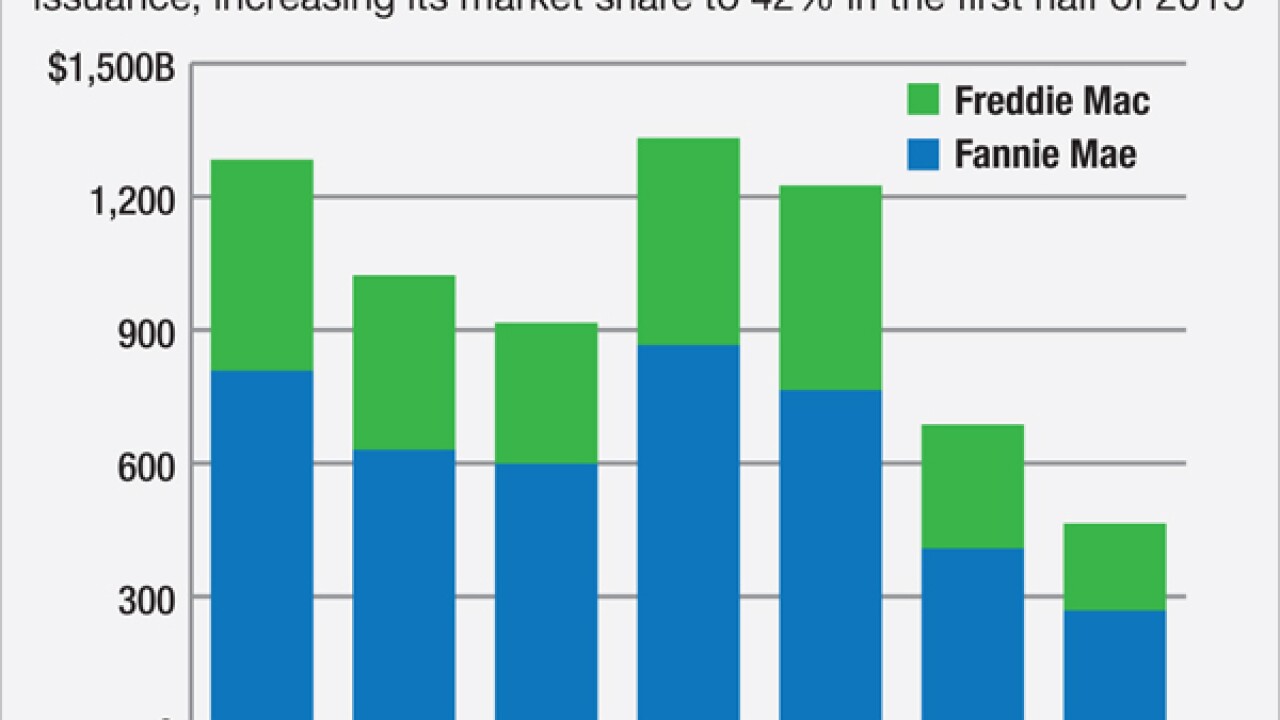

Fannie Mae and Freddie Mac have a regulatory mandate to shrink. But that's easier said than done, given the GSEs' outsized presence in the mortgage industry, as their latest quarterly results show.

August 17 -

WASHINGTON Four more Federal Home Loan Banks have won regulatory approval to participate in a program that allows member institutions to sell jumbo mortgage loans through a conduit to Redwood Trust.

August 14 -

Banks that sold faulty mortgage-backed securities right before the crisis have suffered a string of legal defeats over the timing of government lawsuits, but some experts believe the industry may still have a shot in the Supreme Court.

August 14 -

The Federal Housing Finance Agency is expected to issue a proposal soon that would require Fannie Mae and Freddie Mac to purchase manufactured housing loans from lenders.

