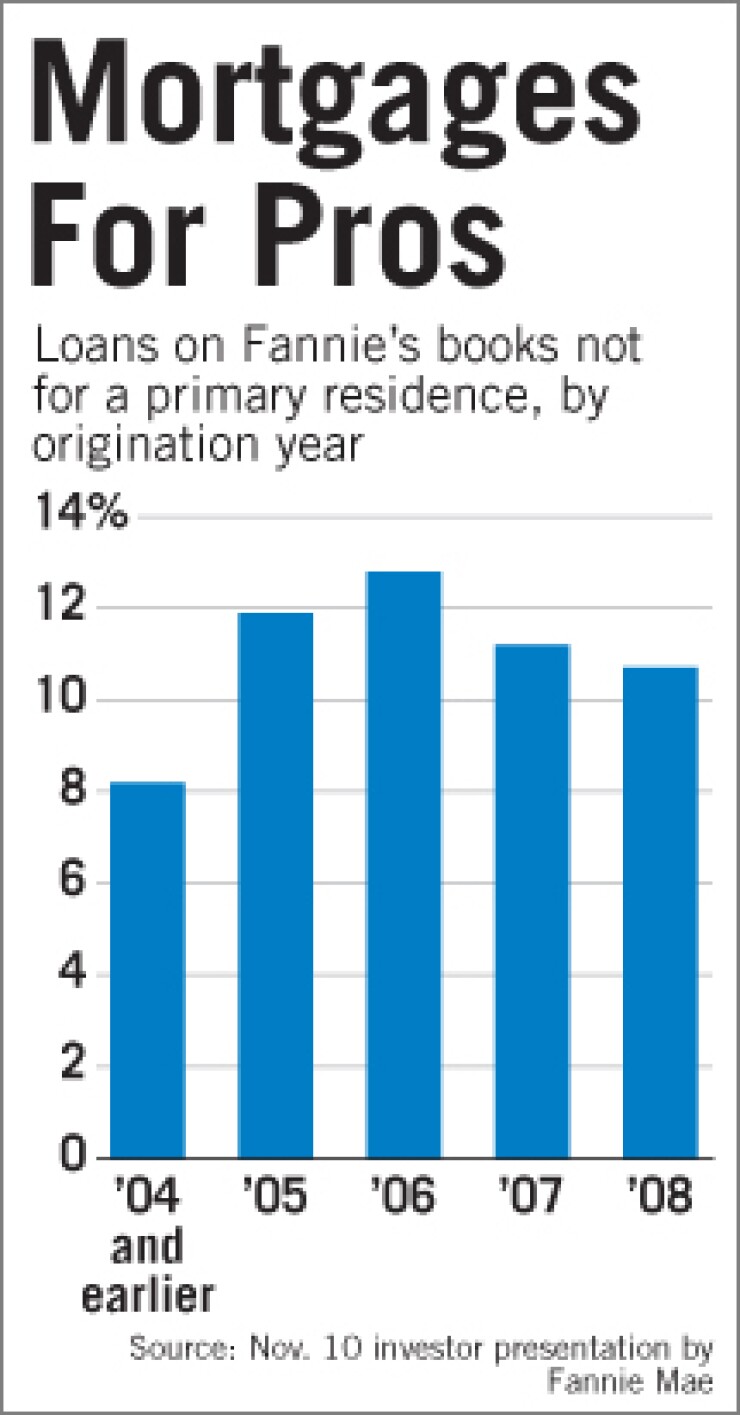

Fannie Mae is loosening a restriction to encourage lending to property investors, a group that has been widely blamed for contributing to the housing meltdown but is also seen by many as critical to a recovery.

The government-sponsored enterprise told lenders last week that starting next month it will buy or guarantee home loans made to borrowers that have mortgaged as many as nine other properties. Currently, Fannie will not touch a loan if the borrower has financed more than three other homes.

The change is meant "to bring added liquidity to the investor segment of the market and help hasten the recovery," Fannie said.

However, the GSE, which said it wants to make more loans available to "high-credit quality, bona fide … experienced investors," is tightening other requirements for this type of borrower. Starting in June, an investor will have to hold six months of payments in reserve, rather than two months, to get a single-family loan approved by Fannie's automated system.

Since they were seized by the government last year, Fannie and Freddie Mac have been directed to put more emphasis on supporting the housing market; like other prospective homebuyers, investors have been dissuaded from making purchases by tightened underwriting standards and forecasts that prices will keep tumbling.

"Investors are often the first sign of a stabilizing market," said Joe Garrett, a principal at Garrett, Watts & Co., a consulting firm in Berkeley, Calif. "One of the things that leads the economy out of a housing crisis is when prices get cheap enough that investors start moving in and buying things. … Then the owner-occupants see that prices have stopped falling — they see how cheap prices have gotten, and they start to jump in."

Fannie also said a desire to expand the range of potential buyers for properties with tenants played a role in the new standards. Last month both GSEs said they would no longer evict tenants living in foreclosed properties and would offer them month-to-month leases instead.

Robert Simpson, the founder and president of Investors Mortgage Asset Recovery Co. LLC, an Irvine, Calif., audit and fraud analysis firm, said he was wary of easing restrictions on investor loans.

"The idea that we need to let investors back in" to shore up the housing market amounts to "an artificial bottom," he said. "Let those prices come down to the point where normal people can afford them, and you'll find buyers, but not at these inflated prices."

Basing loans on a reasonable multiple of rent would be a safe way to lend to investors, Mr. Simpson said. Right now such buyers are "catching a falling knife," with prices likely to tumble further. "The government, I think, rightfully has an interest in seeing that people own a home. … But I don't believe the government has any interest in seeing that people are successful real estate investors," he said.

Moody's Economy.com Inc. has projected that prices will decline another 11% from the fourth quarter before stabilizing at the end of this year.

David Zugheri, the co-founder and chief marketing officer of the Houston lender Envoy Mortgage Ltd., said underwriting standards are "very different" today from years past, when a loan on a tenantless property would be granted on the basis of rents in its geographic market.

For refinancings, underwriters today typically look for income from the property "to support itself and then some," he said. They also want to make sure borrowers "can stand on their own feet, even if the property is not bringing in any income at all, if it were vacant."

As a result of such changes and market conditions, Envoy is "seeing less and less investment properties," Mr. Zugheri said. When the private securitization market was operating, there was "no real defined cap" on the number of mortgages for investment homes. "People would come by with 20-plus properties."

Mr. Garrett said that "the biggest problem" in securing loans for investment properties "is the lack of equity."

"A few years ago you could've bought, as an investor, these same properties for 5% down or 10% down. Now it's more like 30% down," and in some cases 40%.

"Prices haven't fallen enough in most places for investors to come in," he said. "In areas where the prices have fallen low enough," and rental income is enough to produce "a break-even or a positive cash flow, underwriters are approving those loans."

During the boom, cash flow often got little attention, under the assumption that properties might be resold within three months, Mr. Garrett said. Now cash flows, debt coverage, leases, and the borrower's experience as a landlord and independent financial strength are scrutinized, he said. "These are actually pretty good loans."