-

Over 50 House members Monday urged Fannie Mae and Freddie Mac's regulator to allow principal reductions on mortgages held by the two government-sponsored enterprises.

March 14 -

The Federal Housing Finance Agency said it will extend for another year the Home Affordable Refinancing Program, which allows refinancing of underwater loans through Fannie Mae and Freddie Mac.

March 11

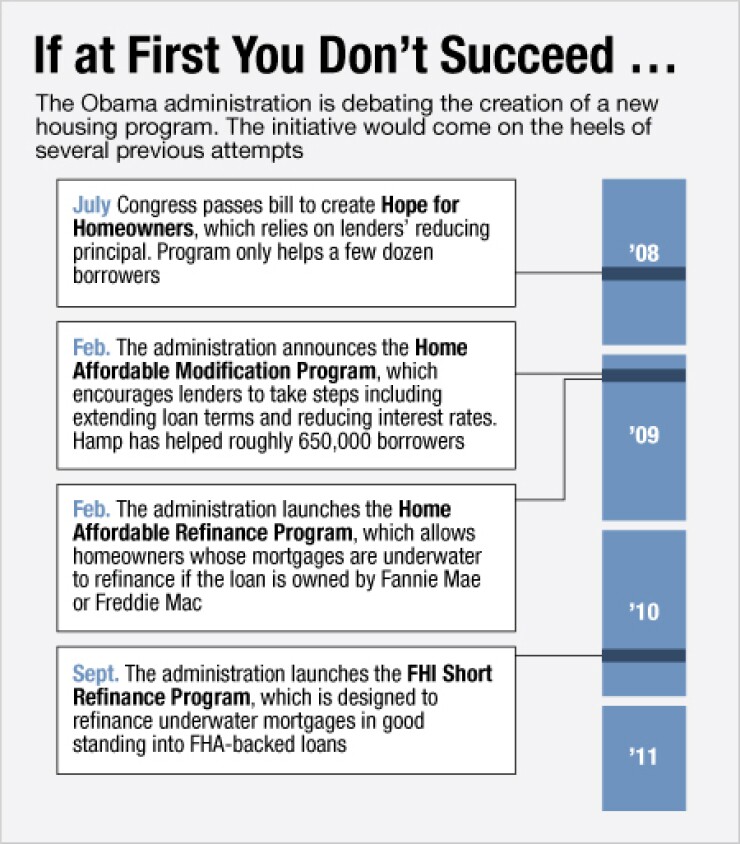

WASHINGTON — After trying multiple other plans to help the flagging housing market, the Obama administration's latest refinancing idea may help boost the economy and assist troubled homeowners without sparking as much opposition as earlier mortgage relief proposals.

From the administration's perspective, there are several benefits to loosening the criteria for refinancing a Fannie Mae or Freddie Mac mortgage: it would allow homeowners to reduce their monthly mortgage payments, encourage those borrowers to stimulate the economy by spending some of their savings, and reduce the chance that taxpayers will ultimately have to pick up the tab on defaulted loans, all without any additional cost to taxpayers.

"You've got near record low interest rates. We desperately want to put money in the hands of consumers. And we want to do things to stimulate the housing market," said Kevin Jacques, a former Treasury economist who now teaches at Baldwin-Wallace College in Berea, Ohio.

Another bonus: the plan would not necessarily need the approval of Congress, where Republicans are giving an icy reception to many of President Obama's economic proposals.

But there would also be certain downsides. Investors in bonds backed by Fannie and Freddie would lose some of the returns they have been expecting. It is also not clear whether any administration plan will get the necessary support of the independent government agency that oversees Fannie and Freddie.

The New York Times first reported Wednesday on the broad outlines of a mortgage refinancing plan that is under consideration. On Thursday, an administration official who requested anonymity said there are currently no plans to announce any major new initiatives.

"As one would expect, we continue to look for ways to ease the burden on struggling homeowners and to help stabilize the market, whether that's through assessing new proposals or older ones worth re-considering as market conditions change," the administration official said.

