After the financial crisis forced them to retrench, credit card issuers are again on the hunt for new customers.

Their tactics — low teaser rates that last for a long time and generous rewards offers — include features that many industry watchers expected the big banks would eliminate because of growing cost pressures. But despite some very real concerns about the economy, banks are flooding consumers' mailboxes with credit card offers.

"One thing is for sure, and that is competition is increasing," said Andrew Davidson, a senior vice president with Mintel Comperemedia, a Chicago research firm that tracks direct mailings.

Unemployment remains high, but fewer people are becoming jobless, causing slow declines in delinquencies and chargeoffs and enabling issuers to reduce reserves for loan losses.

As a result, issuers are positioned to grow again and are using competitive pricing to entice prospective customers, Davidson said.

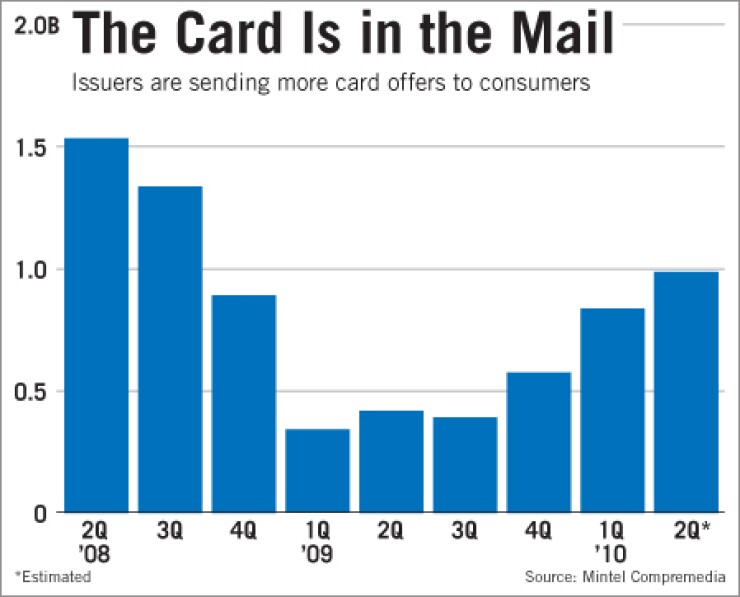

Mintel in May projected that U.S. credit card acquisition mail offers would reach 988 million in the second quarter based on preliminary data. While that figure is down from the 1.53 billion offers sent in the same quarter in 2008, it's up 136% from the offer volume from the year-earlier quarter.

Davidson said the upward trend is likely to continue, with some issuers planning to increase spending on advertising and marketing throughout the year.

But while many of the features included in new card offers are similar to those seen before the recession, the pool of consumers receiving offers is smaller because issuers have raised underwriting standards and are now trying to win higher-quality borrowers.

Mail offer volumes "are coming back, but a lot of them are not finding" their way into "the mailbox of every customer," said John Stilmar, a director who follows card issuers for SunTrust Robinson Humphrey in Atlanta. There has been an "upmarket shift" in "terms of quality," he said.

David Nelms, the chairman and chief executive of Discover Financial Services, told analysts last month that it planned to significantly increase marketing spending in its third quarter because of greater confidence in consumer credit conditions.

"We will be focused both on expanding our wallet share of our existing customers as well as attracting more new customers," Nelms said in a June 24 interview after the Riverwoods, Ill., issuer reported its second-quarter earnings.

A few large issuers are driving the surge in offers.

Of the 988 million second-quarter mail offers Mintel projected, JPMorgan Chase & Co. accounted for 33% of the volume. It accounted for just 8% of the year-earlier quarter's volume.

Chase did not make an employee available for an interview but spokesman Paul Hartwick said via e-mail that it is "focused on several distinct customer segments: affluent, mass-affluent, small-business and partner products."

Chase recently has been marketing a Southwest Airlines Co. co-branded Visa Inc. credit card that lets new customers earn a free flight after making their first purchase — no matter how small the transaction.

Chase has been among the more aggressive players from the standpoint of promotional annual percentage rates and introductory balance-transfer rates, Davidson said. Previous concerns that such perks would disappear and annual fees would become common have been largely unfounded, he said.

For example, 34% of the projected mail offers Chase sent out in the second quarter include an annual fee, up from 54% in the year-earlier quarter, Mintel said.

Similarly, 24% of mail offers from Citigroup Inc. included an annual fee compared with 52% a year earlier and 57% of American Express Co.'s offers included an annual fee compared with 90% a year earlier.

"We have increased and diversified the mix of our direct mail offers recently, with a greater emphasis on offers that deliver incremental value to our customers, such as promotional offers and no-annual-fee offers," Citi spokesman Samuel Wang said in e-mailed statement.

In its most recent quarterly earnings report, Citi said it "continues to actively eliminate riskier accounts to mitigate losses" by reducing available credit lines and closing accounts of "higher-risk customers."

Issuers also are looking for growth in their existing customer portfolios, focusing on cross-selling opportunities for new card products and even tapping customers whose accounts have been charged off, experts said.

Tim Smith, a senior vice president with Firstsource Solutions Ltd., a Mumbai company that provides outsourced collection and customer services for card issuers, said its clients have been more aggressive about offering perks to customers who call to cancel their accounts.

For example, a top 10 issuer Firstsource works with has in some instances offered cardholders who call to cancel their accounts the chance earn double rewards points for six months if they keep their cards open for at least three months, Smith said.

Another issuer it works with has been offering customers whose accounts have been charged off the ability to have their previous rewards points reinstated in addition to giving them 10,000 to 20,000 additional points for paying a portion of their charged-off balance.

"If you go back to the beginning of this calendar year, issuers were admittedly unsure what the true impact of" the Credit Card Accountability, Responsibility and Disclosure Act would be, Smith said. "They were really focusing on just handling and facilitating the whole change of terms. If you could retain a customer great, but if you couldn't that's OK."

Now "the large credit card issuers are making a concerted effort to both retain and acquire new customers," he said.

Capital One Financial Corp. has beefed up its loyalty offerings with its Venture and Venture for Business travel rewards cards unveiled this year.

Both cards earn two miles per dollar spent and have no limit on the number of miles a user can accumulate. Both also offer the ability for cardholders who spend $1,000 in the first three months of opening the card to earn 10,000 bonus points.

"A key area of focus for Capital One is the higher spend customer segment," spokeswoman Pam Girardo said in an e-mail.

Wells Fargo & Co., which focuses its card marketing on existing banking customers and does not use direct mail to acquire new accounts, is "hoping that 2010 and '11 are growth years in terms of new customers" for its card portfolio, Mike McCoy, the president of consumer credit cards for the San Francisco banking company, said in an interview last week.

As a result of the CARD Act, McCoy said issuers must "do a much better job in customer segmentation" when it comes to marketing specific card features.

Wells Fargo is evaluating its card products, including its loyalty and rewards programs, McCoy said, but he declined to discuss specific changes it expects to make for competitive reasons.