August 13 -

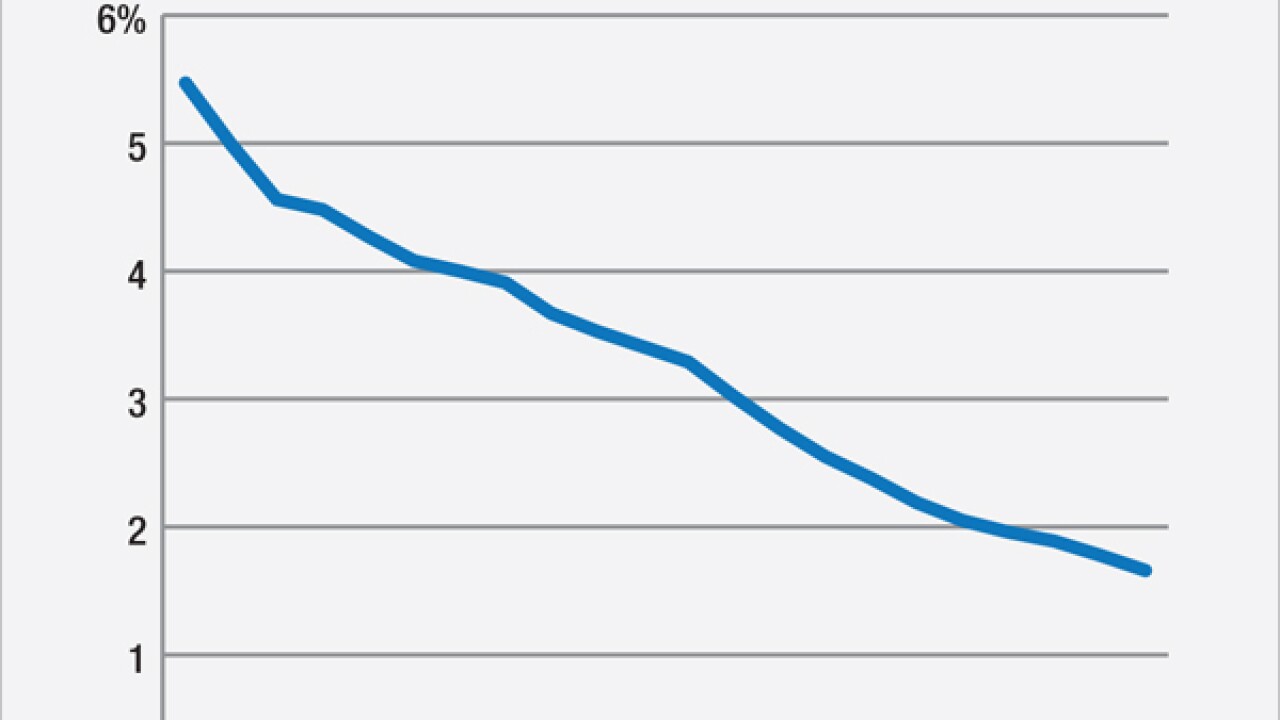

Homeownership is out of reach for too many Americans. The next president could change that with a few simple policies aimed at encouraging private capital to invest in residential mortgages.

August 13

-

Despite being introduced to the market with great fanfare, Fannie Mae's 3% down payment mortgage offering has yet to gain much traction with lenders and consumers.

