-

In a letter to CFPB Director Kathy Kraninger, the Democratic senators argue that task force members cannot be trusted to protect consumers because they have represented payday lenders or Wall Street banks, or worked at law firms that did so.

February 5 -

An intraparty rift went public Wednesday over legislation that would impose a 36% rate limit on all consumer loans. Critics are concerned it would cut off minority borrowers’ access to small-dollar loans and hurt some community banks.

February 5 -

Investors have made a $10 million bet on Stori, which is pushing mobile money over a branch network to bring more consumers into Mexico's banking system.

February 5 -

The agency agreed to most recommendations made by its inspector general but pushed back on some conclusions.

February 5 -

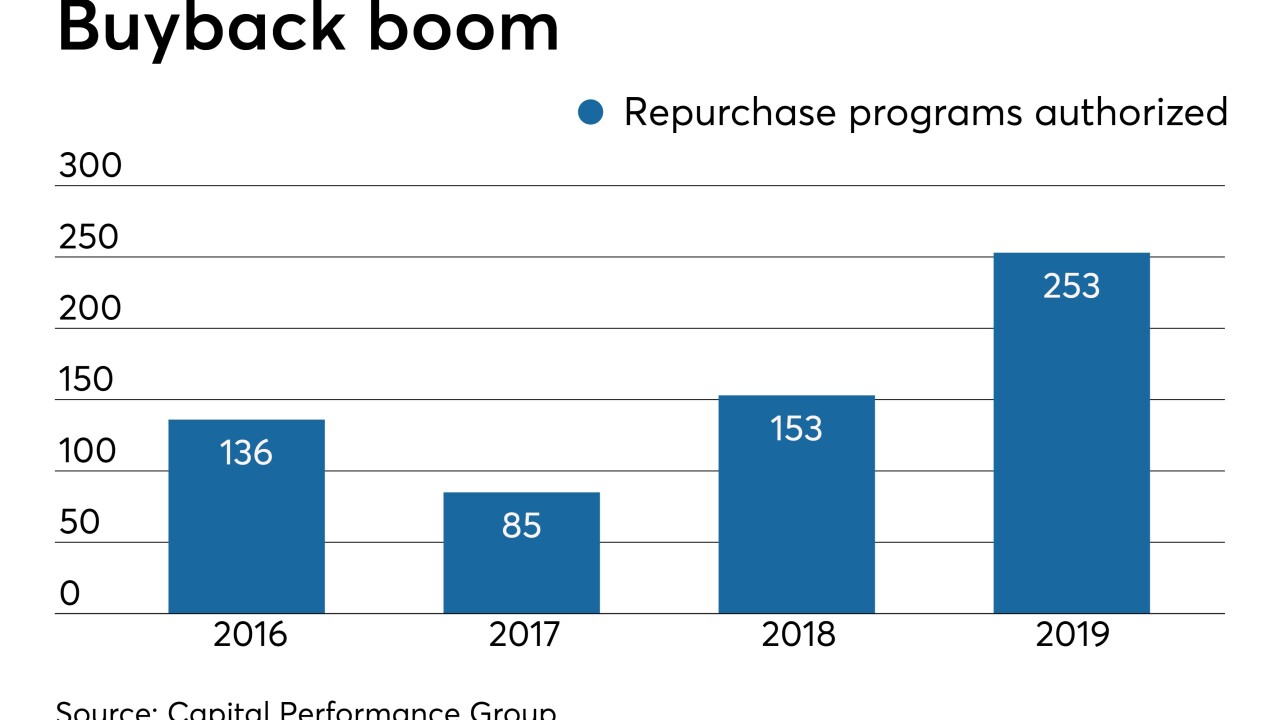

Anticipating a weaker economy and added pressure on stock prices, banks authorized more repurchases of outstanding shares last year.

February 5 -

MyCUID, an identity-verification tool launched in early 2018, has a new identity of its own.

February 5 -

Popular’s branch in a Brooklyn neighborhood faced an uncertain future until it was designated as a bank development district. Now it’s eligible to receive millions of dollars in municipal deposits.

February 5 -

Inertia or resistance to change have kept small businesses from making the move to more modern systems, says Clover's Mark Schulze.

February 5 Clover

Clover -

Investors think the billions being shelled out to keep up with the likes of Amazon might be better spent elsewhere.

February 5 Oliver Wyman

Oliver Wyman