-

Consolidation has left one of the nation's most crowded banking markets without a dominant local player. But a handful of hometown banks, including Ed Wehmer's Wintrust Financial along with PrivateBancorp, MB Financial and First Midwest Bancorp, look to be in a good poisiton to pursue the mantle.

February 1 -

MB Financial Inc. picked up the pieces of Corus Bank after its seizure Friday and now plans to spend the rest of the year integrating what was a sizable hometown acquisition.

September 14

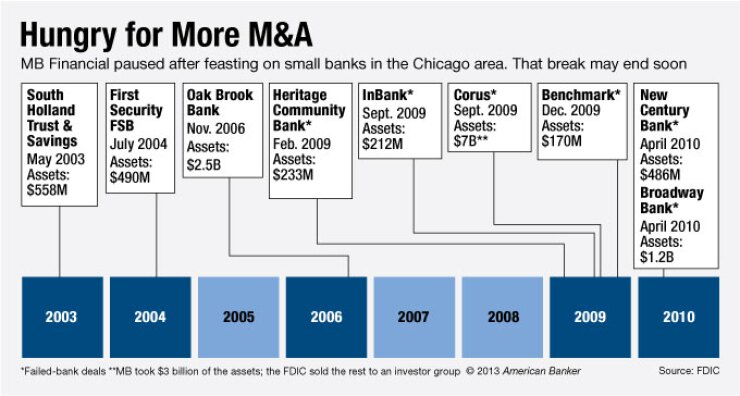

MB Financial (MBFI) looks ready to come off the ropes and get back in the dealmaking ring.

The $9.6 billion-asset company has long been a Chicago bank consolidator, but it

The hiatus may end soon; Chief Executive Mitch Feiger recently said MB would hoard its capital rather than buy back shares.

"We are of the mind that unless our stock price is very, very low, we are better off retaining our capital than repurchasing our stock because we think there will be other very good opportunities to use that capital in the future," Feiger said late last month during a conference call with analysts.

Feiger's comments were a part of his prepared remarks about fourth-quarter results, and he knew they would prompt a lot of questions.

"Now don't jump to conclusions," Feiger said. "There is nothing imminent, but at this time we would rather have capital to deploy than not have it."

MB's stock closed Wednesday at $22.73, close to its 52-week high.

Mergers and acquisitions

However, MB's readiness signals stick out because most of

The $17 billion-asset Wintrust Financial in Rosemont, Ill., has been the only active buyer. It has

"Chicago has such good potential, but a lot of the buyers just haven't been active for a variety of reasons," says Stephen E. Nelson, managing director of investment banking for D.A. Davidson in Chicago. "But maybe the next six to nine months might be more robust."

Sellers should view MB's willingness to do a deal as a positive because it ups their chance of finding a buyer. However, the odds are low of Feiger and Wintrust CEO Ed Wehmer getting into a bidding war over a target and bidding up the price.

"Another bidder out there always helps," Nelson says. "Sellers may still end up getting the same price, but it doesn't hurt to have another buyer in the market."

MB officials did not answer questions for this story, but Feiger has been steadily warming up followers of MB to the idea of doing more M&A.

In a conference call early last year Feiger hinted that the company was open to deals but that the targets were unappealing. By October Feiger said that MB was "ready, willing, and able to execute a merger or acquisition" but there were only a few worth pursuing.

Analysts described his most recent comments as bullish but perhaps purposely vague.

"My read was that he was guarded, but that they have the capital to do something," says John Moran, an analyst at Macquarie Equities Research. "They might be on the prowl. … I would not be surprised to see them participate in a bank transaction sometime in the next 12 to 18 months."

Though MB has not acquired a bank in several years, it bought Celtic Leasing, an equipment-leasing company that originated between $75 million and $100 million in loans each year, in December.

MB's closeness to the

The Durbin Amendment kicks in and insurance fees from the Federal Deposit Insurance Corp. increase when a bank hits $10 billion of assets. For MB, that could be between $6 million and $7 million of additional fees annually, executives say. It would also become subject to oversight of the Consumer Financial Protection Bureau.

Because of the additional costs and regulation, analysts say that banks nearing the $10 billion mark should either stay below it or well exceed it.

Feiger downplayed such concerns.

"I don't view that as an insurmountable hurdle by any means," he said during the call last month. "Listen, I think we are going to go over $10 billion sooner or later anyway, whether it is organically or with an acquisition; it's just a matter of time."