Since April 2009, 11.5 million U.S. homeowners have taken advantage of historically low mortgage rates in order to refinance, according to the Obama administration. Some of those refinancings have been made possible by the Home Affordable Refinance Program, or HARP, which is aimed at Fannie and Freddie borrowers who are current on their mortgages and whose mortgages are not more than 25% higher than the current value of the house.

But in spite of the rock-bottom mortgage rates, the pace of refinancings has slowed somewhat in 2011. There were fewer refinancings in the first two quarters of this year than at any point since 2008.

An expanded mortgage refinancing plan could address two problems that are preventing some homeowners who want to refinance from qualifying, said Laurence Platt, a financial services lawyer with K&L Gates.

The first barrier is that homeowners in some hard-hit parts of the country are more than 25% underwater, and therefore don't qualify for a refinancing. Nationwide, more than one in five home owners owes more than their home is worth.

The second barrier is that some home owners don't currently qualify for a refinancing, often because they have lost income or become unemployed, even though they remain current on their mortgage payments. In some cases, their loans have to be underwritten again, which can get in the way of a refinancing.

"So they could change that," Platt said. "They could say that regardless who does the refinancing, there's a very skinny review process."

But there are a number of impediments to any new refinance plan. One problem is a broad refinancing of mortgages backed by Fannie and Freddie would speed up repayments on mortgage bonds, unending expectations in the marketplace.

"You could have a lot of investors whose reasonable expectations were disrupted by these accelerated refinancings," Platt said.

In addition, a refinance plan, assuming that it was only open to borrowers who have been making their monthly mortgage payments, would do nothing to help the millions of borrowers who are delinquent. The Obama administration's initiatives aimed at helping delinquent borrowers have fallen well short of expectations. Second liens, which have bedeviled the administration's efforts to address the foreclosure crisis, are another obstacle.

An expanded refinance plan also could face resistance from the Federal Housing Finance Agency, which oversees Fannie and Freddie. According to reports, the FHFA has opposed the idea of allowing principal reductions on Fannie and Freddie mortgages, given that such writedowns would show up as losses at Fannie and Freddie.

However, a plan to expand refinancing would likely be viewed differently by the agency than a plan for principal reductions, because lower monthly payments would make it less likely that Fannie and Freddie will be left holding the bag, according to Platt.

Still, there is no guarantee that the FHFA will go along with a refinancing proposal from the Obama administration, and its approval would be necessary. The FHFA is seeking to reduce the size of the balance sheets at Fannie and Freddie, and a refinancing plan would not necessarily be consistent with that goal.

"Many people inside Treasury have been trying to make the argument for years that Fannie and Freddie are not government agencies," Jacques said. "If you're going to make that argument, and now here we come and say, 'Let's tell Fannie and Freddie to do this,' there is a need for some consistency on Treasury's part."

Some observers are skeptical that even an expanded refinance plan would have a major impact on the housing market and the broader economy.

"People who could afford to refinance have already done so once or twice," said Joseph Mason, a finance professor at Louisiana State University, adding: "With high jobless rates and consumer confidence at an all-time low, it's not clear that consumers won't just put that money in the bank."

But others are hopeful that after a series of tentative steps, the Obama administration will finally take bold action.

"HARP has worked to a degree. I don't think it's fair to say that nothing has worked. It's just that the problem is so gigantic and no solution has been big enough," said Karen Shaw Petrou, managing partner of Federal Financial Analytics in Washington.

"There are lots of reasons why this wasn't easy, and the administration wasn't willing to do this before. It's not cost-free. I think what we'll see is a decision finally to do something daring, at least I hope so."

In an interview, James Lockhart, a former director of the FHFA, endorsed a broader refinance program at Fannie and Freddie. One way to encourage the refinancing of more mortgages would be to lower the fees on those transactions, he said.

"Anything we can do to try to get through this housing mess, the better off we'll be," said Lockhart, who is now vice chairman of WL Ross & Co.

Lockhart said he believes that an expanded refinancing program is in sync with the FHFA's goal of conserving taxpayer assets, as well with the goal for Fannie and Freddie of providing stability and liquidity to the housing market.

Comparing a new refinance plan to a principal-reduction plan, Lockhart said, "I think it is less controversial. They already have the HARP program in place."