-

The bank was accused of forcing borrowers to pay for insurance they did not need, pushing almost 250,000 of them into delinquency, according to a 2017 lawsuit.

June 7 - cuj bulletin lead

The Federal Communications Commission is expected to consider changes that would allow consumers to block calls from numbers not on their contacts list while the House should vote to extend the National Flood Insurance Program.

June 3 -

Congress extended the National Flood Insurance Program through June 14, preventing the federal initiative from expiring on Saturday.

May 30 -

Rodney Hood, chairman of the National Credit Union Administration board, will testify later this week before a Senate committee with CECL as a likely topic.

May 13 -

The company will record a $2.1 million pretax gain in the second quarter after selling Summit Insurance Services to the Hilb Group.

May 6 -

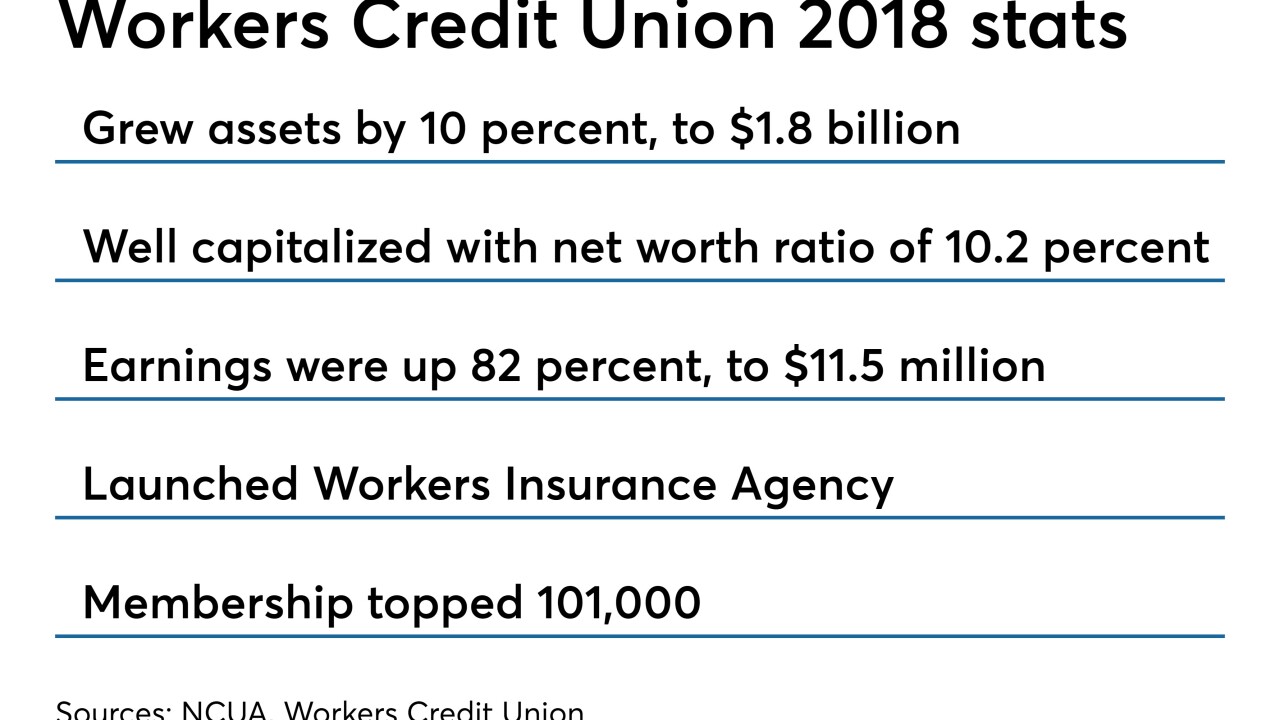

The Fitchburg, Mass.-based institution also started an insurance agency and upgraded its mobile banking last year.

April 12 -

First-term Rep. Rashida Tlaib, D-Mich., has sponsored the Prevent Discrimination in Auto Insurance Act in order to prevent “undue burden” on low-income individuals seeking auto insurance.

March 18 -

The House Financial Services Committee debated legislation Wednesday to reform and reauthorize the National Flood Insurance Program, but no clear solution emerged.

March 13 -

The House Financial Services Committee will hold eight hearings next month, looking at Wells Fargo's recent consumer protection scandals, a reauthorization of the flood insurance program and more.

February 25 -

The agency has required restitution in just one of six settlements under its new director, raising questions about whether the pattern will continue.

February 20 -

The National Credit Union Administration board was also briefed on a final interagency rule regarding private flood insurance during its regular monthly meeting.

February 14 -

Depository mortgage lenders are optimistic the final version of a regulation designed to open up the flood insurance market will make it easier for them to comply with a rule requiring them to accept private carrier policies.

February 11 -

The company owning brands such as Kay Jewelers and Jared the Galleria of Jewelry will pay $11 million under a settlement with the consumer bureau and New York's attorney general.

January 16 -

Many federal agencies have been closed for more than three weeks, making it the longest shutdown in U.S. history. With no end in sight, here's how it's affecting banks, credit unions and mortgage lenders.

January 13 -

The Dodd-Frank Act gave the central bank authority to set capital requirements for insurance companies that own a federally insured bank, as well as those determined to be systemically important.

January 9 -

The crypto market has typically been viewed as too risky to make insurance viable, but there are ways to enhance risk management, says BlockRe’s Raymond Zenkich.

January 2 BlockRe

BlockRe -

The announcement rescinded the agency's earlier guidance issued to industry partners to suspend sales operations as a result of the current lapse in funding from Congress.

December 31 -

The cost of Wells Fargo's scandals continues to rise as regulators from all 50 states forced the institution to pay hundreds of millions in penalties for the creation of fake accounts, improper enrollment in life insurance, force-placed auto insurance policies and other activities.

December 28 -

Lawmakers and industry groups were caught off guard when FEMA said it wouldn't issue flood insurance policies during the government shutdown, despite an extension passed last week.

December 27 -

The sale should increase Shore's capital levels and allow it to expand its banking activities.

December 18