-

In what would be its largest acquisition in more 15 years, UnionBanCal Corp. in San Francisco is buying Pacific Capital Corp. in Santa Barbara, Calif., for about $1.5 billion in cash.

March 12 -

UnionBanCal is taking the unusual step of marking up the value of Pacific Capital's loan portfolio as part of its $1.5 billion deal for the Santa Barbara, Calif., lender.

March 12

A $1.5 billion bank deal on Monday shows what could have been.

Had Washington been less reluctant to let private-equity firms buy U.S. banks after the financial crisis, experts say, there would be a lot more deals like

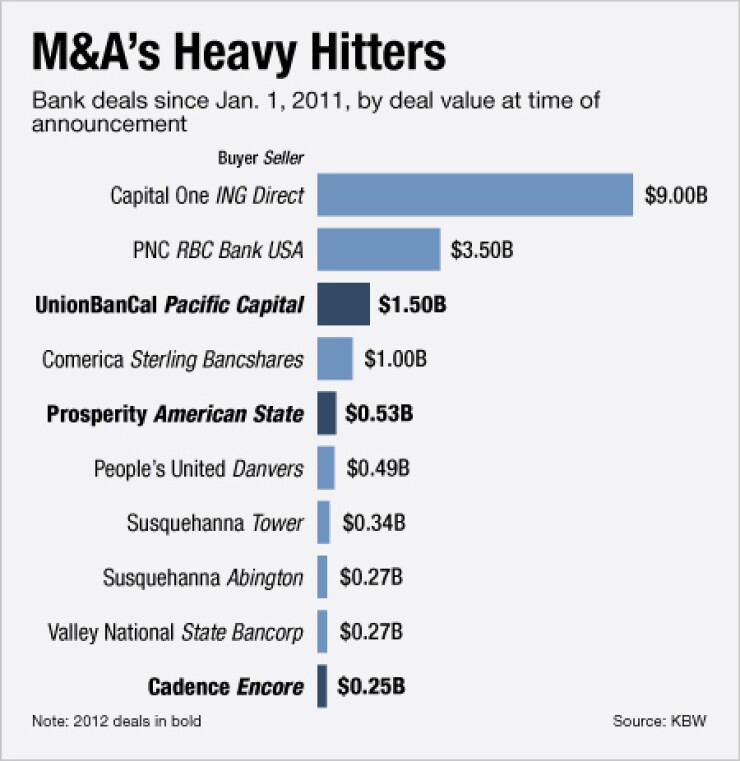

Instead, this type of deal likely will remain rare. It is the largest in more than a year excluding the spinoffs of deposit franchises by ING Group NV and Royal Bank of Canada. It came together because of a $500 million bet the Texas financier Gerald Ford took on Pacific Capital in 2010.

Ford, a billionaire who made his fortune fixing troubled banks in the '80s and '90s, was among the few private investors that managed to jump through the regulatory hoops required to take majority control of a depository. He also did the financial legwork that likely will enable UnionBanCal in San Francisco and its parent, Mitsubishi UFJ Financial Group Inc., to pull off a big, affordable takeover at a time when most buyers are reluctant to cut big checks, and when a lot of sellers view offers of less than two times book as low.

In this case, striking a deal at a moderate price has the potential to deliver jumbo returns for both parties. Pacific Capital in Santa Barbara, Calif., could be a financial boon for UnionBanCal because Ford already wrote down most of its junk assets when he took a majority stake in the lender 18 months ago. The cost savings should be ample, too.

"They did something we couldn't do, which is take a huge risk that is not safe and sound," said Jon Woods, the chief financial officer of the $89 billion-asset UnionBanCal. Most sizable banks in affluent markets have been holding out for buyers willing to pay up. Ford has an incentive to sell Pacific Capital at the ho-hum price of 160% its tangible book value, or equity excluding goodwill and intangibles. That is a decent premium compared with the ones slightly over book value that most banks fetched last year. But it is low by historical standards, and low compared with the more than two times tangible book recent banks in Texas have received.

But pricing is relative: This deal, should it close as expected in the fourth quarter, would enable Ford to sell at roughly $1.2 billion a 76% stake in Pacific Capital that he purchased for $500 million. Ford is poised to double his money by buying a damaged franchise at a distressed price and selling it at a normal one. That is a classic private-equity play.

Pacific Capital has another important — and somewhat rare — impetus for selling: The U.S. government owns about 11% of its common stock, after swapping $180 million of preferred shares for common shares now valued at $162 million. The government wants banks to repay money borrowed from taxpayers sooner rather than later.

This is a rare chance for UnionBanCal, in turn, to buy a franchise already vetted by another buyer. Ford basically wrote down all of its bad construction loans, commercial property loans and everything else on its balance sheet to about 72 cents on the dollar. This means that UnionBanCal will mark up Pacific Capital, something unseen in a deal this size in at least a year. The deal will basically unlock $268 million — or roughly $9 per share — in Pacific Capital's book value that for accounting purposes it could not recognize. A small portion of that — about $27 million — will come from UnionBanCal valuing Pacific Capital's loan book higher than Ford did. The rest represents deferred tax writeoffs on loan losses that Pacific Capital cannot recognize because of weak profits.

The novel markup is a crucial reason UnionBanCal can afford to buy Pacific Capital, Woods said. The deal also makes financial sense because UnionBanCal expects to be able to remove about 40%, or $80 million, of its annual costs and realize revenue gains from selling wealth advisory, treasury management and other products the seller lacked.

Pacific Capital's shares rose 57% on Monday, to $45.03 apiece.

Morgan Stanley advised UnionBanCal in the deal. Pacific Capital was advised by Sandler O'Neill & Partners LP.

Are there potentially more deals of this type on the horizon? Yes, experts say, but not enough to make a meaningful wave of $1 billion-plus bank mergers. Few private-equity funds exercise majority control over a large depository, and others that do are not as well positioned to sell as Pacific Capital.

Two of the other largest private equity-backed franchises are more likely buyers than sellers at the moment: