First Niagara Financial Group Inc. in Lockport, N.Y., is insisting that its recent management shake-up is not a sign that it is on the verge of a sale, but talk of one persists.

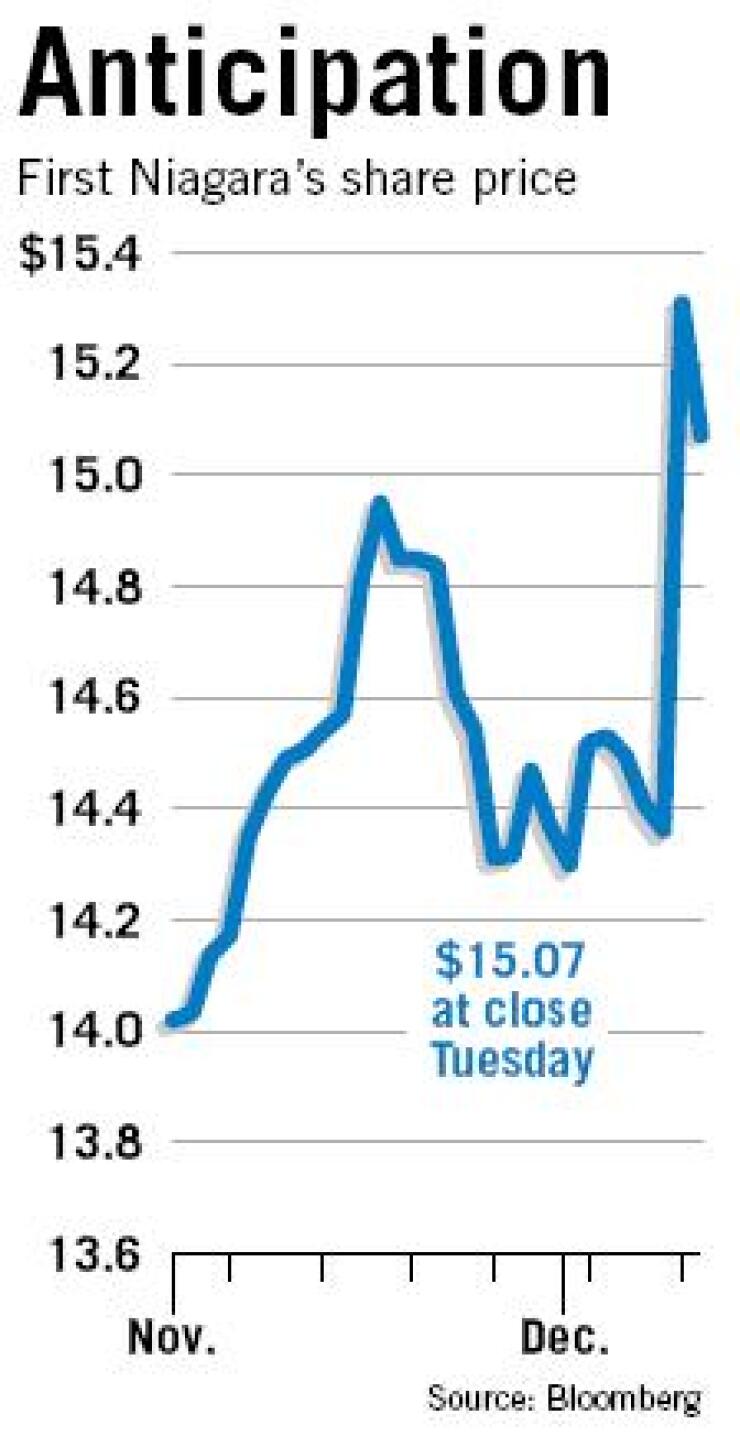

The stock closed at a 52-week high Monday, and though it retreated somewhat Tuesday, the events of the past three days left some investors with the idea that something might be in the works, analysts said.

The buzz surrounding the $8 billion-asset First Niagara started Thursday, when it abruptly canceled an appearance scheduled for that day at Ryan Beck & Co. Inc.'s investor conference in New York.

It escalated late Friday after the company disclosed that the board had replaced Paul J. Kolkmeyer, who had been First Niagara's president and chief executive officer since December 2003. It named chief financial officer John R. Koelmel as its president, chief operating officer, and acting CEO.

The press release about the management change cited "differences in management style," which fueled speculation that Mr. Kolkmeyer had clashed with the board over the company's direction. The release also said First Niagara would not be conducting a CEO search, which some observers interpreted as a sign that the company planned to sell itself.

On Monday the stock closed at $15.31, up $6.6%. It gave back some of those gains Tuesday and closed at $15.07.

First Niagara said that Mr. Koelmel or Robert G. Weber, its chairman, would not be available for interviews, but spokeswoman Leslie Garrity said there was "no triggering event" that led to the management move.

"The board decided it was time for a change in leadership at the CEO level," she said.

The company is not set up for a sale and intends to continue with its "buy and build" strategy, Ms. Garrity said.

"We don't anticipate that this change is going to slow that down, mostly because [Mr. Koelmel] has been with First Niagara for three years," she said. "There's no reason for an interruption in strategy."

The title of acting CEO was not intended to suggest a "temporary" appointment, she said.

"They chose to name him 'acting' as a way to demonstrate confidence," Ms. Garrity said. "The board wasn't comfortable with the word 'trial' or 'interim' or 'transition,' because it implies an end time, and the board has confidence that John is the best person to lead First Niagara going forward."

Ms. Garrity said the company expects to appoint a new CFO within 30 days.

Anthony R. Davis, an analyst with Ryan Beck, a BankAtlantic Bancorp Inc. unit, issued a research note Monday upgrading First Niagara's stock to "outperform."

"Based on our interpretation of this week's developments, it appears that First Niagara's board is open to bids," he wrote. "Whether this is true or not probably doesn't matter, since competitors and investors are apt to react as if this is the case."

In Mr. Kolkmeyer's three years as CEO, First Niagara's stock has fallen 6%, while the stock for publicly traded thrifts overall went up 17%, Mr. Davis wrote.

He speculated the challenging operating environment - which will probably preclude meaningful gains in per-share earnings next year - might have persuaded the board it should be more receptive to merger offers. But he said he suspected Mr. Kolkmeyer felt differently.

Even if that is not the case, Mr. Davis wrote, "the subsequent appointment of a CEO with little bank operating experience will likely prompt overtures from competing banks."

Mr. Koelmel, who joined First Niagara in January 2004, had a 26-year career at KPMG - where, several analysts pointed out, he got to know Mr. Weber.

Laurie Hunsicker, an analyst at Friedman Billings Ramsey & Co. Inc. in Arlington, Va., said that given the margin pressures, "it would be a good idea" for First Niagara to consider a sale.

She added, however, that its stock is richly priced right now and is trading at close what a takeout price would be.

First Niagara's stock is trading at about a 20% deposit premium, or more than 30% looking at core deposits, excluding certificates of deposit, Ms. Hunsicker said. That is high compared with the prices paid for 17 acquisitions in upstate New York since January 2002. Those averaged a 14% deposit premium and a 24% core deposit premium, according to her research.

"Even if it were for sale - and you probably have a limited pool of buyers for this bank anyway - you're trading at your inherent takeout value," Ms. Hunsicker said. "I think people tend to get excited about low price-to-book without looking at the other side - which is why deposit premium is so important."