JPMorgan Chase & Co.'s strength in credit cards and its experience with integration make Washington Mutual Inc.'s distribution platform a rich opportunity, but problems in the acquired $28 billion card portfolio will pose challenges.

The New York banking company said it plans to let the subprime half of that portfolio run off, but it hopes to accelerate card sales at Wamu branches and extract significant cost savings from the card business.

Last week's acquisition of Wamu's banking operation from the Federal Deposit Insurance Corp. raised JPMorgan Chase's card receivables to about $181 billion.

"We will be keeping the near-prime stuff. There's some very good stuff they do" in the card business, James Dimon, JPMorgan Chase's chairman and chief executive officer, said on a conference call last week. "We do think there will be substantial cost saves in that business, too."

Robert Hammer, the CEO of R.K. Hammer Investment Bankers, a Thousand Oaks, Calif., broker of card portfolio sales, said about half of Wamu's portfolio "is junk status, and half is wonderful, branch-sourced, multiple-sales customers, which have lower delinquency, lower chargeoff, higher usage, more loyalty," and are in markets "where JPMorgan doesn't have a lot of branch presence."

The $2 trillion-asset JPMorgan Chase must "get rid of $13 billion worth of junk" before it can fully capitalize on the portfolio's opportunities, he said.

Such a disposition "takes time, and it's a distraction from what they do with good accounts," Mr. Hammer said. "Every time you have collectors and customer service and marketing people worrying about the junk-status accounts, of which there's a lot, that's a distraction from limited resources."

And such distractions will last "for probably six months to a year," he said.

JPMorgan Chase would not elaborate beyond its previous remarks, saying the transition is in its early stages.

Tim Kolk, a managing partner at Brookwood Capital LLC, a Peterborough, N.H., card portfolio consulting firm and brokerage, said: "I think the card portfolio from Wamu probably has got a lot in it that JPMorgan had to swallow hard about. … They're spectacular managers of these kinds of businesses, so they'll make of it all they can. But I think the card program probably brought more headaches than it did opportunities."

Selling cards from branches is one of JPMorgan Chase's "core strengths," Mr. Kolk said. "I'm sure they really want" the larger distribution platform "more than the existing portfolio, because in today's environment, taking on a portfolio that someone else underwrote is a very stressful proposition, and I'm sure they like the opportunity of originating their own accounts in their own way."

In terms of the backbone of the operation, Mr. Hammer said, "I don't think there's any new technology or new management skill" in Wamu's banking operation "that doesn't already exist within the borders of JPMorgan."

Card distribution through branches had been a focus at Wamu, accounting for 35% of its new accounts in the second quarter, compared with 38% in the first quarter and 37% in the fourth quarter.

But JPMorgan Chase said that its branches produced two times more credit card sales than Wamu's did last year, and that improving the Wamu branches' performance to the average in JPMorgan Chase's network would result in 500,000 additional card sales a year.

John Grund, a partner at First Annapolis Consulting Inc. in Linthicum, Md., said Wamu's card sales through branches were "borderline nonexistent" before it bought Providian Financial Corp. of San Francisco in October 2005. "Wamu is just a few years into using its branch channel to sell credit cards."

Mr. Hammer said: "There hasn't been a lot of extra money running around at Wamu lately, so there's not been a lot of budget to throw into new marketing programs and extra rewards programs and extra branch sales staff training and branch rewards programs. JPMorgan's got all that … not just the technology, but they've got the budget to be able to throw against it."

Card sales through Wamu's branches could double "within 18 months," he said.

Mr. Grund said branch sales cannot be increased by "the flip of a switch by any stretch, because it involves behavioral changes and cultural changes, systems changes, perhaps."

Nevertheless, "Chase has a template that it has used in its own branches, in Bank One branches, in Bank of New York branches," he said.

"This is a competency that Chase has used time and time again. … It's really just a matter of when, not if."

Mr. Hammer said boosting branch sales "takes time and money." He also raised the issue of where Wamu was focusing its attention in the last year. "What kept them awake at night was not marketing plans. It was saving the company."

Charles Scharf, the CEO of JPMorgan Chase's retail financial services, said on last week's call, "Because of what we have at JPMorgan Chase, we'll have the ability to just bring a whole series of products and services that Washington Mutual didn't have."

These offerings include "things that we can offer because of the size of the credit card company we have, some of our debit products, bill pay, online banking," Mr. Scharf said.

Mr. Dimon said his company does expect card losses to accelerate.

"We are assuming they get much worse than what you're seeing in Washington Mutual."

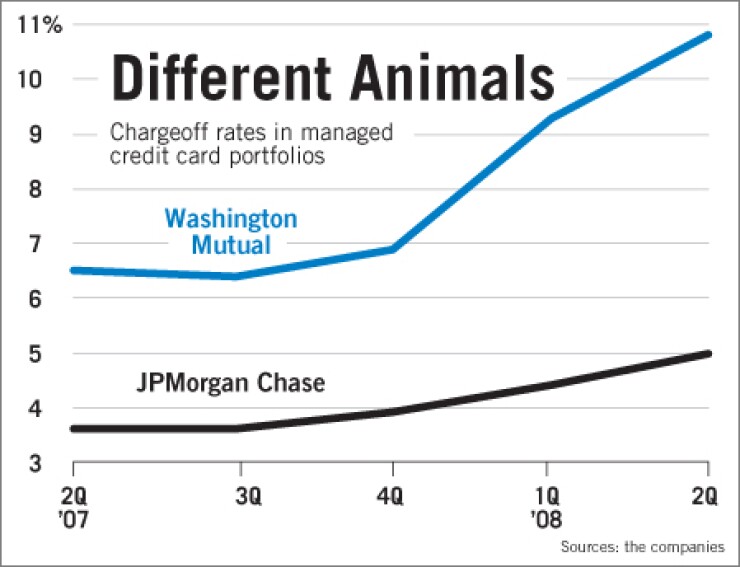

Last week JPMorgan Chase reiterated the third-quarter chargeoff projection of 5% or more it gave in July during a conference call on second-quarter results. (It also said its chargeoff rate could average 6% next year.)

During its own second-quarter earnings conference call in July, Wamu increased its chargeoff projection for this year to 10.5%, from the range of 9.5% to 10.5% it predicted in April. In the second quarter the Seattle thrift company's chargeoff rate climbed 152 basis points from the first quarter and 435 basis points from a year earlier, to 10.84%.

In the first quarter, Wamu's chargeoff rate increased 242 basis points from the fourth quarter.