Housing and Urban Development officials repeatedly said Tuesday that the department's "review" of 15 lenders was not an investigation and that the companies may continue writing Federal Housing Administration loans.

So why call a press conference and name the lenders that HUD subpoenaed for documents and data on defaulted loans?

"We want to send a message to the industry that as the mortgage landscape has shifted, we are watching very carefully and that we are poised to take action against bad performers," said Kenneth Donohue, HUD's inspector general.

As if to drive home the point, he added: "The fact that these institutions were named does not mean there were not others we're looking at."

The review comes as HUD grapples with the hangover from a surge in FHA lending over the past three years.

FHA loans are the only product lenders can offer most borrowers who have little money for a down payment. HUD now says the FHA attracted companies with questionable practices during the growth spurt. The toll became apparent last year when HUD revealed that the FHA's reserves had dwindled below the congressionally mandated level.

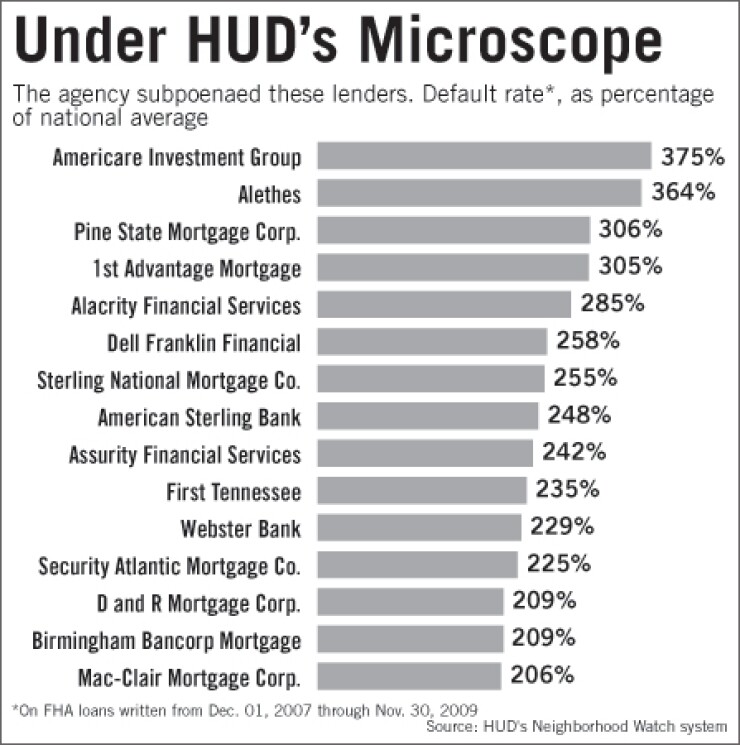

HUD said it singled out the 15 companies because their FHA loans had high default rates, compared to the national average, and foreclosures that occurred early in the life of the loans.

"Many of these target loans didn't last but a short time before defaulting," Donohue said.

The review will determine why these companies had such high default rates and whether there was any wrongdoing.

If so, "we will conduct an investigation, if appropriate, to determine who is responsible and will recommend that appropriate action be taken against individuals and corporations," Donohue said.

Observers said HUD, which is restricted in its ability to take legal action against lenders, is using the power of shame.

"They are using the bully pulpit and going at lenders' reputational risk," said Brian Chappelle, a partner at the Washington consulting firm Potomac Partners.

Information on poorly-performing lenders has been publicly available through HUD's Web site since 1999, Chapelle noted. But "if a lender gets put on a HUD press release and it goes in the local newspaper, that's a huge stick HUD has to hold over lenders' heads."

The approach did not sit well with some of the lenders that HUD identified.

Phillip Schulman, a partner at K&L Gates LLP whose clients include six of the 15 lenders, said HUD should not have released their names because it gives the impression they did not originate the loans in compliance with FHA requirements. When HUD conducts a routine audit, it does not release the name of the lender, he said.

"There may be many reasons why these loans became claims that have nothing to do with FHA's guidelines or how they were originated," Schulman said.

He pointed out that three of the 15 lenders were based in hard-hit Michigan. "A substantial portion of these loans may have to do with the downturn in the economy."

Richard Reese, the president of Dell Franklin Financial LLC of Columbia, Md., agreed, saying the fact that the subpoenas were given to a variety of lenders "is proof that it has nothing to do with the lenders themselves as much as it has to do with the state of the economy."

Reese said he was "very surprised" that his company was subpoenaed, because HUD had just audited the company in November "and there were no problems at that time."

HUD has subpoenaed information on 20 Dell Franklin loans, out of the 2,000 to 3,000 FHA loans it has written in the past five years, he said.

Most of the 20 loans being examined are several years old, he said, dating as far back as January 2005. "Many of the files don't even exist anymore," Reese said. "By law, we're not required to keep files more than two years."

Bernie Cason, the president of Mac-Clair Mortgage Corp., said he was "blown away" when his lender received one of the subpoenas. He, too, said his company got a clean audit from HUD this past fall.

"The fact that we live in Flint, Mich., doesn't help matters," Cason said. "We've lost more jobs here. It's caused probably more insurance claims to HUD than a normal area."

Cason said he is worried about the repercussions to his business from HUD's subpoena. "It can create unnecessary panic with the servicers," he said.

"I think it was unnecessary to handle it this way."

Steve Holmes, the president and general counsel of Alacrity Financial Services LLC in Southlake, Tex., which also received a subpoena, said it has tightened underwriting standards, which has reduced its default rate.

"Our numbers came down significantly in 2009, and we're excited about that," Holmes said. "And we applaud HUD for doing what they need to do to keep the mortgage industry in line."

Other subpoenaed lenders either did not return calls or simply said they were cooperating or evaluating the subpoenas. One of the lenders, Americare Investment Group Inc., closed its doors on Oct. 31, according to the receptionist who answered the phone Tuesday.

Last month, HUD Secretary Shawn Donovan told lawmakers he wanted more authority to police lenders on a national level, "as we are presently limited to sanctioning individual branches."

For the FHA, "the problem is there are only so many actions they can take on their own," said John Courson, the president of the Mortgage Bankers Association.

Ed Pinto, a mortgage industry consultant, called HUD's review "appropriate because FHA has been the victim to fraudulent activity over the years." However, he said HUD also needs to raise its minimum down payment from the current 3.5% — a step that would require legislative change — to make sure borrowers have an incentive to keep paying their loans.

"You can try to tighten it up on the lender side but unless you do some tightening on the loan risk side it's a losing battle."