-

More than 100 former HSBC Bank branches across upstate New York and Connecticut are now operating as branches of First Niagara Bank.

May 21 -

KeyCorp returns to the M&A trail for first time in years in agreeing to buy 37 branches in western New York. The seller, First Niagara, is still trying to digest what it already has in the works.

January 12

Banking customers in upstate New York and Connecticut must be experiencing a case of whiplash lately. Some community banks hope that's a good thing.

First Niagara Financial Group (FNFG) and four other banks are playing a game of musical chairs that will continue through September. While there is nothing new to branches changing signage and owners, a decision by HSBC Holdings (HBC)

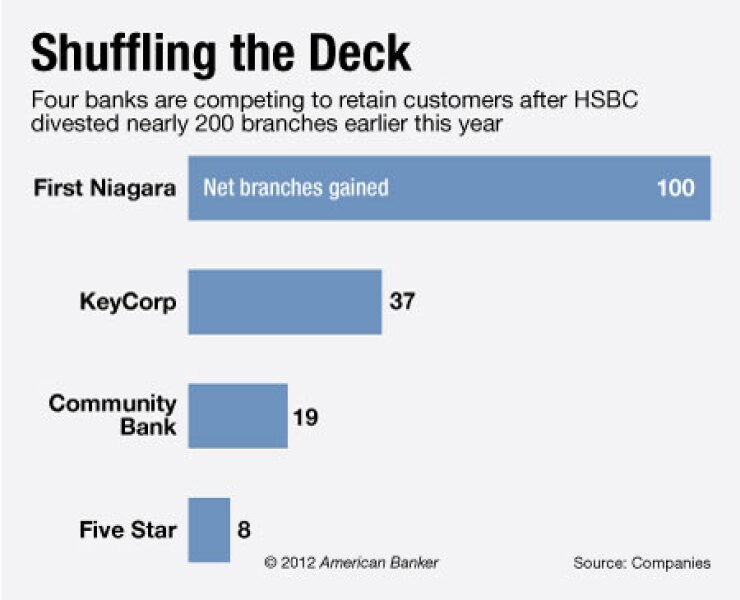

Like breaking pool balls on a billiards table, 195 branches that once operated under the HSBC banner will be scattered among two community banks, Community Bank System (CBU) and Financial Institutions (FISI), and a pair of regionals, First Niagara and KeyCorp (KEY).

The new owners are scrambling to prevent a mass exodus during the transition. Several banks could benefit, such as the $5.8 billion-asset NBT Bancorp (NBTB), the $1.4 billion-asset Alliance Financial (AMNC), and the $3.5 billion-asset Tompkins Financial (TMP), says Timur Braziler, an analyst at KBW's Keefe, Bruyette & Woods.

Most of the accounts that Community Bank System, are acquiring belong to small businesses and midsize commercial clients, says Scott Kingsley, the DeWitt, N.Y., company's chief financial officer. "We sent out a letter, saying we're going to acquire you in July, and saying this is how the accounts work," he says.

First Niagara purchased the HSBC branches in May, while its divestitures will close during the summer.

First Niagara is also selling some of its own branches. The Buffalo, N.Y., company has also closed 16 branches since the HSBC deal, and it plans to close another 21 later this year, a spokesman says. At the end, First Niagara will end up with a net increase of 100 branches.

Before First Niagara converted the branches, it held in-person meetings with its biggest customers, says Mark Rendulic, the company's executive vice president of retail banking.

"We met with those customers and tried to understand how they might be impacted," Rendulic says. "It was more of a concierge service."

First Niagara defines its "highest value" customers as those that have at least $25,000 in aggregate deposits and investments, Rendulic says.

Such face-to-face encounters did not prevent the $36 billion-asset First Niagara from losing customers before the deal closed. The company lost about $800 million in deposits through attrition, according to a May 24 regulatory filing. That represents about 8% of the $9.8 billion in total acquired deposits it obtained from HSBC.

First Niagara lost another $600 million from customers who live outside the upstate New York area and wanted to keep their accounts with HSBC.

Still, the pre-closing attrition of $800 million was "consistent with the company's prior experience in the National City Bank branch transaction," First Niagara said in the filing. First Niagara bought 57 former National City branches from PNC Financial Services Group (PNC) in 2009.

Instead of specifically mentioning the widespread bank name changes from the HSBC deal, Alliance in Syracuse, N.Y., decided to stick to its guns by emphasizing that it's a local bank, says Joseph Russo, the company's senior vice president of marketing.

The move has so far paid off, Russo says.

"We didn't sit down and have a strategy meeting about it," Russo says. "We have seen some movement into Alliance from the affected banks, and you'll see that anytime you have upheaval and people become uncomfortable."

That may be the type of strategy that other smaller banks in the market pursue, because the branches that HSBC sold are predominantly located in small cities and towns, says Paul Schaus, the president of CCG Catalyst Consulting Group in Phoenix. In those locales, HSBC was an out-of-town unknown to many customers, he says.

"Things are going back to the way it used to be, when the bank was locally owned," Schaus says. "A lot of these branches are in community bank-type markets."

First Niagara

Financial Institutions, based in Warsaw, N.Y., will convert the four branches that it's acquiring from First Niagara this weekend, says spokesman Shaun Seufert. The company has yet to close on a separate deal for four HSBC branches.

KeyCorp, of Cleveland, plans to complete its purchase of 37 former HSBC branches in mid-July.