ShareBuilder Corp. of Bellevue, Wash., has begun offering discounts on 401(k) plan administration fees to certain small-business customers of the warehouse retailer Costco Wholesale Corp.

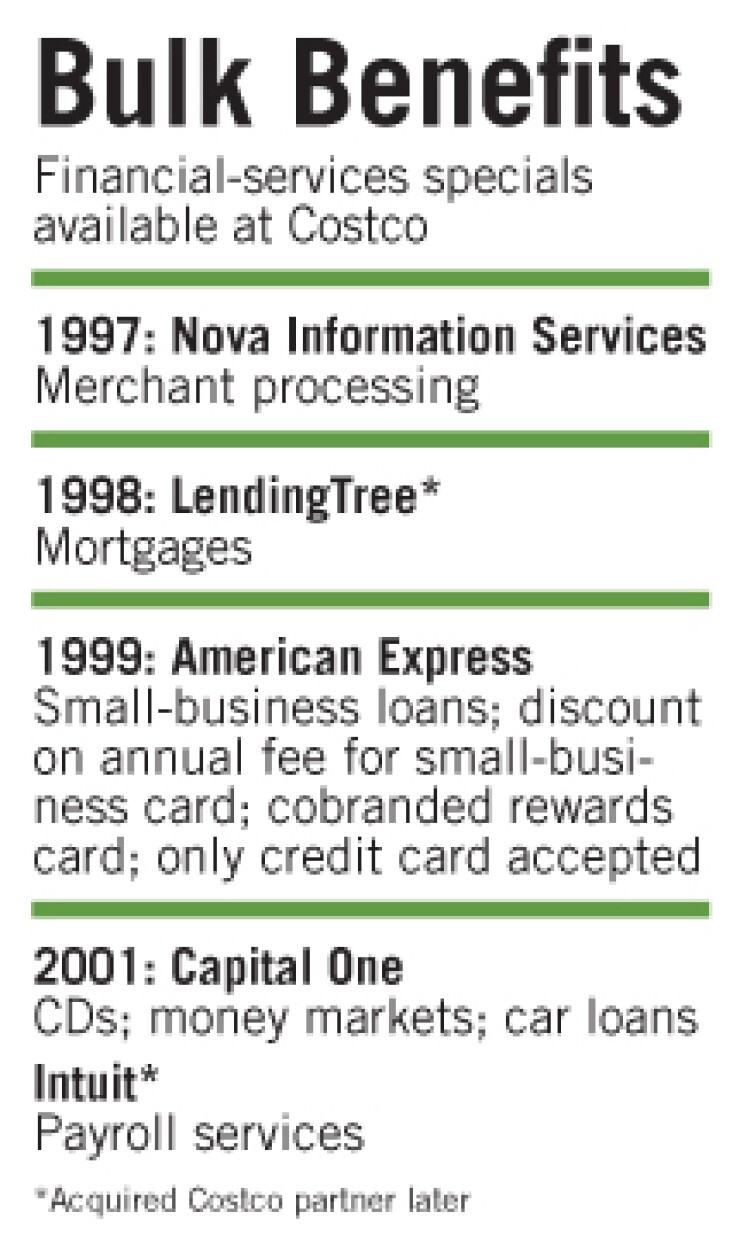

The pilot test, which began in February at 48 Costco stores in Northern California and Reno and is available at the retailer's Web site, is the latest in a series of partnerships the retailer has formed with financial services companies over the last 10 years. Costco members, who pay annual fees to shop at its 450 warehouses in North America, can get promotional deals on mortgages, certificates of deposit, car loans, payroll services, and merchant card processing.

The providers get access to Costco's 45.1 million memebers, whom Matthew Park, an analyst of financial services companies at Prudential Equity Group LLC, calls "the epitome of loyal and high-spending customers."

According to Patrick Callans, a vice president at the Issaquah, Wash., retailer who oversees partnerships with financial institutions, 87% of its members are homeowners, the average member's household income is $76,000, and the median income is $62,000.

ShareBuilder is expanding on a partnership that began five years ago, when it started offering reduced trading fees and cash sign-up bonuses to Costco members who use its online brokerage.

"Very quickly, we built a very strong customer base with Costco members," said Stephan Roche, the general manager of ShareBuilder's small-business group. His company started offering 401(k) products a year and a half ago, and "it was natural for us to talk to Costco, given its very strong small-business customer base."

Kathy Schanno, ShareBuilder's senior director of partnership marketing, said it has found Costco customers to be consistent investors who overwhelmingly refer ShareBuilder to others.

In the 401(k) promotion, ShareBuilder is offering a 5% discount on administrative fees to the retailer's Gold members and a 10% discount to its Executive members. (Costco charges an annual fee of $50 for a Gold membership and $100 for an Executive one.)

John Lees, Costco's director of consumer services, said it agreed to participate in the 401(k) test because ShareBuilder offers a simple and inexpensive plan. Costco will run the test for a few months to gauge responses, he said.

The retailer says being a sales channel for financial products and services has helped it attract and retain members.

"We want to make sure that they don't think twice when they have to sign that check for the membership fee for next year," Mr. Callans said. Unlike

Mr. Lees said marketing is Costco's biggest cost for running these programs. Each is "expected to at least stand on its own" and pay for itself, and the retailer does not want too many partnerships, because they would confuse members.

American Express Co. offers small-business loans, and a discount on the annual fee for its small-business card, to Costco members. "Costco brings us an attractive base of people who value membership," said David Patron, an Amex vice president.

Nova Information Systems Inc., an Atlanta card processor owned by U.S. Bancorp of Minneapolis, is Costco's oldest financial services partner; their partnership began in 1997.

Executive members who use Nova's services get discounts on payment equipment and do not pay monthly statement fees.

"They have a reach to our target merchants: the small mom-and-pop merchants," said Michelle Graff, a Nova spokeswoman.