August 6 -

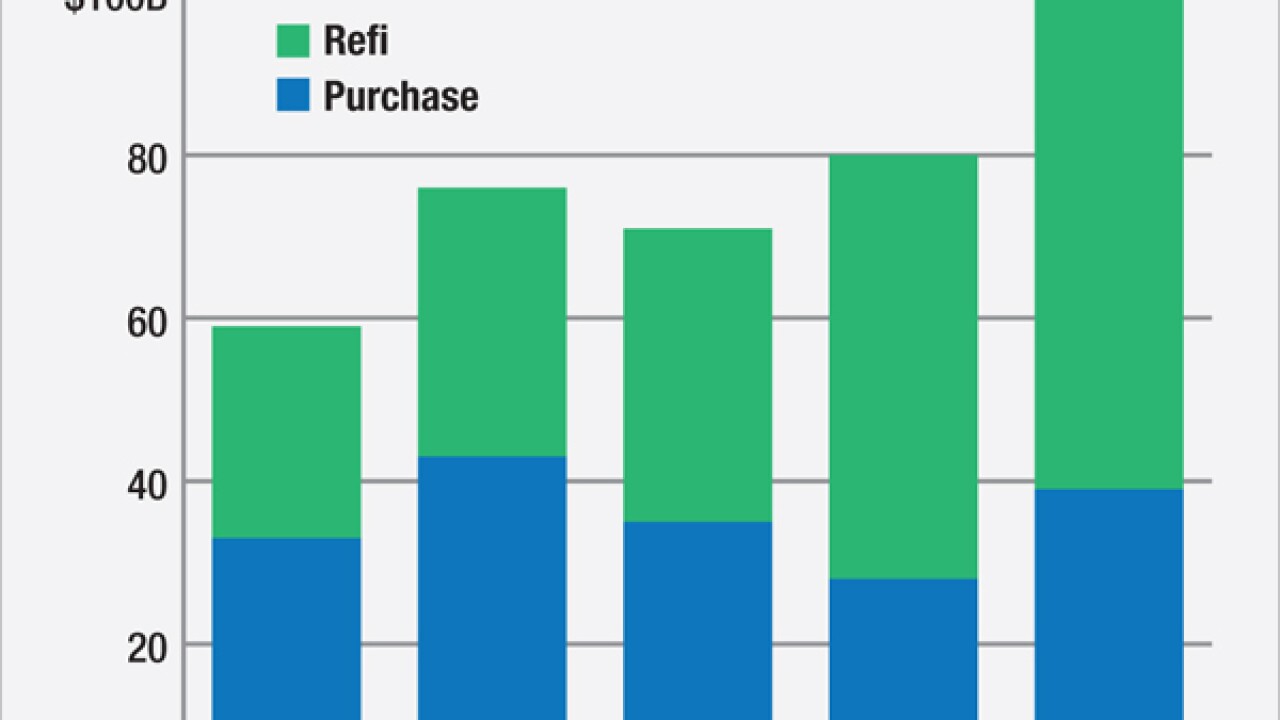

Freddie Mac's second-quarter single-family funding was the strongest it's been in a year, positioning the company to supplant the coming drop in refinancing with purchase mortgages.

August 4 -

Former Texas Gov. Rick Perry laid out a sweeping financial reform agenda on Wednesday, suggesting he would force the biggest banks to hold even more capital or reinstitute elements of the Glass-Steagall Act.

July 29 -

The Federal Housing Finance Agency is still not producing enough adequately-trained examiners necessary to monitor Fannie Mae and Freddie Mac, according to an inspector general report.

July 29 -

The House Financial Services Committee tackled several key bills including ones targeting Operation Choke Point, executive compensation at Fannie Mae and Freddie Mac, small banks' exam cycle, and changes or delays to several actions by the Consumer Financial Protection Bureau.

July 28 -

Just a day after the Dodd-Frank Act's fifth anniversary, Senate Banking Committee Chairman Richard Shelby launched a new attempt to make significant changes to the law, attaching his regulatory relief bill to legislation that would provide funding for financial services agencies.

July 22 -

WASHINGTON The Senate Finance Committee voted Tuesday for a measure that would extend a temporary 10-basis point hike in Fannie Mae and Freddie Mac guarantee fees for an additional four years.

July 22 -

The new MBS program gives FHLB members direct access to the secondary market.

July 21 -

WASHINGTON The efforts of Fannie Mae and Freddie Mac shareholders to claw back the value of their investments by suing the U.S. Treasury have not elicited much support on Capitol Hill.

July 16 -

FHFA report shows FHLBs are well capitalized while Fannie and Freddie continue to see improving loan performance.

June 29 -

Fannie Mae will no longer charge mortgage lenders to submit loans to its Desktop Underwriter automated underwriting system, a decision that follows a similar move by Freddie Mac earlier this month.

June 23 -

Some argue that nonbank mortgage lenders' rising market share poses a risk to the financial system. But this belief arises from an inaccurate understanding of what is in fact a well-regulated sector.

June 16